- On-chain data from Glassnode indicated that US entities hold 11% less BTC than they did in 2022.

- The data also showed that the supply of USDT has reached new all-time highs recently.

- Glassnode also pointed out that the inflows of stablecoins significantly outweighed the inflows of BTC and ETH in Q1.

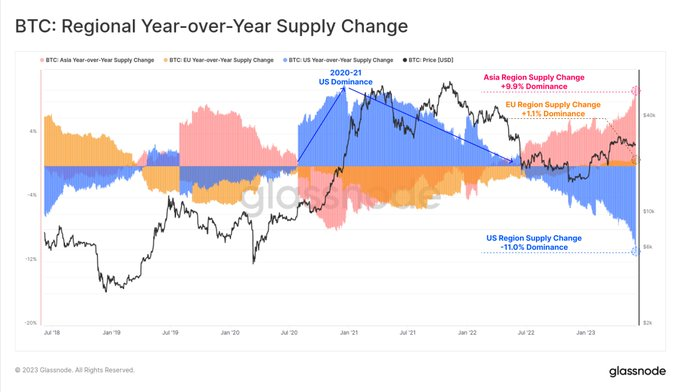

The on-chain analysis platform Glassnode shared a few posts on Twitter today to highlight some new trends that can be observed within the crypto space. Glassnode explained in one of the posts that over the past two years, there has been a significant shift in the dominance of Bitcoin’s (BTC) supply.

On-chain data indicated that US entities experienced a notable decrease of 11% in their Bitcoin holdings since June of 2022. In contrast, investors who actively participate during Asian trading hours have seen a considerable increase of 9.9% in their Bitcoin holdings. This represents a distinct reversal from the bullish trend observed during the 2020-2021 cycle.

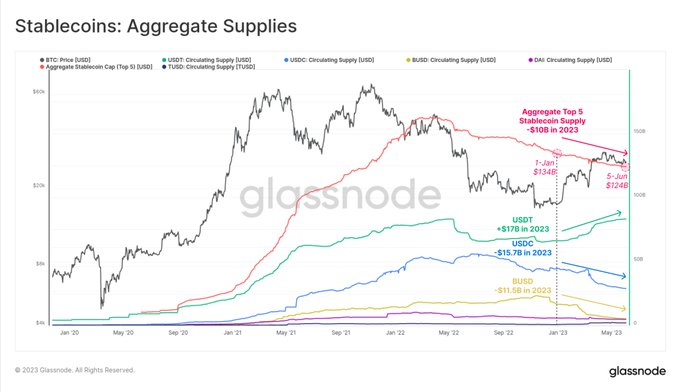

Meanwhile, Glassnode also pointed out in a second post that significant shifts are taking place in the world of stablecoins. The supply of Tether (USDT) has reached new all-time highs, indicating increased usage and demand.

On the other hand, stablecoins like USD Coin (USDC) and Binance USD (BUSD) have seen their supplies dwindle to multi-year lows. These developments imply that US capital is becoming less active in the digital asset space, according to the analytics firm.

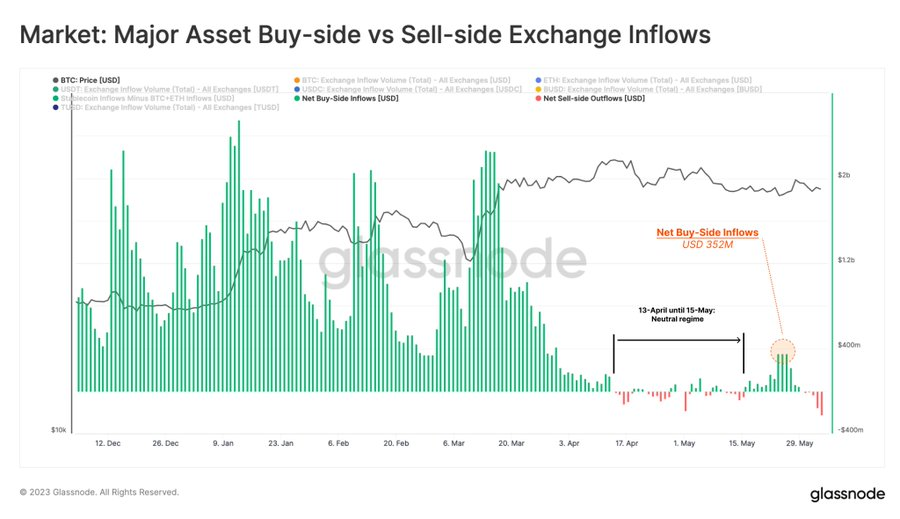

In addition to this, Glassnode also referred to the recent exchange on-chain data in another post. When examining on-chain flows on exchanges, the analytics firm found that there has been a notable decrease in demand since April.

In the first quarter, the inflows of stablecoins significantly outweighed the inflows of Bitcoin (BTC) and Ethereum (ETH), indicating a preference for stable assets. However, the current market correction has led to larger inflows of Bitcoin and Ethereum, which are assumed to be sell-side transactions, relative to stablecoins.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.