- FTX Ventures will acquire a 30% stake in SkyBridge Capital.

- An estimated $40 million of the assets would be used by SkyBridge to pay off previous investors and improve its balance sheet.

- Previously, GameStop announced a partnership with FTX.US to promote interaction between the gaming and crypto communities.

It is officially four days and a few hours to the much-anticipated Ethereum Merge, its transition to the more efficient proof-of-stake consensus.

While the Merge will occur around block 15,537,351, estimated to be Thursday, September 15, 2022, it remains few than 30,000 blocks to hit the merge threshold, according to Ethernode’s live status update.

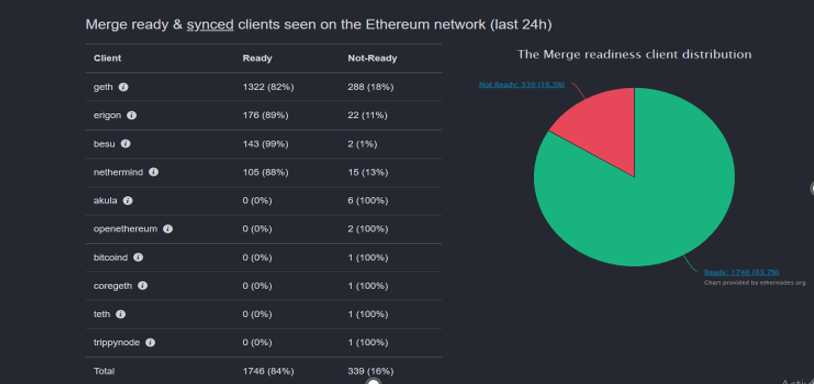

The live update also shows that a sizeable portion of Ethereum’s clients is not merge-ready, although the other side of the divide makes up over 80%.

The Ethereum Foundation had earlier warned that Ethereum node operators must update their consensus layer clients before epoch 144896 on the Beacon Chain to be Merge ready. Since the timeline for this update has elapsed, defaulters may be stuck on an incompatible chain following old rules. They will be unable to send Ether or operate on the post-Merge Ethereum network.

Additionally, the Ethereum engineers have run continuous tests after tests in the frantic lead-up to the historic event to ensure everything goes without a hitch upon migration. Yesterday, the blockchain completed what its developers called the absolute final dress rehearsal for the merge, the 13th shadow fork, which went live without a hitch.

Transition in Mainnet-Shadowfork-13 (the last shadowfork before The Merge) was successful for all Nethermind nodes!🐼💪#TheMerge #Ethereum #Nethermind #MSF13 pic.twitter.com/sddPPwSR1u

— Nethermind (@nethermindeth) September 9, 2022

Shadow forks help developers stress test synchronization assumptions to ensure network safety during permanent upgrades. Notably, the “Merge” represents the formal fusion of the Beacon Chain, which runs in parallel using proof-of-stake and the Ethereum Mainnet, comprising all its accounts, balances, smart contracts, and blockchain state.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.