- BTC and ETH’s year-to-date performance is up by more than 50%.

- Shiba Inu and Binance Coin both saw increases of 38%.

- SOL is currently worth $21.55 after a 3.40% drop in price.

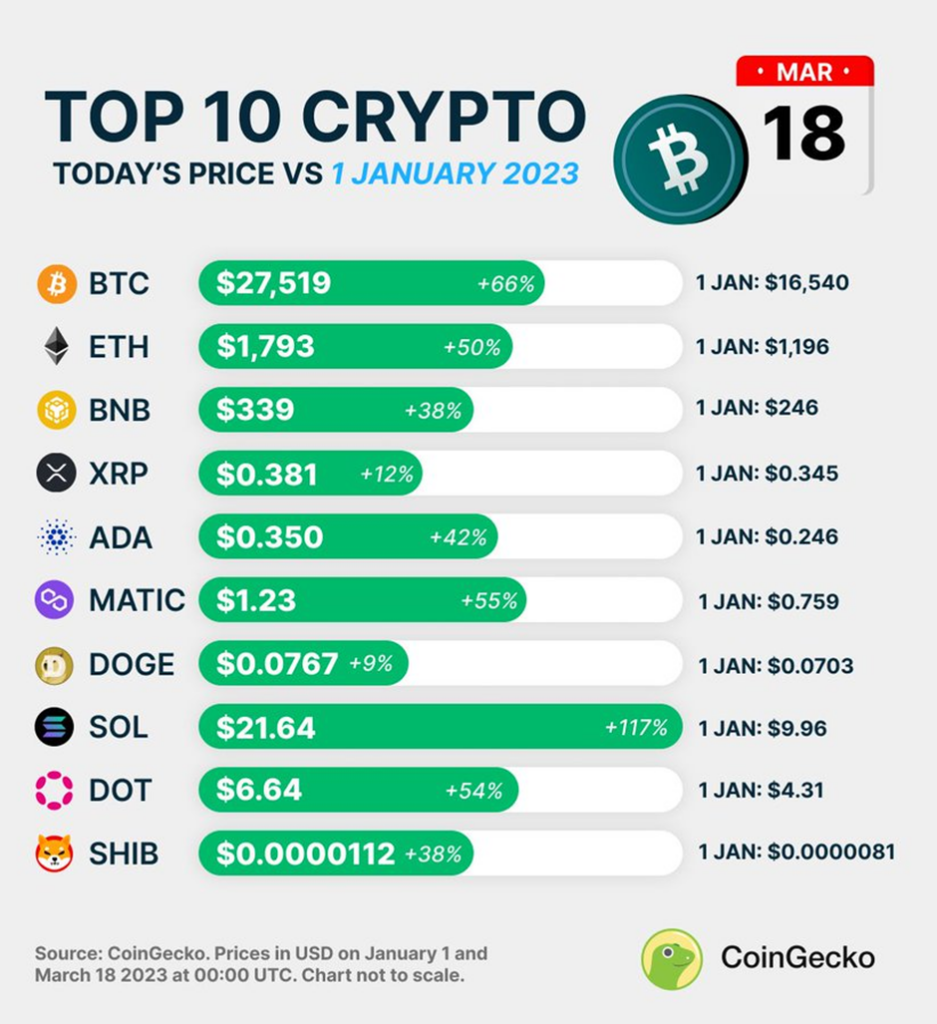

The world’s largest crypto data aggregator, CoinGecko, took to Twitter yesterday to share the year-to-date performances of certain cryptos. According to the post, the crypto market leader is up 66% since March 18 of last year, while Ethereum (ETH) is up by 50%. Solana (SOL) stole the show as the altcoin is up by a whopping 117% since march of 2022.

Some of the other performances worth noting are those of Polygon (MATIC) which is up by 55% since last year and Cardano (ADA) that saw an increase of just over 40%. Shiba Inu (SHIB) and Binance Coin (BNB) both saw increases of 38%.

The crypto king BTC is currently worth $27,042 after a 1.66% drop in price over the last 24 hours. Despite this, BTC is still in the green by more than 30% over the last week. The crypto’s 24 hour trading volume is in the green zone at the moment and now stands at $32,091,481,252 after a more than 33% drop since yesterday.

ETH is also in the red at the moment after a 2.55% price decrease over the last day, and now trades at $1,776.51. ETH’s weekly performance is still looking up as the altcoin is up by more than 20% over the last seven days.

SOL is also trading in the red as the weekend comes to a close. SOL is currently worth $21.55 after a 3.40% drop in price over the last 24 hours. With its market cap of $8,263,759,202, SOL is currently ranked as the 10th biggest crypto in terms of market capitalization.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.