- WOO market shows signs of recovery despite cautious investor sentiment.

- Bullish momentum in WOO/USD 7-day chart presents a buying opportunity.

- WOO/USD 24-hour chart suggests market consolidation with negative momentum.

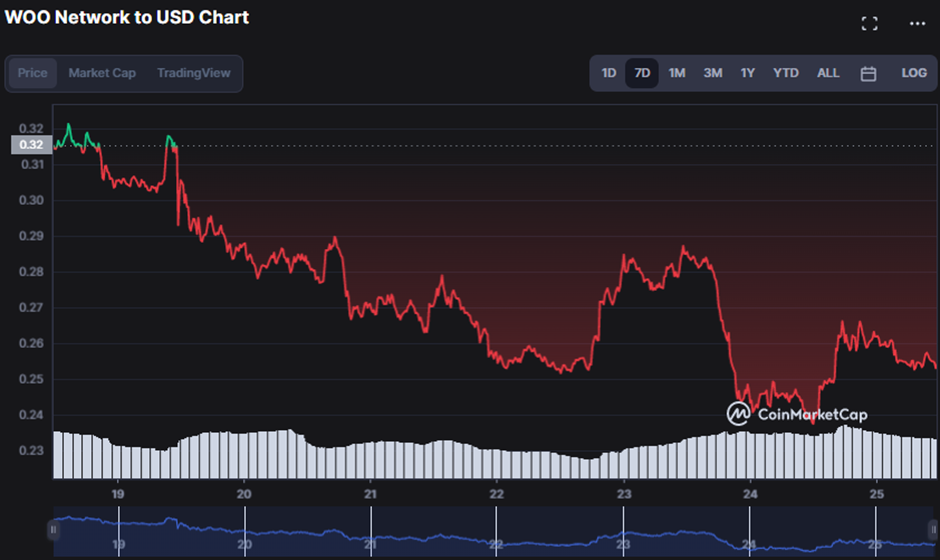

WOO Network’s (WOO) price has declined over the past seven days, falling from a 7-day high of $0.3188 to a low of $0.237. However, at the time of publication, bulls had retaken control of WOO, sending prices up 6.93% to $0.2546.

During the positive rebound, the market capitalization climbed by 6.97% to $429,026,681, indicating that investors are enthusiastic about the WOO market’s future and are prepared to spend more on it, perhaps leading to more rise in the coming days.

However, the 7.58% drop in trading volume to $51,035,695 suggests that investors may be cautious and may wait for a more transparent market direction before making further deals.

The Bollinger bands are rising and expanding on the WOO/USD price chart, indicating more volatility and the possibility of a trend reversal. The upper Bollinger band touching at 0.29853664, while the lower at 0.10463150, reflect this bullish momentum. As the price action progresses toward the top band, the developing green candlesticks suggest buyers control the market and drive higher prices.

The MACD line advances above its signal line with a value of 0.01607917, adding to the bullish momentum, and the histogram is in positive territory. These signs indicate that the asset’s price may continue rising, and traders may consider purchasing the asset to capitalize on possible profits.

With a value of 55.86, the Relative Strength Index climbs over its signal line, indicating positive market momentum. This shows that purchasing pressure is more significant than selling pressure, indicating that the market will likely continue to increase in the near future.

Conversely, the Bollinger bands move linearly on the 24-hour price chart (upper bar at 0.33881688 and lower bar at 0.18275831). This linear motion suggests that WOO is experiencing a period of low volatility, indicating that the price is expected to remain stable in the short term.

However, the MACD line moves below its signal line with a reading of 0.01172468, indicating that negative momentum may still be present in the near term. The histogram, which gauges the distance between the MACD line and the signal line, also has a negative value, suggesting that the decline might continue.

The RSI reading of 49.74 and movement below its signal line indicate a negative market attitude; however, it is not yet oversold and may have an opportunity for more downward movement before a possible turnaround.

In conclusion, while WOO’s recent rebound shows promise, cautious trading may be necessary as volatility and consolidation continue to impact the market.

Disclaimer: The views, opinions, and information shared in this price analysis are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.