DeFi or decentralized finance provides financial services that are conducted on public blockchains such as Ethereum. One of the main goals of DeFi is to remove the interventions from third parties, thus, simplifying the process of borrowing and earning for investors. As diverse traders are always on the lookout for revolutionary DeFi projects, Coin Edition will be reviewing Summer.fi (previously known as Oasis) — a project that dated back to 2016, before the existence of the first Maker Protocol, Single Collateral Dai.

This Summer.fi project review article will conduct a comprehensive analysis of its products, services, and unique features that set it apart from other DeFi service providers.

Summer.fi Overview

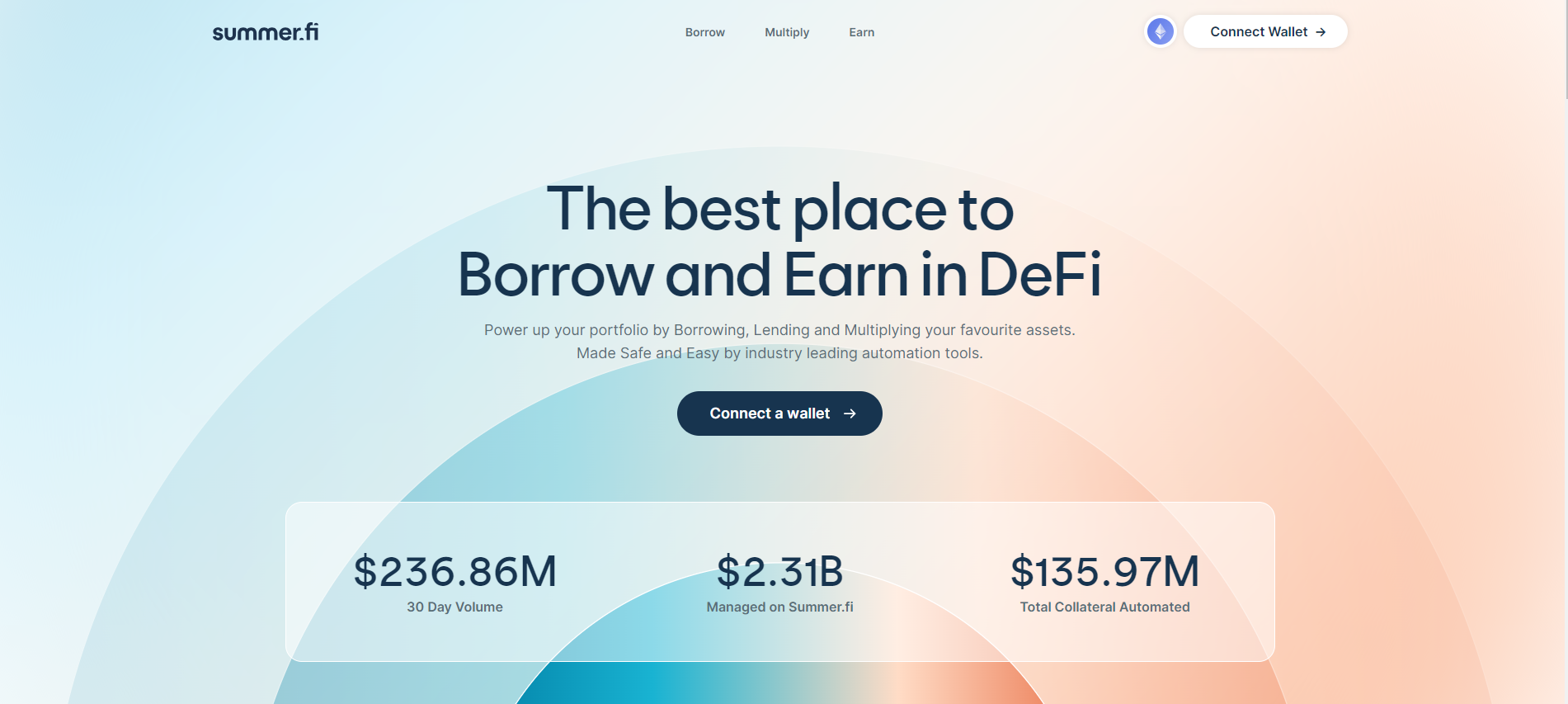

Founded back in 2016, Summer.fi (previously known as Oasis.app) boasts itself as “the best place to borrow and earn in DeFi.” Its mission is to build the most trusted app to deploy capital in DeFi. It was only recently that the project was rebranded to ‘Summer.fi’ to encapsulate its goals of promoting simplicity, vitality, and a friendly atmosphere — a theme many users expect to experience when utilizing a DeFi service provider.

Summer.fi presents three main offerings; Borrow, Multiply, and Earn. Apart from its main products, the DeFi service platform also provides advanced automation features such as Stop-Loss, Take-Profit, Auto Buy and Auto Sell, and Constant Multiple, hence, proving that it is more than just the front end to access Maker Protocol. Users can also enhance their DeFi experience through Summer.fi Smart DeFi Account which offers additional features such as being gas efficient, deploying the capital at ease, reducing the exposure to common approval bugs or errors in DeFi, and more.

While trying to provide simple and revolutionary DeFi solutions, Summer.fi also ensures to maintain the key features of transparency and decentralization enabling users to freely pressure test and audit its core technology.

Platform Interface

Traversing across the Summer.fi user interface, we can see that the platform highlights user-friendliness and simplicity. The UI on the website makes it easier for beginners and experts alike to easily grasp Summer.fi’s revolutionary DeFi solutions.

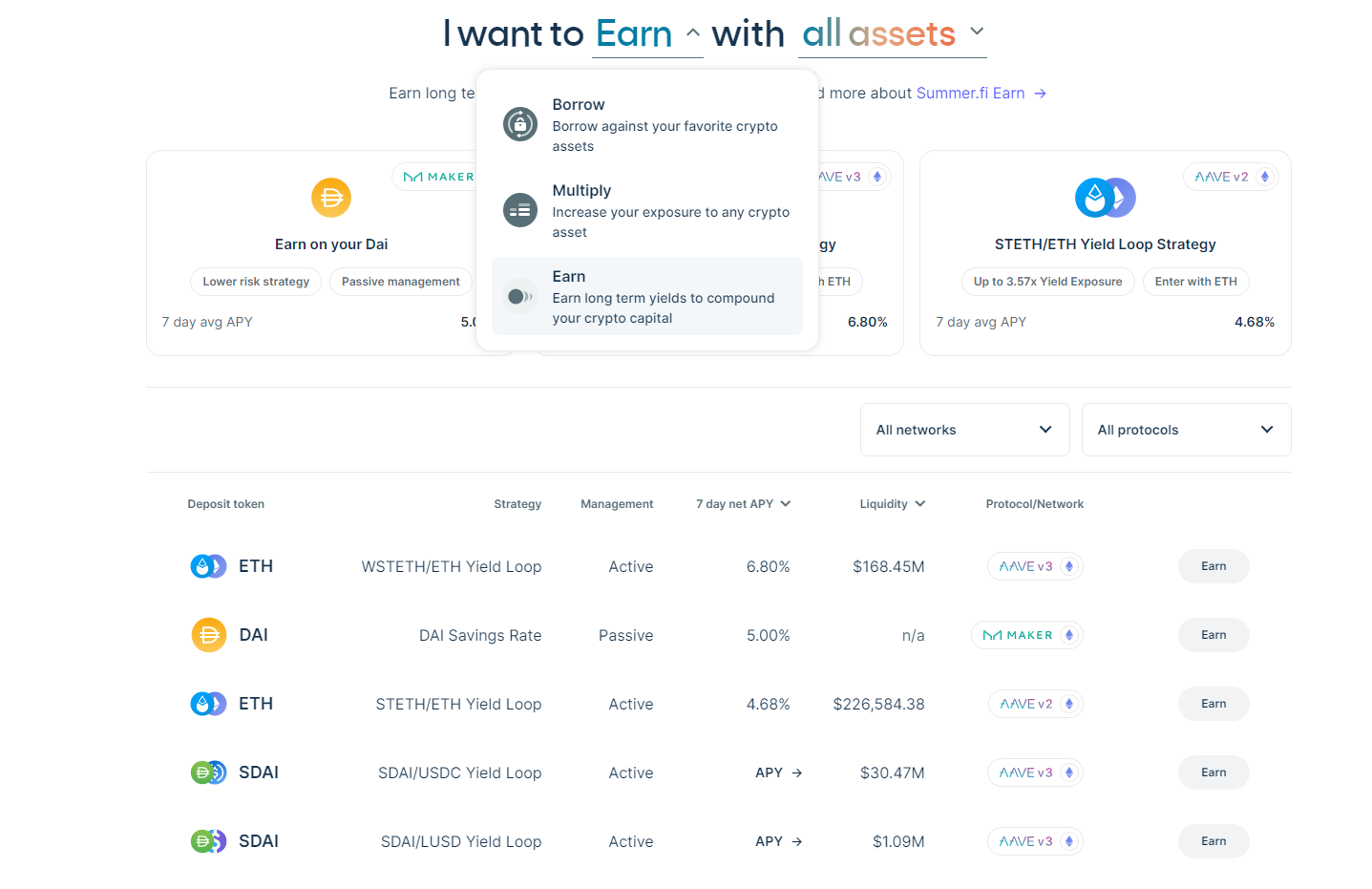

Users can easily conduct the three main functions such as Earn, Borrow, and Multiply which can be selected on the drop-down menu available on the main page. Users can also easily select the asset of their choice by browsing through the list presented on the main page. To further filter down the list, users can also choose whether they want to earn, borrow, or multiply with ETH or DAI.

The list points out the strategy, protocol network, management, seven-day net APY, and liquidity, hence, making it easier for users to make well-informed decisions. The platform also supports multiple languages such as English, Español, Chinese, and Portuguese, further enabling diverse user groups to be able to navigate through its platform easily.

Key Features

Apart from its main three products, Summer.fi also offers various features for its users. In this section, we will take a look at the different features and the benefits it provides for its users.

Borrow

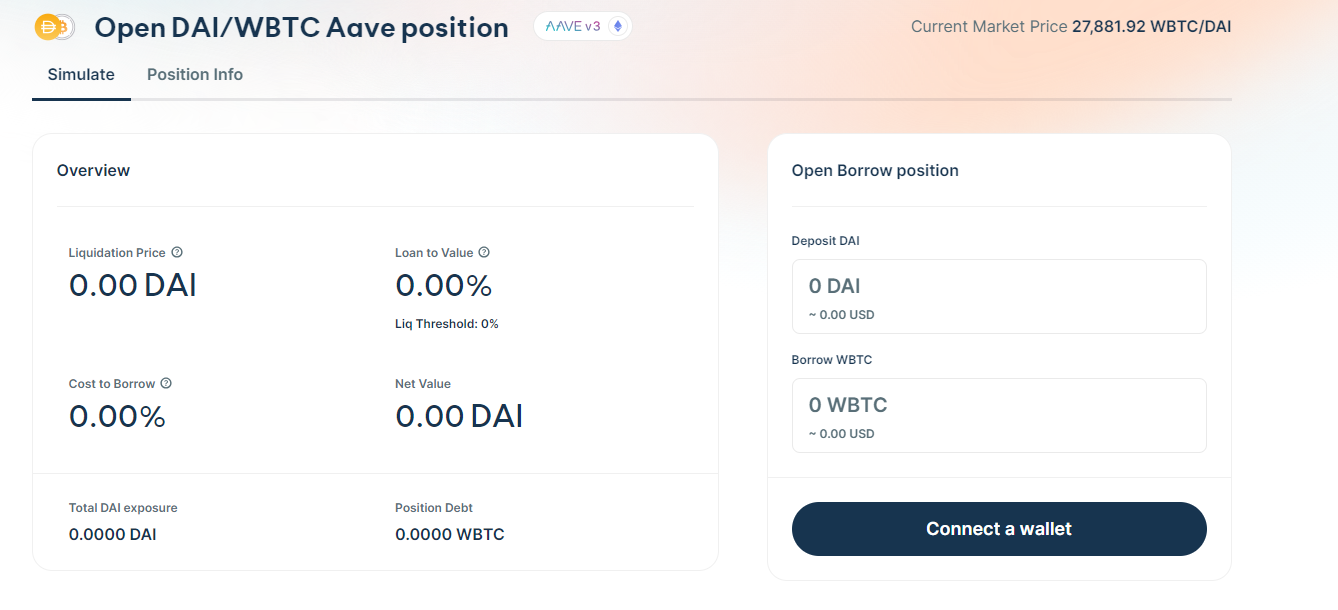

The Borrow feature is one of the main components of the Summer.fi platform, allowing users to easily borrow DAI or other supported assets in any of the protocols such as Aave and Ajna against any collateral supported like ETH, WBTC, and more than 20 additional assets. Summer.fi’s UX ensures that the users can seamlessly complete the process of borrowing DAI or any other asset in AAVE or Ajna.

The Borrow feature offers users extra liquidity when they choose to DAI on Maker. DAI, a stablecoin, could be used for trading, spending, saving, and multiple other scenarios. Summer.fi also provides diverse collateral types with different rates and collateral ratios helping users to select the right risk profile for them.

Another benefit of Summer.fi’s Borrow feature is the flexible repayment schedules. This feature ensures that there are no repayment schedules, no minimum payments, and no credit history requirement further simplifying the borrowing process.

Although users can repay at their own pace, they must ensure that the Vault is properly collateralized. When users keep their vaults properly collateralized, it avoids liquidations. In this context, liquidations are the forceful sale of collateral to cover the borrowed funds and carry a penalty.

Each protocol supported in Summer.fi has its own oracle and liquidation mechanism. In the case of Maker, it utilizes the Oracle Security Module, also known as the OSM, which warrants that the prices are updated only once an hour, protecting borrowers from flash crashes and short-lasting market volatility, as well as compromised price feeds. The OSM delays the price updates it receives from the Medianizer by one hour, giving users the chance to react to it accordingly. When using AAVE, updates are continuously sourced from Chainlink and this means that liquidation penalties can be lower. For Ajna protocol, there are no oracles and it’s all market driven.

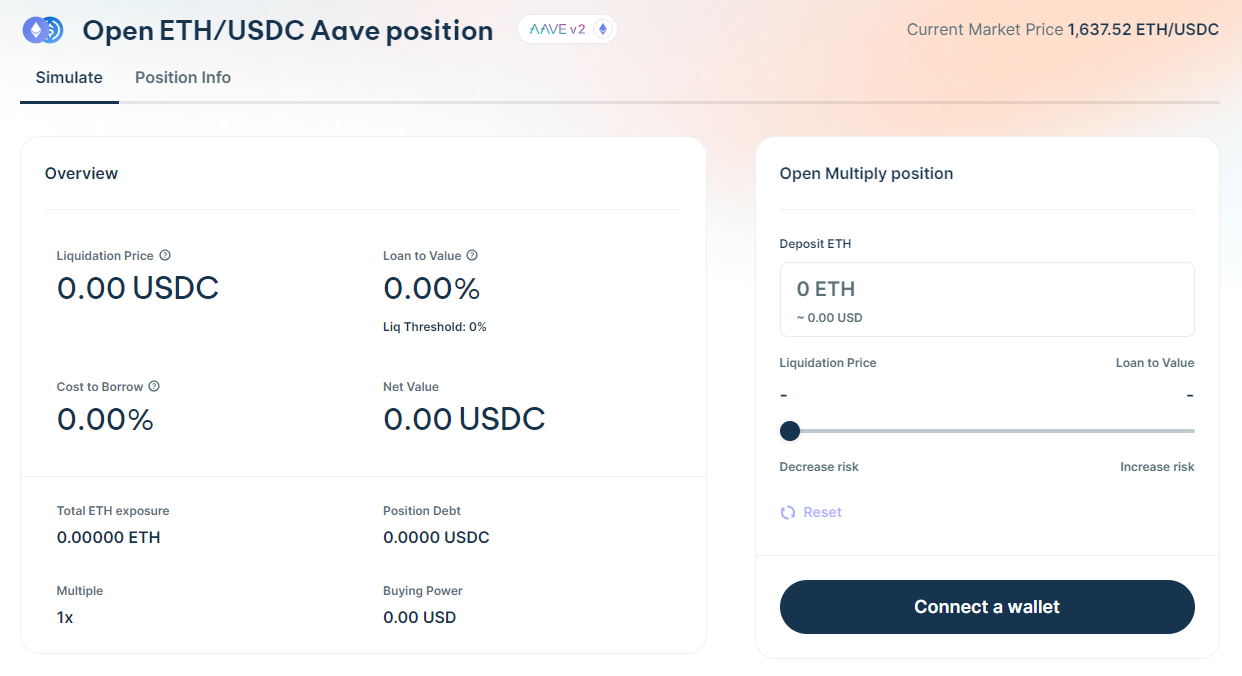

Multiply

The Multiply feature is claimed to be a relatively new feature of Summer.fi. It enables users to increase or decrease the exposure to the collateral asset in one transaction. Users can utilize the borrowed tokens to buy more collateral within Summer.fi. Users can deposit collateral in a position to borrow DAI, USDC, or other debt tokens as a funding source to purchase more collateral, hence, further multiplying the exposure to the assets.

The main purpose of this feature is to eliminate the need for multiple transactions. This would allow users to conveniently conduct their transactions without the need to switch between various apps and prevent users from incurring multiple transaction fees. This Multiply position would leave users with at least a 1x multiple exposure, up to 5x depending on the collateral users choose.

Summer.fi’s Multiply has also added new integrations such as sourcing flash loans from the most liquid platforms to guarantee the cheapest execution and sourcing liquidity from the 1inch DEX aggregator, to provide users with the best price when they swap their debts or collateral.

Compared to Summer.fi Borrow, Summer.fi Multiply dons new features with a new dedicated interface showing users Buying Power, Net Value, Multiple numbers, and more information on the comparison screen. This new interface would help users easily determine and manage their positions.

The Multiply Vault grants the users the ability to perform Multiply actions, which use flash loans to make the trades, deposits, and withdrawals of the extra collateral – all in one transaction. These Multiply actions have a fee of 0.2% based on the trade size that takes place in each transaction. If a transaction is a Multiply action, the fee will be distinctly shown in the order summary screen.

Since the Multiply and Borrow are the same vaults or positions, users can use the Multiply position to deposit, borrow, and generate DAI or any other collateral, which are available under the ‘Other Actions’ tab. The Multiply vaults also allow users to close their position instantly to either collateral or the borrowed asset, without the need for any DAI or collateral in their wallet.

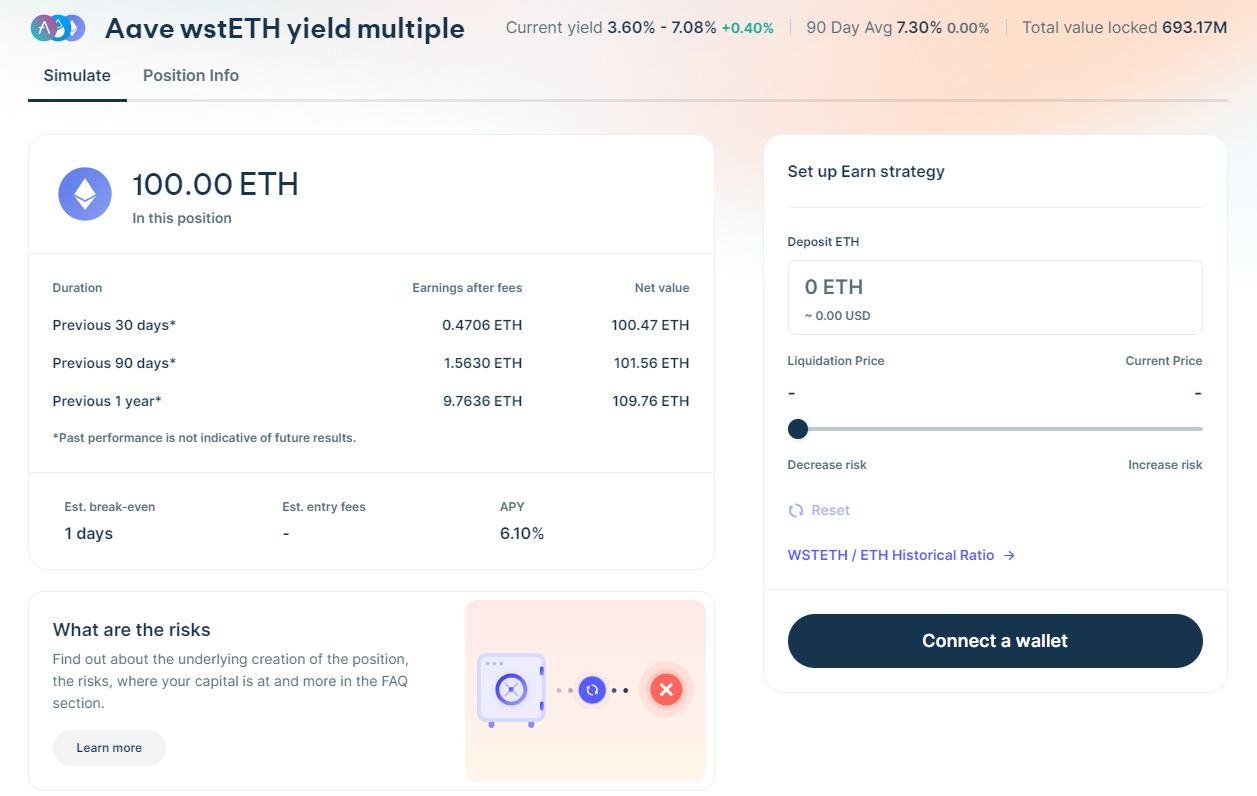

Earn

Summer.fi Earn helps users easily put their deposits in a position to earn a yield. It acts as a full self-custody solution for entering and existing yield positions enabling users to stay in control of their funds and works with Aave and Maker protocols. Users can increase the yield from StETH and earn passive income with the Dai Savings Rate (DSR).

To increase their yield from StETH, a flash loan for DAI is taken from Maker and deposited into the Aave Protocol. Then ETH is borrowed until it reaches the desired Multiple levels. The loaned ETH and the user’s initial deposit are exchanged to StETH via 1Inch. The return comes first from the ETH staking yield provided by StETH. That yield is multiplied by increasing exposure to StETH by borrowing ETH.

When it comes to earning passive income, the DSR is a special module in the MakerDAO smart contract system, allowing DAI holders to receive a share of the revenue earned by MakerDAO. Users can deposit as much as they want and withdraw at any moment, without any lockups or fees.

Automation

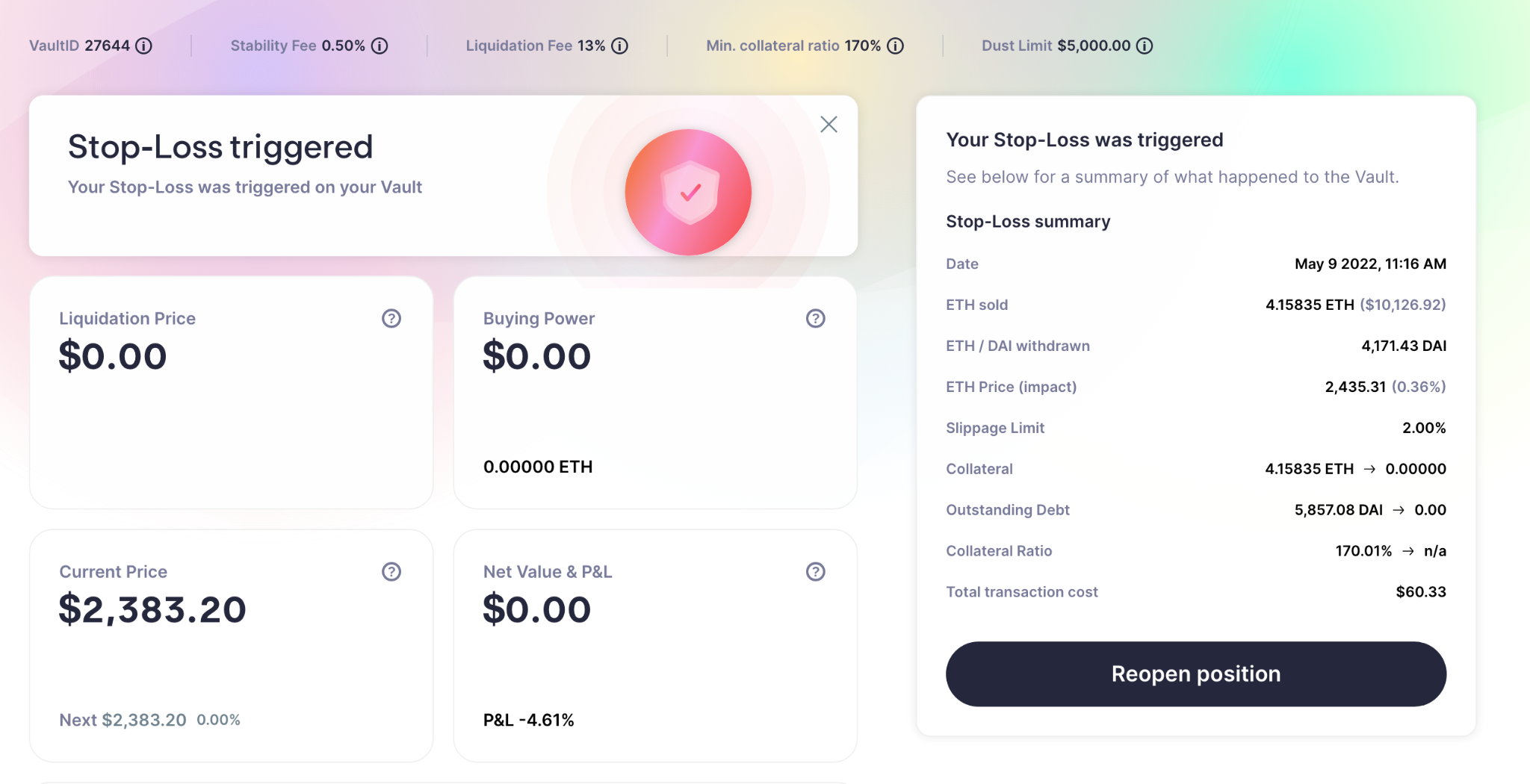

Summer.fi’s automation tools help users to easily control and manage their capital. The main purpose of this feature is to provide the best and most trusted entry point to deploy the capital. With automation, users can seamlessly automate critical functions related to the management of their position. Summer.fi has provided its users with five Automation strategies — Stop-Loss, Take-Profit, Auto-Buy, Auto-Sell, and Constant Multiple.

Stop-Loss

The Stop-Loss feature within Summer.fi’s Automation enables users to prevent liquidations on their Vaults if the collateralization ratio falls too low. The Stop-Loss feature is currently available for Maker and Aave v3 positions. Users can set the minimum collateralization they are willing to accept on their Vault. When the Vault’s ratio is at this level or drops below it, a Stop-Loss action would be triggered.

Take-Profit

Take-Profit is the second strategy designed by Summer.fi to provide an efficient exit strategy for the users. To initiate the Take-Profit, users can set a Target Price for their collateral asset, which will monitor and activate when the trigger is reached. Take-Profit will automatically sell the user’s collateral to DAI and close their Vault.

Auto-Buy

Auto-Buy will help users reduce their vault’s collateralization ratio by generating more DAI which is swapped for collateral and deposited into the vault. One of the main reasons behind this innovation is to help users earn more benefits in a bull market where the value of the collateral is increasing.

Auto-Sell

When it comes to Auto-Sell, it enables users to increase their vault’s collateralization ratio by automatically repaying their vault debt and de-risking their vault without closing it.

Constant Multiple

This feature is described as an “advanced automation strategy,” allowing users to maintain their vault’s Multiple factor in a predefined value, by automatically buying or selling their collateral when their collateralization ratio changes. The Constant Multiple is currently available on Maker positions.

Summer.fi Partnerships

Throughout, Summer.fi has integrated with various networks and wallets to provide the most optimal services for its users. Currently, the wallets compatible with Summer.fi include Metamask, WalletConnect, Ledger, Portis Wallet, My Ether Wallet, Coinbase Wallet, and Trezor Safe. These wallets that are compatible with Summer.fi, help users easily access the platform. Summer.fi has also successfully integrated and launched on various other networks to drastically improve its DeFi solutions.

1inch Network Integration

In a strategic move designed to enhance user convenience and mitigate challenges associated with high gas costs, Summer.fi integrated the 1inch Network decentralized finance aggregator protocol into its platform.

This integration represented a significant leap forward in the realm of decentralized finance as users could enjoy cost-efficient token swaps and more secure liquidity provision. This integration with the 1inch Network aimed to permanently solve the issue of high gas costs.

Launched on Optimism Layer 2

In July, Summer.fi was also launched on the Optimism Layer 2, a scaling solution for the Ethereum network. This enabled Summer.fi to take advantage of the benefits of Layer 2 protocols and elevate the users’ experience with much more enhanced trading functionality. This also reduced the transaction costs by up to 42 times using the ‘Summer Multiply’ on Optimism and improved the scalability significantly.

Utilizing Layer 2 solutions provides a seamless and efficient trading experience during peak periods. By harnessing the power of Layer 2 solutions, Summer.fi has enabled users to engage in leverage-like trading with reduced fees, making it more cost-effective to participate in trading activities and explore other strategies.

Ajna Protocol Integration

Summer.fi further expanded its multi-protocol offer with the integration of Ajna protocol. Users can then seamlessly borrow or lend on curated Ajna pools using Summer.fi. The lack of protocol-level governance and dependency on external price feeds creates a more secure system.

Summer.fi has enhanced Ajna’s user experience by integrating external sources like Chainlink for price information, bridging the gap caused by the absence of oracles. This integration ensures a seamless and user-friendly interface, allowing users to comfortably navigate Ajna with the added UI/UX improvements from Summer.fi.

Conclusion

Founded in 2016, Summer.fi (previously known as Oasis.app) boasts itself as “the best place to borrow and earn in DeFi.” Its mission is to build the most trusted app to deploy capital in DeFi. It was only recently that the project was rebranded to ‘Summer.fi’ to encapsulate its goals of promoting simplicity, vitality, and a friendly atmosphere — a theme many users expect to experience when utilizing a DeFi service provider.

In a nutshell, Summer.fi offers three main products: Borrow, Multiply, and Earn. Apart from its main products, the DeFi service platform also provides advanced automation features such as Stop-Loss, Take-Profit, Auto Buy and Auto Sell, and Constant Multiple.

Following a comprehensive analysis, Summer.fi provides its users with some of the most efficient DeFi solutions, helping them to seamlessly manage their capital within this ever-evolving market. Moreover, Summer.fi’s integrations and partnerships with various wallets and networks highlight that the DeFi service provider is focusing on enhancing user experience drastically. As Summer.fi continues to grow, it could reach out to multiple Layer 2 applications to further enhance the trading experience.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.