- ZkSync has been outperforming Polygon in terms of TVL over the past few weeks.

- Since the launch of zkSync’s Era and Polygon’s zkEVM, the zkSync ecosystem has been growing rapidly.

- The crypto data library Messari tweeted that zkSync holds a TVL of nearly $200 million.

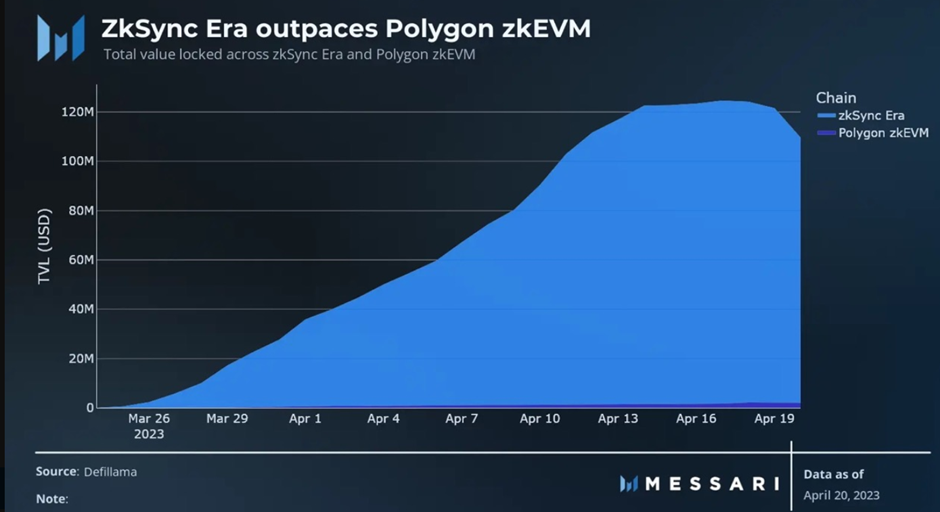

Recent reports revealed that the Ethereum developer platform zkSync Ecosystem has been rapidly growing over the past few weeks, especially after the launch of zkSync’s Layer-2 scaling protocol, Era, on March 24. Juxtaposing zkSync with the blockchain platform Polygon which recently launched the EVM equivalent zkEVM, it could be analyzed that the former has been outperforming the latter, in terms of TVL.

The crypto market intelligence platform Messari shared a Twitter thread on its official platform informing its 313k followers about the excellent performance of the zkSync Ecosystem “in the few weeks since the launch of zkSync’s Era”:

Explaining in detail, Messari stated that “at the end of Q1, zkSync had nearly $200M in TVL across its ecosystem while Polygon’s zkEVM had seen little adoption in comparison”.

The crypto data library has also incorporated a chart, picturing the Total Value Locked (TVL) of both zkSync Era and Polygon zkEVM, extracting details given by the DeFi TVL aggregator DeFiLlama. The chart explicitly shows that in contrast to the slowly moving Polygon, ZkSync ascends in a drastic mode.

As per CoinMarketCap, the major difference between both the chains is that “zkSync Era is EVM compatible whereas Polygon zkEVM is EVM equivalent”, which would have different impacts on performances. While the TVL of zkSync substantially grew since the launch of Era, reaching $200 million, Polygon’s TVL has been standing stagnant at a rate of nearly $2.2 million.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.