- The US jobs report will have the final say when it comes to the fates of the two biggest cryptocurrencies.

- ETH is trading at $1,581.55 after a 2.13% increase in price.

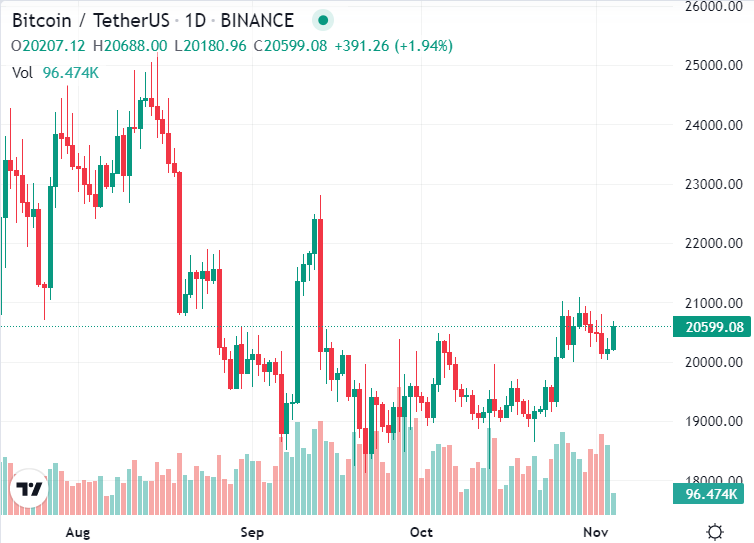

- BTC needs to avoid the $20,226 pivot to then target its first major resistance at $20,401.

It has been a bullish start to the Friday session so far, however, the US jobs report will have the final say when it comes to the fates of the two biggest cryptocurrencies in the market, Bitcoin (BTC) and Ethereum (ETH).

Some US economic indicators are rather crypto friendly at the moment. On the other hand, Fed Chair Powell’s speech was still fresh in people’s minds. This, in turn, weighed on the NASDAQ Composite Index which fell by 1.73%.

Today will also be a deciding factor as the US jobs report will have a material impact on not only the NASDAQ Composite Index, but the crypto market as a whole. Adding to the importance of today is BTC’s and ETH’s sensitivity to US economic indicators.

At the moment, ETH is trading at $1,581.55 after a 2.13% increase in price over the last 24 hours. The altcoin is also still up more than 4% over the last week.

From a technical standpoint, ETH needs to avoid the $1,535 pivot to retarget its first major resistance level at $1,555. If the altcoin is able to return to this level, it could signal a bullish afternoon session.

CoinMarketCap indicates the BTC is currently trading at $20,608.20 after a 1.41% price increase over the last day. Today, BTC needs to avoid the $20,226 pivot in order to target its first major resistance at $20.401.

If BTC is able to return to $20,300, it could mean that a price breakout is in the cards for the crypto market leader.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.