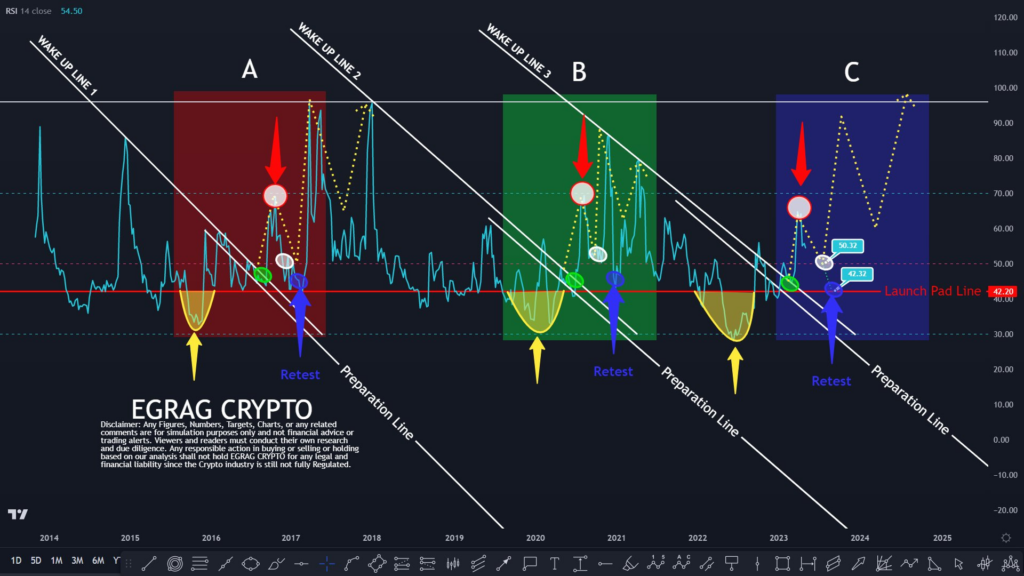

- EGRAG CRYPTO, a trader and analyst, shared that XRP’s RSI is following the same trend as 2017.

- In the post, the trader alludes to the possibility that XRP will print a higher high soon.

- At press time, technical indicators on XRP’s chart were contradicting the trader’s bullish thesis.

The crypto trader and analyst EGRAG CRYPTO tweeted an update to his Ripple (XRP) analysis this morning. In the post, he focused specifically on the Relative Strength Index (RSI) on XRP’s chart.

XRP RSI (Source: Twitter)

According to EGRAG CRYPTO, this indicator is providing a clear path in relation to historical data. He questions whether XRP’s price will print a higher high in the near future since the RSI is moving in a similar way to what it did in 2017 before the remittance token’s price had printed a higher high back then.

At press time, XRP’s price was trading at $0.4647 after it had achieved a 24-hour gain of 0.47% according to CoinMarketCap. XRP was also up against the two crypto market leaders Bitcoin (BTC) and Ethereum (ETH) by 0.38% and 0.35% respectively.

Daily chart for XRP/USDT (Source: TradingView)

Technical indicators on XRP’s daily chart suggest that the crypto’s price may not be printing a higher high any time soon. At press time, the 9-day EMA line was looking to cross bearishly below the 50-day EMA line. If this cross happens in the next 24-48 hours, it could spell disaster for XRP’s price and push it down to $0.4191 as a result.

In addition to the 9-day and 50-day EMA lines, traders will also want to keep an eye on the nearest support level at $0.4470. A break below this price mark will serve as a confirmation of the bearish thesis. On the other hand, XRP’s price closing above the 50-day EMA line in the next 24-48 hours will result in it climbing to $0.4925 in the next few days.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.