- FUD in the crypto market continues to revolve around Binance.

- The exchange’s social dominance currently stands at around 24%.

- Binance Coin’s price has recovered slightly and BUSD maintains its peg to the dollar.

There has been a lot of fear, uncertainty and doubt (FUD) revolving around the crypto exchange, Binance, making rounds in the market recently. As a result, the largest crypto exchange has become a trending topic on social platforms.

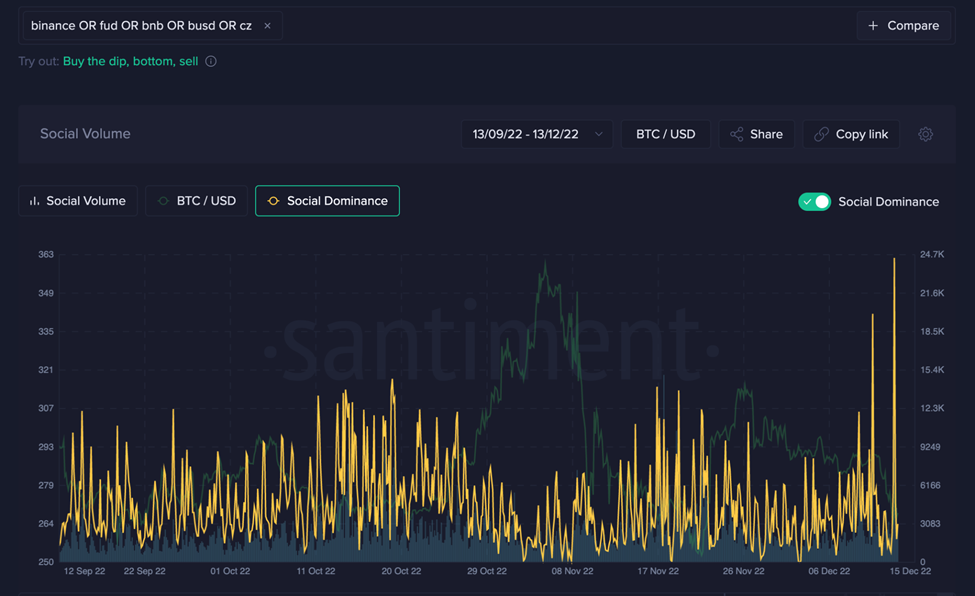

According to a tweet made today by the blockchain analysis firm, Santiment, 24% of all crypto platform conversations are related to Binance.

The report published by Santiment shows that the social dominance for Binance stands at around 24% of all messages. In comparison, “cpi” takes 0.43% domination, the report added.

Members of the crypto community are still recovering from the downfall of FTX, and fear levels escalated when withdrawals for some accounts on the Binance platform were restricted.

Additional news that Binance was accused of being involved in money laundering activities saw the fear levels in the market surge, with many withdrawing their funds from the platform.

The price of Binance Coin(BNB) was affected by the news as it dropped 4.89% over the last 7 days. However, the price of the platform’s native coin has recovered somewhat and was able to post a gain of 2.70% over the last 24 hours according to the crypto market tracking website, CoinMarketCap. At press time, BNB is changing hands at $274.44.

Binance USD (BUSD), which is the platform’s native stablecoin, has been able to retain its peg against the U.S. Dollar. Trading volume for BUSD has surged over the last 24 hours as investors panic to exit the Binance ecosystem. Currently, the daily trading volume for BUSD stands at $10,233,775,633, which is a 53.99% increase.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.