- The three biggest stablecoins have been able to maintain their peg to the US Dollar.

- USDC liquidity on Uniswap has just reached a 2-year low.

- BUSD and BNB are holding their own in the midst of the Binance FUD.

Despite the latest turmoil in the crypto markets, the three biggest stablecoins have been able to maintain their peg to the US Dollar, according to the crypto market tracking website, CoinMarketCap. At press time, Tether (USDT), USD Coin (USDC) and Binance USD (BUSD) are all in a one-to-one relationship with the US Dollar.

The biggest stablecoin by market cap, USDT, is ranked as the third biggest crypto project in terms of market cap, right behind Ethereum (ETH) and Bitcoin (BTC). At press time, the market cap of USDT stands at $66,221,780,391.

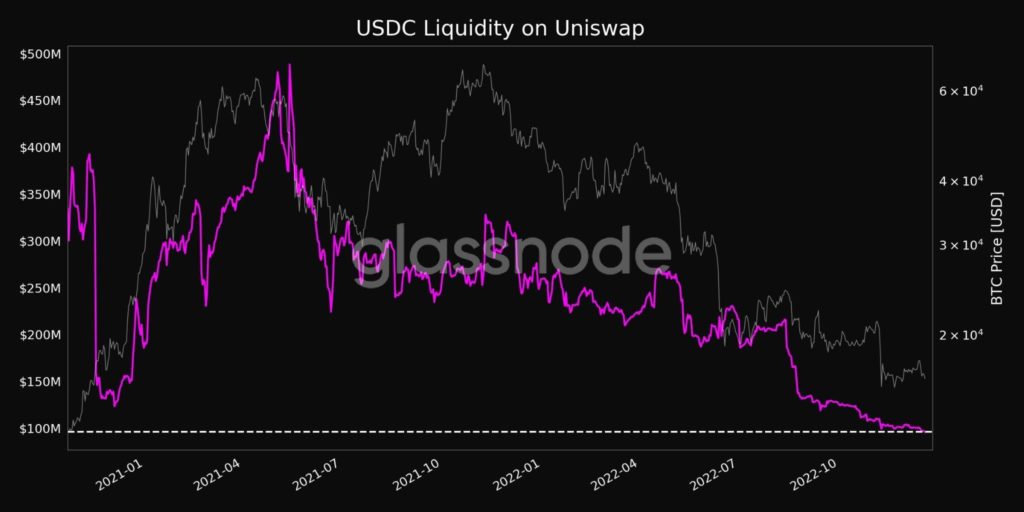

Meanwhile, at number 4 on CoinMarketCap’s list of the biggest crypto projects by market cap, USD Coin (USDC) has a market cap of $44,581,521,641. The blockchain analysis firm, Glassnode Alerts (@glassnodealerts), posted a tweet this morning sharing that the liquidity of USDC on Uniswap has just reached a 2-year low of $96,207,035.53.

The tweet added that the previous 2-year low of $96,674,715.27 was observed on December 16 of this year.

Lastly, Binance USD has been able to maintain its peg to the US Dollar despite ongoing FUD surrounding the largest crypto exchange by daily trading volume, Binance. At press time, BUSD is ranked as the 6th biggest crypto project by market cap with its market cap of approximately $18,345,650,462.

This ranks BUSD behind Binance’s native token, Binance Coin (BNB), which dropped by as much as 20% when the FUD began circulating. BNB is currently trading at $249.27 after gaining 0.89% over the last 24 hours.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.