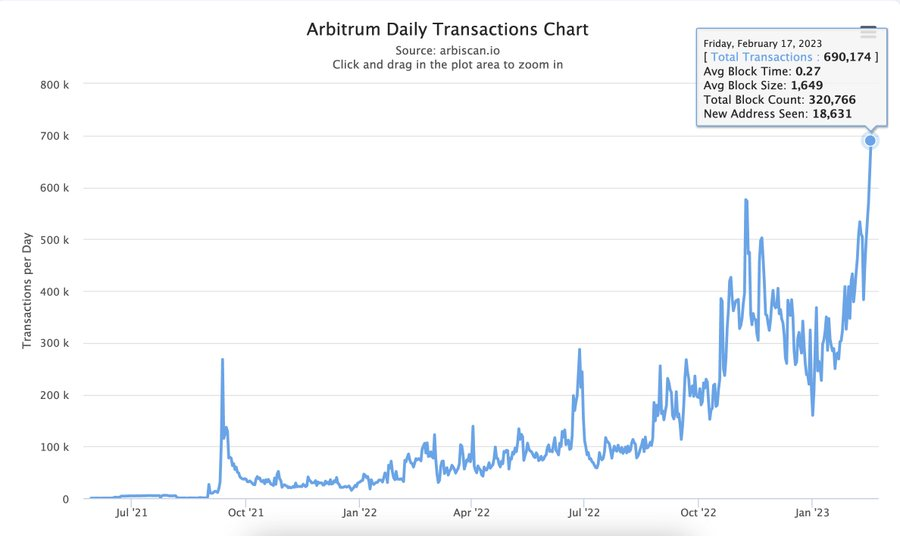

- The number of Arbitrum daily active transactions has reached a new all-time high.

- Arbitrum is a layer 2 blockchain designed to increase scalability on the Ethereum blockchain.

- ETH is currently trading hands at $1,694.49 after a 1.91% increase in price.

The crypto analytics platform known as Nansen took to Twitter earlier this morning to share some new insights about Arbitrum. According to the post, the number of Arbitrum daily active transactions has reached a new all-time high.

Arbitrum is a layer 2 blockchain designed to increase scalability on the Ethereum blockchain. Arbitrum is being touted as the next-generation blockchain platform that aims to solve the scalability issues of Ethereum blockchain technology. It is the most significant layer two on Ethereum, using roll-up technology with a TVL of over 1 billion US dollars. Currently, there are 184 protocols on Arbitrum, including GMX, Aave, Uniswap, and others.

It is the fifth largest of any L1 or L2 and records a market share of 3% of TVL across all chains. Arbitrum’s market share has increased significantly over the past year, up from 1% among all chains a year ago. This increase is partially due to the growth of applications in the Arbitrum ecosystem, such as the GMX perpetual exchange.

CoinMarketCap indicates that Ethereum (ETH) is currently trading hands at $1,694.49 after a 1.91% increase in price over the last 24 hours. In addition to this, the biggest crypto by market cap is in the green by more than 11% over the last seven days.

ETH did, however, weaken against BTC over the last day by about 1.48%. Its 24-hour trading volume is also in the red zone and now stands at $8,998,894,960 after a more than 22% decrease since yesterday.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.