- Bullish SLP price prediction ranges from $0.0015 to $0.00600.

- Analysis suggests that the SLP price might reach $0.005548.

- The SLP bearish market price prediction for 2023 is $0.001310.

What is Smooth Love Potion (SLP)?

Smooth Love Potion (SLP) is a utility token used on the Axie Infinity ecosystem. Axie Infinity is a virtual world filled with cute, formidable creatures known as Axies. Axies can be battled, bred, collected, and even used to earn resources & collectibles that can be traded on an open marketplace.

Axie was designed to introduce the world to an exciting new technology called Blockchain, through a fun, nostalgic, & charming game.

SLP are ERC-20 tokens that can be earned by playing Axie Infinity games, and they can be used to breed new digital pets that are known as Axies. The cost of breeding begins at 100 SLP. However, this amount increases gradually — rising from 200 SLP for the second breed, 300 for the third, 500 for the fourth, 800 for the fifth, and 1,300 for the sixth. Interestingly, Axies can be bred a maximum of seven times, and the seventh breed costs 2,100 SLP. This limit exists in order to prevent hyperinflation in the marketplace.

Table of contents

- What is Smooth Love Potion (SLP)?

- Smooth Love Potion (SLP) Market Overview

- Analysts’ View on Smooth Love Potion (SLP)

- Smooth Love Potion (SLP) Current Market Status

- Smooth Love Potion (SLP) Price Analysis 2023

- Smooth Love Potion (SLP) Price Prediction 2023-2030 Overview

- Smooth Love Potion (SLP) Price Prediction 2023

- Smooth Love Potion (SLP) Price Prediction 2024

- Smooth Love Potion (SLP) Price Prediction 2025

- Smooth Love Potion (SLP) Price Prediction 2026

- Smooth Love Potion (SLP) Price Prediction 2027

- Smooth Love Potion (SLP) Price Prediction 2028

- Smooth Love Potion (SLP) Price Prediction 2029

- Smooth Love Potion (SLP) Price Prediction 2030

- Smooth Love Potion (SLP) Price Prediction 2040

- Smooth Love Potion (SLP) Price Prediction 2050

- Conclusion

- FAQ

- More Crypto Price Predictions:

Smooth Love Potion (SLP) Market Overview

HTTP Request Failed... Error: file_get_contents(https://pro-api.coinmarketcap.com/v2/cryptocurrency/quotes/latest?slug=smooth-love-potion): Failed to open stream: HTTP request failed! HTTP/1.1 429 Too Many RequestsAnalysts’ View on Smooth Love Potion (SLP)

P2E News, a crypto-related news platform tweeted that SLP topped the chart among price gainers accumulating 14% back in December 2021. As such it was valued at $0.04 during the aforementioned time.

Smooth Love Potion (SLP) Current Market Status

Smooth Love Potion has a circulating supply of 41,819,636,843 SLP coins, while its maximum supply is not available, according to CoinMarketCap. At the time of writing, SLP is trading at $0.001673 representing 24 hours decrease of 1.62%. The trading volume of SLP in the past 24 hours is $5,619,145 which represents a 37.91% decrease.

Some top cryptocurrency exchanges for trading SLP are Binance, OKX, Deepcoin, Bitrue, and Bybit.

Now that you know SLP and its current market status, we shall discuss the price analysis of SLP for 2023.

Smooth Love Potion (SLP) Price Analysis 2023

Currently, Smooth Love Potion (SLP) ranks 308 on CoinMarketCap. Will SLP’s most recent improvements, additions, and modifications help its price go up? First, let’s focus on the charts in this article’s SLP price forecast.

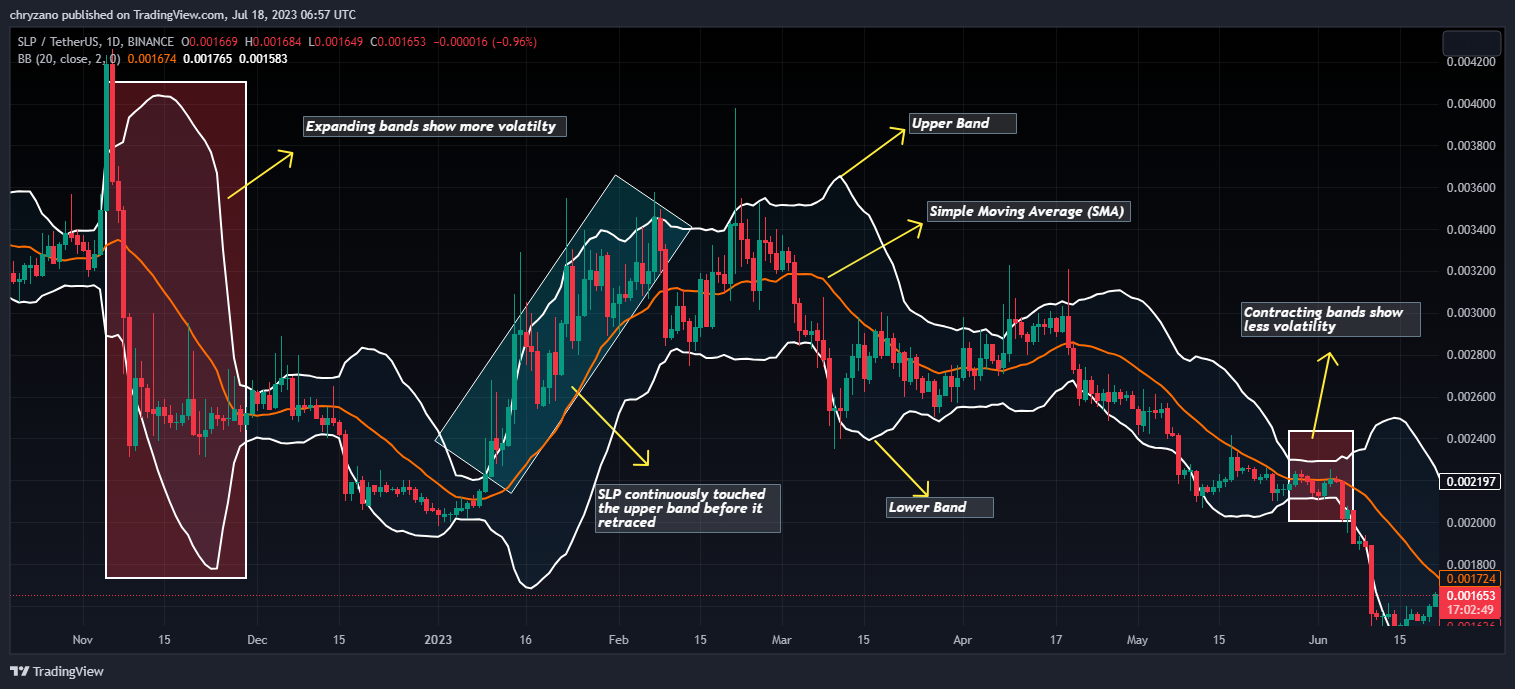

Smooth Love Potion (SLP) Price Analysis – Bollinger Bands

The Bollinger bands are a type of price envelope developed by John Bollinger. It gives a range with an upper and lower limit for the price to fluctuate. The Bollinger bands work on the principle of standard deviation and period (time).

The upper band as shown in the chart is calculated by adding two times the standard deviation to the Simple Moving Average while the lower band is calculated by subtracting two times the standard deviation from the Simple Moving Average. When the bands widen, it shows there’s going to be more volatility and when they contract, there is less volatility.

When Bollinger bands are used in a cryptocurrency chart, we could expect the price of the cryptocurrency to reside within the upper and lower bounds of the Bollinger bands 95% of the time. The above thesis is derived from an Empirical law.

The sections highlighted by red rectangles in the chart above show how the bands expand and contract. When the bands widen, we could expect more volatility, and when the bands contract, it denotes less volatility. The green rectangles show how SLP retraced after touching the upper band (overbought).

Currently, the Bollinger bands are squeezing, as such, it’s quite unlikely to see a big drop or increase in SLP prices. When scrutinizing SLP’s position inside the bands, it could be noted that SLP is close to the SMA. Moreover, there seems to be a big tussle going on between the buyers and sellers, as the market seems to be approaching equilibrium.

Moreover, the Bollinger bandwidth indicator seems to be moving sideway while slowly heading towards its next reversal point. Currently, the Bollinger bandwidth indicator is at 0.11. It could be expected to reach 0.08 before it starts to rise again and the volatility could increase.

As such, traders entering the market at this stage may need to concentrate more on volume as the price action could be small. However, if they wait for the market to make a move, there may come a period where there could be more volatility.

Smooth Love Potion (SLP) Price Analysis – Relative Strength Index

The Relative Strength Index is an indicator that is used to find out whether the price of a security is overvalued or undervalued. As per its name, RSI indicators help determine how the security is doing at present, relative to its previous price.

Moreover, it has a signal line which is a Simple Moving Average (SMA) that acts as a yardstick or reference to the RSI line. Hence, whenever the RSI line is above the SMA, it is considered bullish; if it’s below the SMA, it is bearish.

Currently, the RSI indicator reads a value of 45.73 and the line seems to be approaching the signal line which is below. If the RSI crosses the signal then SLP could be deemed bearish. However, SLP’s trend seems to be strong as it is neither overbought nor oversold. As such, there could be more sideways movement on the horizon for SLP.

The RSI Resistance and Support by DGT indicator shows that SLP has been lately rebounding on the Crossover oversold region, marked by the blue line. At press time SLP is rebounding on the cross-bear zone area (Pink line). Since the market is at the point of saturation, SLP may rebound on the cross-bear zone or crash to the crossover oversold region. However, once the volatility increases when the buyers enter the market, then SLP could reach the Crossunder oversold line zone (Red line).

Smooth Love Potion (SLP) Price Analysis – Moving Average

The Exponential Moving averages are quite similar to the simple moving averages (SMA). However, the SMA equally distributes down all values whereas the Exponential Moving Average gives more weightage to the current prices. Since SMA undermines the weightage of the present price, the EMA is used in price movements.

The 200-day MA is considered to be the long-term moving average while the 50-day MA is considered the short-term moving average in trading. Based on how these two lines behave, the strength of the cryptocurrency or the trend can be determined on average.

In particular, when the short-term moving average (50-day MA) approaches the long-term moving average (200-day MA) from below and crosses it, we call it a Golden Cross.

Contrastingly, when the short-term moving average crosses the long-term moving average from above then, a death cross occurs. Usually, when a Golden Cross occurs, the prices of the cryptocurrency will shoot up drastically, but when there’s a Death Cross, the prices will crash.

The above chart shows how both exponential moving averages are heading in the downward direction. As such, SLP could be adjudicated as bearish. Currently, SLP is testing the 50-day EMA as the market has been saturated, however, once the buyers enter the market, SLP has the potential to break the 50-day EMA which has been a strong hurdle to break.

Considering the above chart, the Moving Average deviation rate indicator reads a value of -5.077. This negative value shows that SLP is trading below the 50-day MA. Moreover, as the MA deviation indicator line is facing downwards, there is a possibility of SLP straying further below the 50-day MA. However, the moving average has been making higher lows and may continue to make higher lows.

Smooth Love Potion (SLP) Price Analysis – Elder Force Index

Elder Force Index is an indicator that was invented by Alexander Elder, who was an entrepreneur. The indicator mainly uses two parameters to adjudicate the buying and selling force and thereby predicts the market trend. In particular, it relies on price change and volume. As such the strength of the buying force or selling force is dependent on either the price change or the volume.

Whenever the EFI is greater than zero, or positive, we could say that the trend is bullish, as there is more buying pressure. However, when the EFI is in the negative zone, we could say that the cryptocurrency is in the negative zone and the selling pressure is more.

Moreover, the Elder Force could also be used to figure out trend reversals and breakouts. For instance when the EFI is making lower highs while the cryptocurrency is making higher highs, then we could say that this is a bearish divergence.

However, in the event that the cryptocurrency is making higher highs while the EFI is making lower highs, then it is a bearish divergence represented in the chart.

Currently, the EFI for SLP reads a value of 919 while the EFI line stills looks to go down. As it is on the verge of crossing the zero line, a bit more pressure from the bears will see SLP tumbling below the zero line. If this happens, then the bears will have dominion. Moreover, the Bear-Bull-Power (BBP) indicator has just gone below the zero line and reads a value of -0.000007. Since the BBP line is tilting downwards, the future may not be that good for SLP.

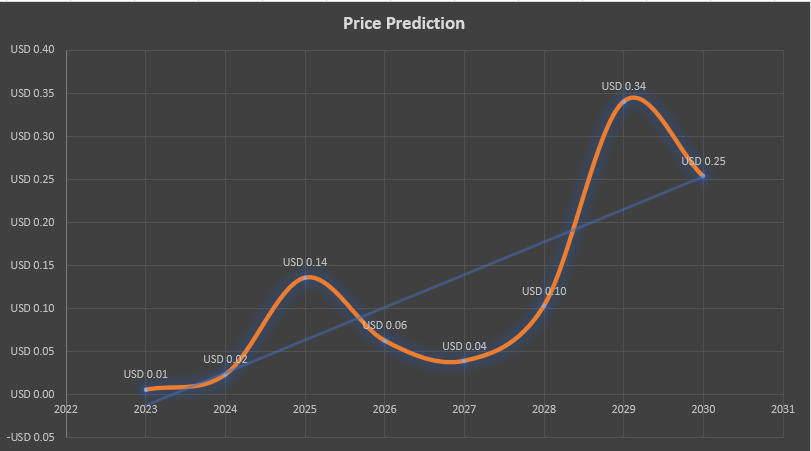

Smooth Love Potion (SLP) Price Prediction 2023-2030 Overview

| Year | Minimum Price | Average Price | Maximum Price |

| 2023 | $0.004848 | $0.005548 | $0.0099100 |

| 2024 | $0.019625 | $0.023255 | $0.025120 |

| 2025 | $0.091235 | $0.135852 | $0.15521 |

| 2026 | $0.049521 | $0.062427 | $0.071250 |

| 2027 | $0.37250 | $0.39004 | $0.40125 |

| 2028 | $0.09821 | $0.102934 | $0.159210 |

| 2029 | $0.312000 | $0.340477 | $0.375820 |

| 2030 | $0.225120 | $0.253828 | $0.289121 |

| 2040 | $0.59781 | $0.666796 | $0.79812 |

| 2050 | $0.912312 | $1.079531 | $1.120050 |

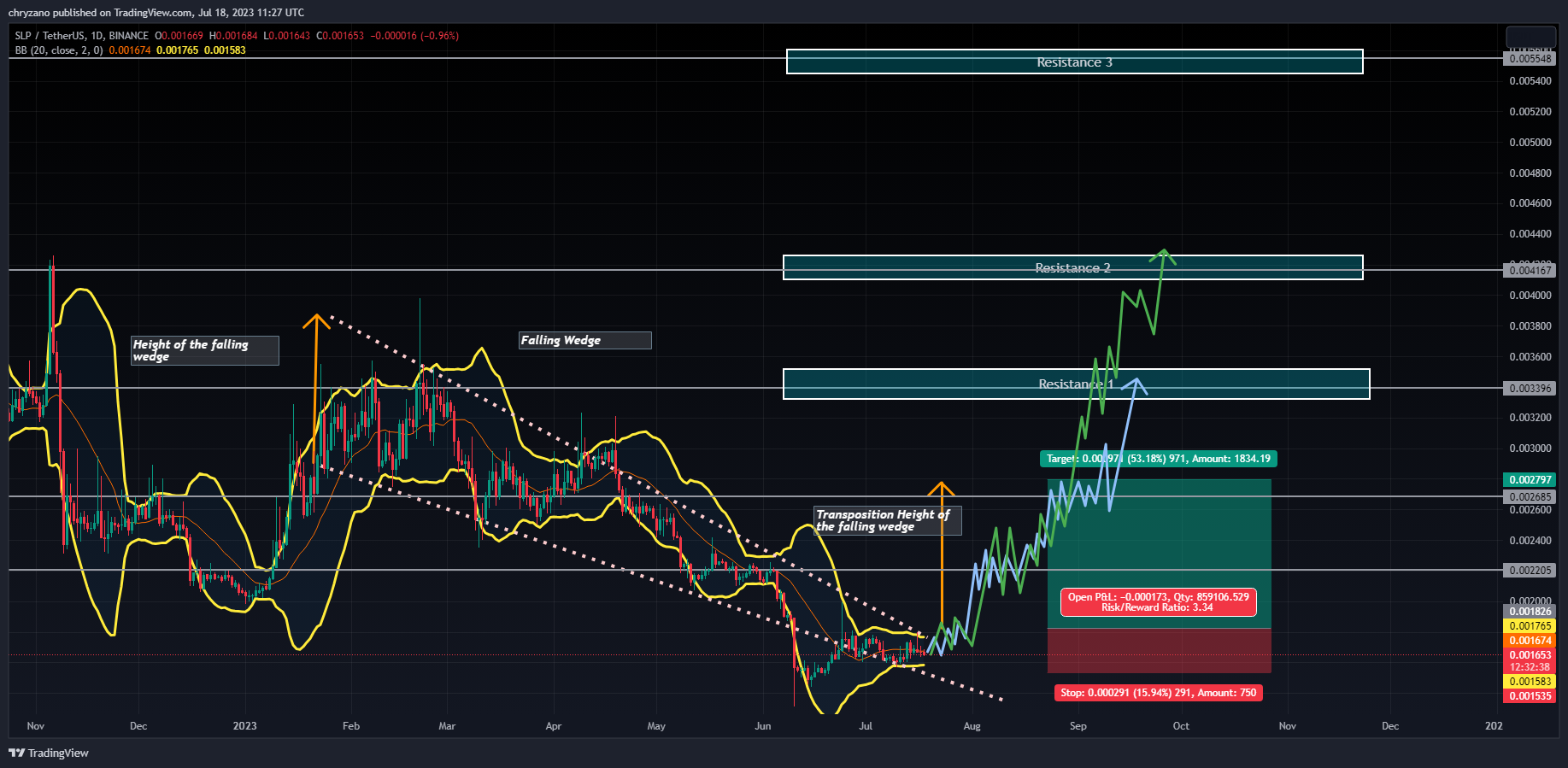

Smooth Love Potion (SLP) Price Prediction 2023

The above chart shows how SLP has been fluctuating inside a falling wedge since late January 2023. Once SLP breaks out from the falling wedge, there could be a burst of price in the upward direction. As such, SLP could be ne anticipated to reach Resistance 1 at $0.003396. Although Resistance 1 has been the go-to option for SLP in the past, it could break Resistance 1 and move on to Resistance 2 at $0.004167 in the future. It has the potential to even touch Resistance 3 at $0.005548 for a brief period.

However, as per the best practice of trading a falling wedge, buyers may have their take profit close to $0.002800. Since many of the buyers would have exited the market by that point, SLP would find some resistance against its upward motion. As such there could be a lag or a period of consolidation at the $0.002800.

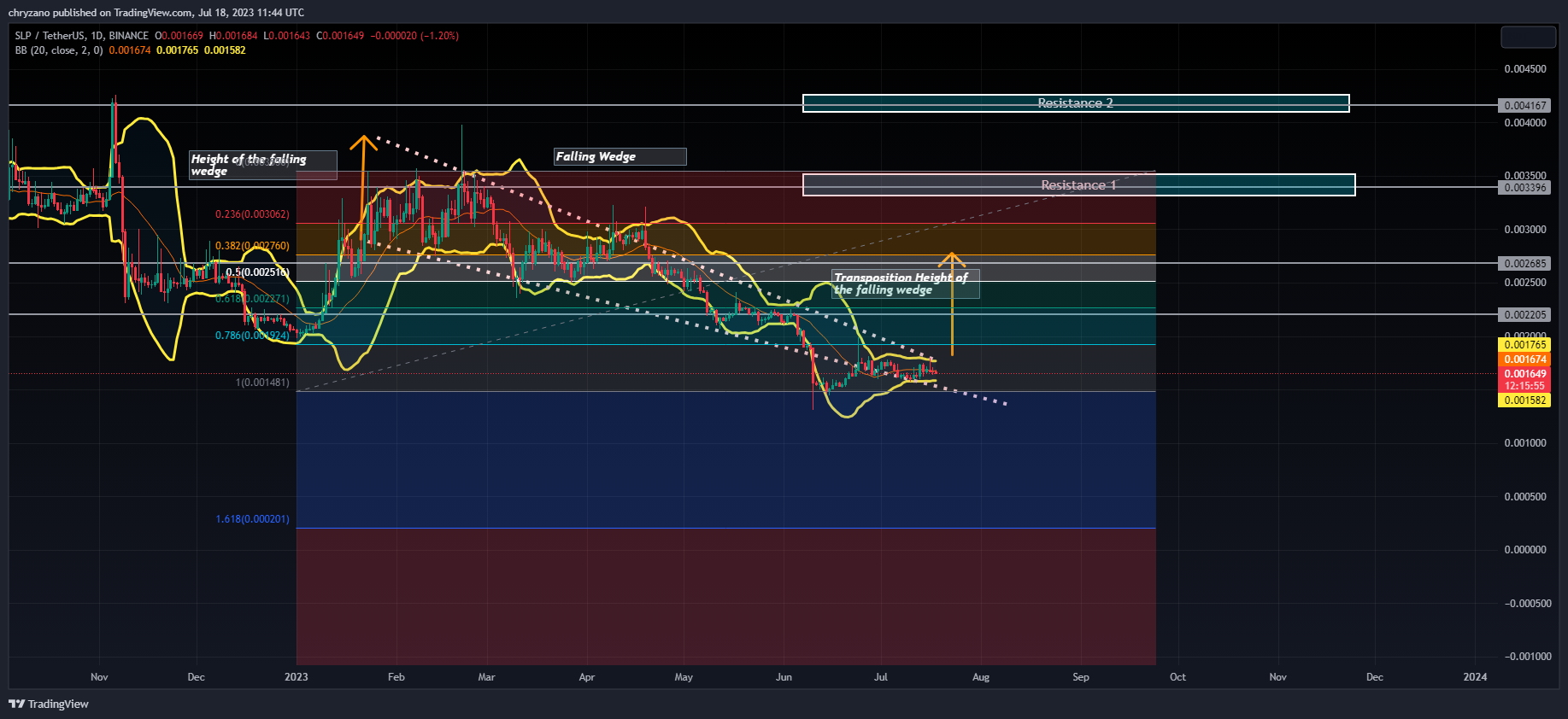

The chart above shows that the expected spike for SLP is within the 0.5 fib retracement level. However, in the unlikely event that SLP stumbles and starts to fall once out of the wedge, then it may seek support at the fib retracement 1 level ($0.001481).

Smooth Love Potion (SLP) Price Prediction – Resistance and Support Levels

The chart above shows SLP’s behavior since May 2022. It could be noted that SLP which was supported by the 0.236 fib retracement level crashed and fell below the 0.5 fib retracement level. It received support from the 0.618 fib retracement before starting to surge again.

On its way up SLP tested the 1:2 Gann fan line. However, SLP’s spike was brought to a stall once it reached the 8:1 Gann line in August 2022. Thereafter it started falling diagonally just below the 2:1 Gann fan line before receiving support from the 8:1 Gann fan line. The 8:1 Gann line helped SLP reach above the 2:1 Gann line.

Currently, SLP is sliding along the 2:1 Gann line. It may continue to fall along that line if the bulls don’t interject. However, if the bulls intervene, SLP could test the 3:1 Gann line.

Smooth Love Potion (SLP) Price Prediction 2024

There will be Bitcoin halving in 2024, and hence we should expect a positive trend in the market due to user sentiments and the quest by investors to accumulate more of the coin. However, the year of BTC halving didn’t yield the maximum SLP based on the previous halving. Hence, we could expect SLP to trade at a price not below $0.023255 by the end of 2024.

Smooth Love Potion (SLP) Price Prediction 2025

SLP may experience the after-effects of the Bitcoin halving and is expected to trade much higher than its 2024 price. Many trade analysts speculate that BTC halving could create a huge impact on the crypto market. Moreover, similar to many altcoins, SLP will continue to rise in 2025 forming new resistance levels. It is expected that SLP would trade beyond the $0.135852 level.

Smooth Love Potion (SLP) Price Prediction 2026

It is expected that after a long period of bull run, the bears would come into power and start negatively impacting the cryptocurrencies. During this bearish sentiment, SLP could tumble into its support regions. During this period of price correction, SLP could lose momentum and be way below its 2025 price. As such it could be trading at $0.062427 by 2026.

Smooth Love Potion (SLP) Price Prediction 2027

Naturally, traders expect a bullish market sentiment after the crypto industry was affected negatively by the bears’ claw. Moreover, the build-up to the next Bitcoin halving in 2028 could evoke excitement in traders. However, that excitement has not been reciprocated in SLP. As such, we could expect SLP to trade just below its 2026 value at around $0.039004 by the end of 2027.

Smooth Love Potion (SLP) Price Prediction 2028

As the crypto community’s hope will be re-ignited looking forward to Bitcoin halving like many altcoins, SLP may reciprocate its past behavior during the BTC halving. Hence, SLP would be trading at $0.102934 after experiencing a considerable surge by the end of 2028.

Smooth Love Potion (SLP) Price Prediction 2029

2029 is expected to be another bull run due to the aftermath of the BTC halving. However, traders speculate that the crypto market would gradually become stable by this year. In tandem with the stable market sentiment, SLP could be trading at $0.340477 by the end of 2029.

Smooth Love Potion (SLP) Price Prediction 2030

After witnessing a bullish run in the market, SLP and many altcoins would show signs of consolidation and might trade sideways and move downwards for some time while experiencing minor spikes. Therefore, by the end of 2030, SLP could be trading at $0.253828

Smooth Love Potion (SLP) Price Prediction 2040

The long-term forecast for SLP indicates that this altcoin could reach a new all-time high(ATH). This would be one of the key moments as HODLERS may expect to sell some of their tokens at the ATH point.

If they start selling then SLP could fall in value. It is expected that the average price of SLP could reach $0.666796 by 2040.

Smooth Love Potion (SLP) Price Prediction 2050

The community believes that there will be widespread adoption of cryptocurrencies, which could maintain gradual bullish gains. By the end of 2050, if the bullish momentum is maintained, SLP could hit $1.079531

Conclusion

If investors continue showing their interest in SLP and add these tokens to their portfolio, it could continue to rise. SLP’s bullish price prediction shows that it could reach the $0.0055 level.

FAQ

Smooth Love Potion (SLP) is a utility token used on the Axie Infinity ecosystem. These are ERC-20 tokens that can be earned by playing Axie Infinity games.

SLP tokens can be traded on many exchanges like Binance, OKX, Deepcoin, Bitrue, and Bybit.

SLP has a possibility of surpassing its present all-time high (ATH) price of $0.4191 in 2021.

SLP has been trading inside a falling wedge and If SLP breaks out, it may reach $0.0055.

SLP has been one of the most suitable investments in the crypto space. It is highly volatile, as such, it has quite a margin when its price fluctuates. Hence, traders may be allured to invest in SLP. It’s a good investment in the short term and in the long term as well.

The present all-time low price of SLP is $0.001384.

The maximum supply of SLP is not available.

SLP can be stored in a cold wallet, hot wallet, or exchange wallet.

SLP is expected to reach $0.005548 by 2023.

SLP is expected to reach $0.023255 by 2024.

SLP is expected to reach $0.135852 by 2025.

SLP is expected to reach $0.062427 by 2026.

SLP is expected to reach $0.039004 by 2027.

SLP is expected to reach $0.102934 by 2028.

SLP is expected to reach $0.340477 by 2029.

SLP is expected to reach $0.253828 by 2030.

SLP is expected to reach $0.666796 by 2040.

SLP is expected to reach $1.079531 by 2050.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

More Crypto Price Predictions:

- Stellar (XLM) Price Prediction 2023-2030

- Arweave (AR) Price Prediction 2023-2030

- Cardano (ADA) Price Prediction 2023-2030

- Bone ShibaSwap Price Prediction 2023-2030

- Curve DAO Token Price Prediction 2023-2030

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.