- AI tool DeepSeek forecasts XRP April price between $1.50 – $3.50 in scenarios

- Bullish AI case ($3.50) depends on ETF approval, market conditions

- Regulatory clarity & ‘inevitable’ ETF hopes support longer-term bullish views

XRP has been the focus of discussion within crypto, especially following the SEC dropping its lawsuit appeal against Ripple. However, the regulatory win hasn’t yet translated into the kind of price surge many investors expected for XRP.

The token currently trades around $2.26, experiencing a slight dip over the past day, which leads market watchers to evaluate various forward-looking analyses, including those from emerging AI platforms.

AI Platform DeepSeek Outlines XRP Scenarios for April & Beyond

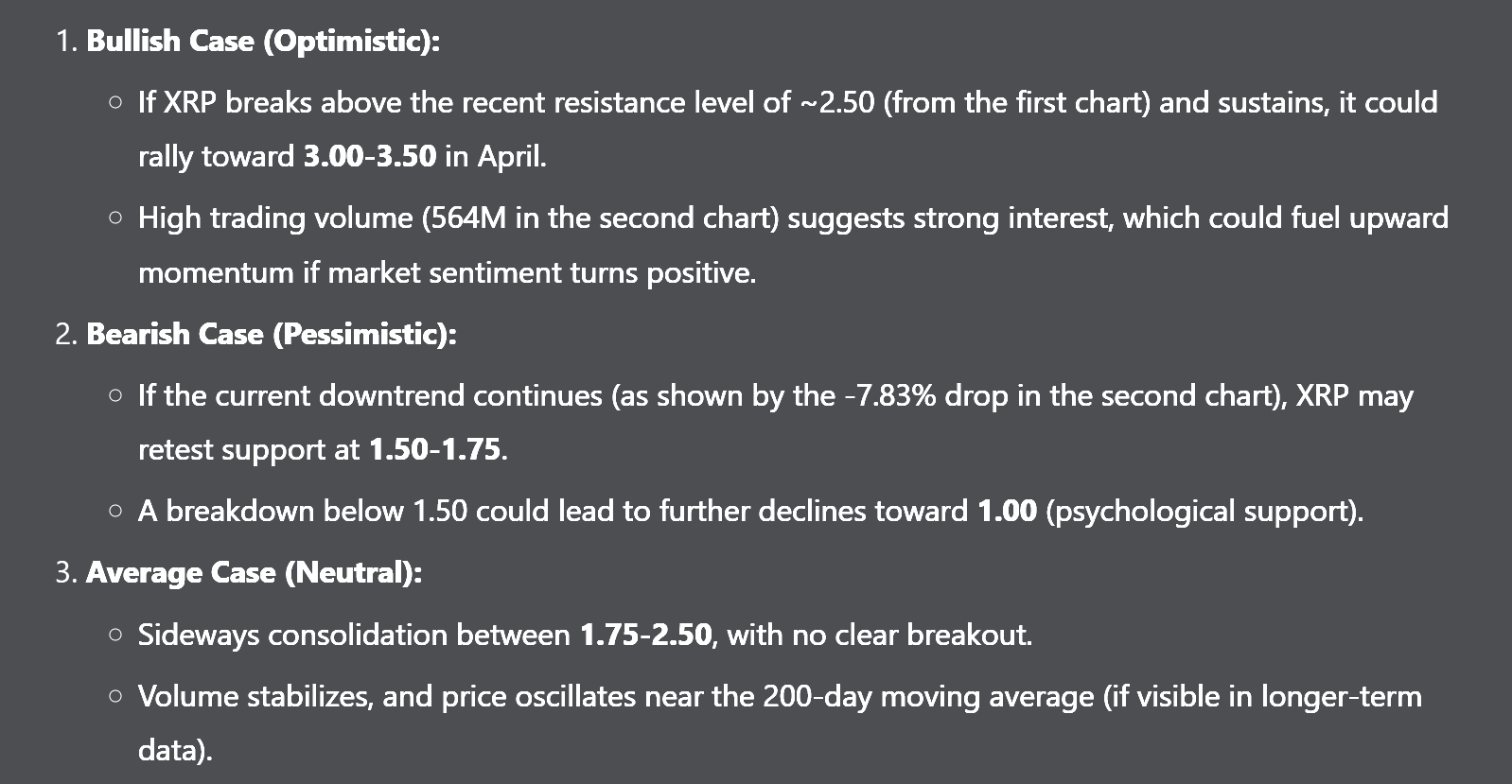

AI-powered chatbot DeepSeek provided three distinct potential price scenarios for XRP specifically targeting April 2025:

- Bullish Case: If favorable market conditions emerge alongside positive catalysts (like a spot XRP ETF approval or increased institutional use), DeepSeek projects XRP could surge into the $3.00-$3.50 range.

- Moderate/Sideways Case: If the market trends sideways without new bullish developments, the AI suggests XRP could consolidate between $1.75-$2.50.

- Bearish Case: Should a bearish turn grip the market, particularly if ETF hopes fade, DeepSeek’s model indicates XRP could drop to test the $1.50-$1.75 support zone.

Looking further out (6-12 months), the AI platform’s bullish case extends toward the $3.50-$4 range, while its potential bearish scenario targets $0.50-$0.75 if the critical $1 support level fails to hold.

Related: Why Wrapped CBDCs Fall Short: Schwartz Makes Case for XRP Bridge Utility

Grounding the Forecasts: How Does XRP Look on the Charts?

Grounding those forward-looking scenarios requires examining XRP’s current technical setup. The daily chart reveals the price recently testing the lower Bollinger Band, a condition sometimes suggesting the asset might be short-term oversold.

If XRP finds buying support and reverses upward from this position, a key near-term resistance level appears around $2.59, which corresponds to the 0 Fibonacci level on recent price action.

However, if downward pressure persists, important technical support lies near $1.72 (the 0.786 Fib retracement) and then around $1.49 (the 1 Fib level). A deeper market correction could potentially bring the $0.81 level (a 1.618 Fib extension) into consideration.

XRP ETF Approval: A Game Changer?

Beyond short-term predictions the AI has brought out or the actual chart analysis done by human experts, both of them point to fundamental factors supporting a positive longer-term outlook for XRP.

In this regard, as a one-up for humans, market analyst Dark Defender has emphasized that XRP is now one of the few cryptocurrencies with clear regulatory standing, following Judge Analisa Torres’ ruling that XRP is not a security.

He argues that this clarity could pave the way for XRP’s inclusion in a US government-backed digital asset reserve and increase its chances of securing an ETF approval.

ETF expert Nate Geraci has also voiced expectations that a spot XRP ETF is “inevitable.” So does Polymarket data; 82% probability of an approval to happen this year.

Related: Ripple Targets African Payment Friction with Chipper Cash Partnership

In the end, DeepSeek’s analysis brings out positive projections for XRP heading into April, and the charts bring out a grainy picture of indecision from real-world traders.

The price is testing support near the lower Bollinger Band and faces resistance just above at $2.59. How XRP resolves from this technical juncture could determine whether the more bullish AI scenarios remain plausible or if downside support levels near $1.72 become the immediate focus.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.