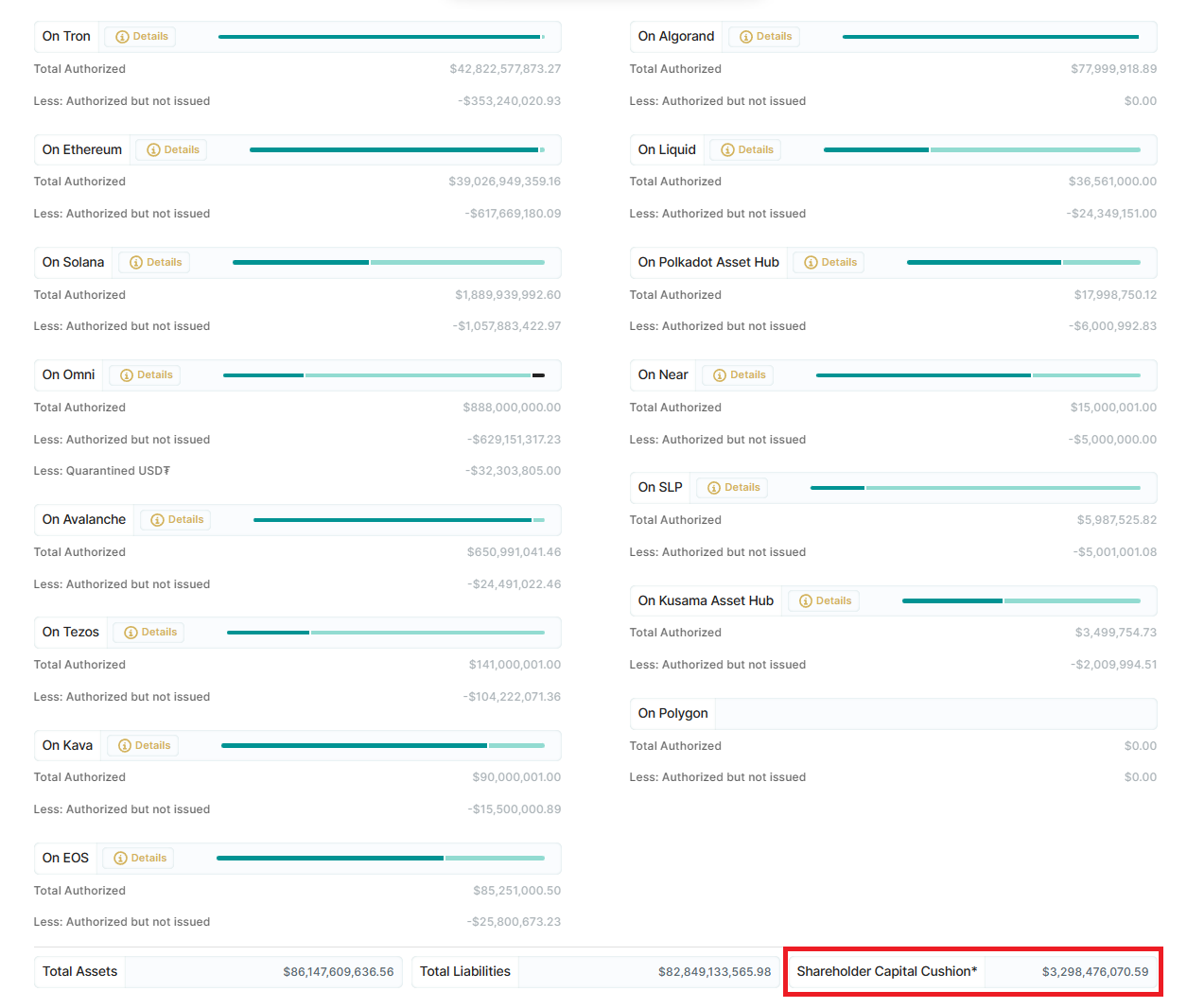

- Tether has almost $3.3 billion in liquidity reserves, across 15 blockchain networks.

- Tether also has a total asset valuation of $86.1 billion as of August 2023.

- Tether has become the 11th largest BTC holder in the world.

Tether has outdone itself when it comes to securing itself against liquidity crisis scenarios. According to Tether’s reserve reports, the stablecoin issuer has a total of $3.29 billion in shareholder capital, distributed across 15 different blockchain ecosystems.

Tether has the exclusive right to issue USDT tokens in millions, alongside Algorand and Polygon. The report also noted that Tether holds $1.7 billion in Bitcoin. Moreover, Tether has $55 billion worth of treasury bills and overall assets valued at more than billion $86.1 billion, under its belt. On August 11, on-chain data and analytics platform, CryptoQuant confirmed that Tether is officially the eleventh-largest Bitcoin holder in the world.

Tether’s strategy advisor, Gabor Gurbacs tweeted on August 23, that if the stablecoin was a country with a total t-bill exposure of $72.5 billion, it would be “the 22nd largest holder of U.S. treasuries,” beating UAE, Australia, and Mexico to the race.

Meanwhile, among other ecosystems, Solana takes the lead when it comes to pre-authorized issuance value, which currently stands at $1.57 billion. Ethereum and Tron follow closely at second and third positions featuring pre-authorized amounts of $617 million and $353 million, respectively.

Stablecoins including XAUT, EURT, MXNT, and CNHT also fall under Tether’s purview. However, they don’t benefit from a comparable liquidity buffer as USDT does, as the report highlighted these don’t have the necessary reserves to uphold a 1-1 peg during a financial turmoil. Additionally, Tether’s CTO, Paolo Ardoino recently announced that Tether is discontinuing its USDT version based on Bitcoin, operating on the OmniLayer protocol.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.