- Santiment tweeted that the crypto markets have been impacted by this year’s news.

- Prices will likely increase once FUD around major events eases.

- All of the top 10 crypto except BNB have seen their prices drop further.

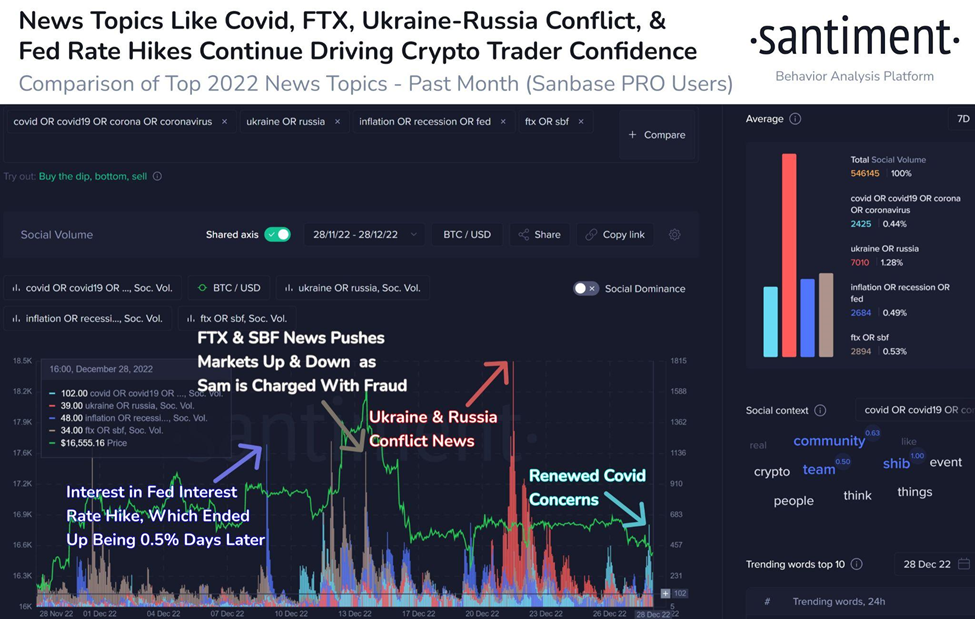

The blockchain analysis firm, Santiment, posted a tweet this morning that sheds some hope for the crypto market as 2022 comes to an end. According to the tweet, “2022 has arguably been the most evidential year of crypto markets being impacted by news events.”

This year has seen several news events impact the traditional finance and crypto markets, and both markets have reacted as expected. Covid, the FTX downfall, Sam Bankman-Fried’s arrest, interest rates and the Russia-Ukraine War are all of the major events that have injected FUD (Fear, Uncertainty and Doubt) into the crypto markets this year.

Santiment concluded the tweet by stating that a decrease in FUD relating to these news events will likely see prices in the crypto market rise.

While the crypto market awaits for the high levels of FUD to ease, the prices of cryptocurrencies across the market continue to fall. The last 24 hours has seen the global crypto market cap drop another 0.37% over the last 24 hours, according to CoinMarketCap. At press time, the total crypto market cap stands at an estimated $795.84 billion.

Looking at the top 10 cryptos by market cap, the two market leaders, Bitcoin (BTC) and Ethereum (ETH), have seen their prices drop 0.51% and 0.26% respectively over the last 24 hours. Binance Coin (BNB) is the only crypto to see its price rise over the last day.

Meanwhile, the prices of Dogecoin (DOGE), Ripple (XRP), Cardano (ADA) and Polygon (MATIC) are all down at press time.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.