- Trading above $42,000, many BTC holders now trade at a profit.

- BTC’s market capitalization has increased by over 170%, while its price has more than doubled.

- The crypto market has seen significant growth in 2023, with many assets currently at multi-month highs.

With many assets currently trading at multi-month highs, the year has marked a recovery from the bearishness that plagued the crypto market in 2022.

In a new report assessing the on-chain performance of leading coins, on-chain data provider Glassnode found that Bitcoin’s [BTC] market capitalization has risen by over 170% since January. As for Ethereum [ETH] and other altcoins, they have witnessed over 90% growth in their market capitalizations.

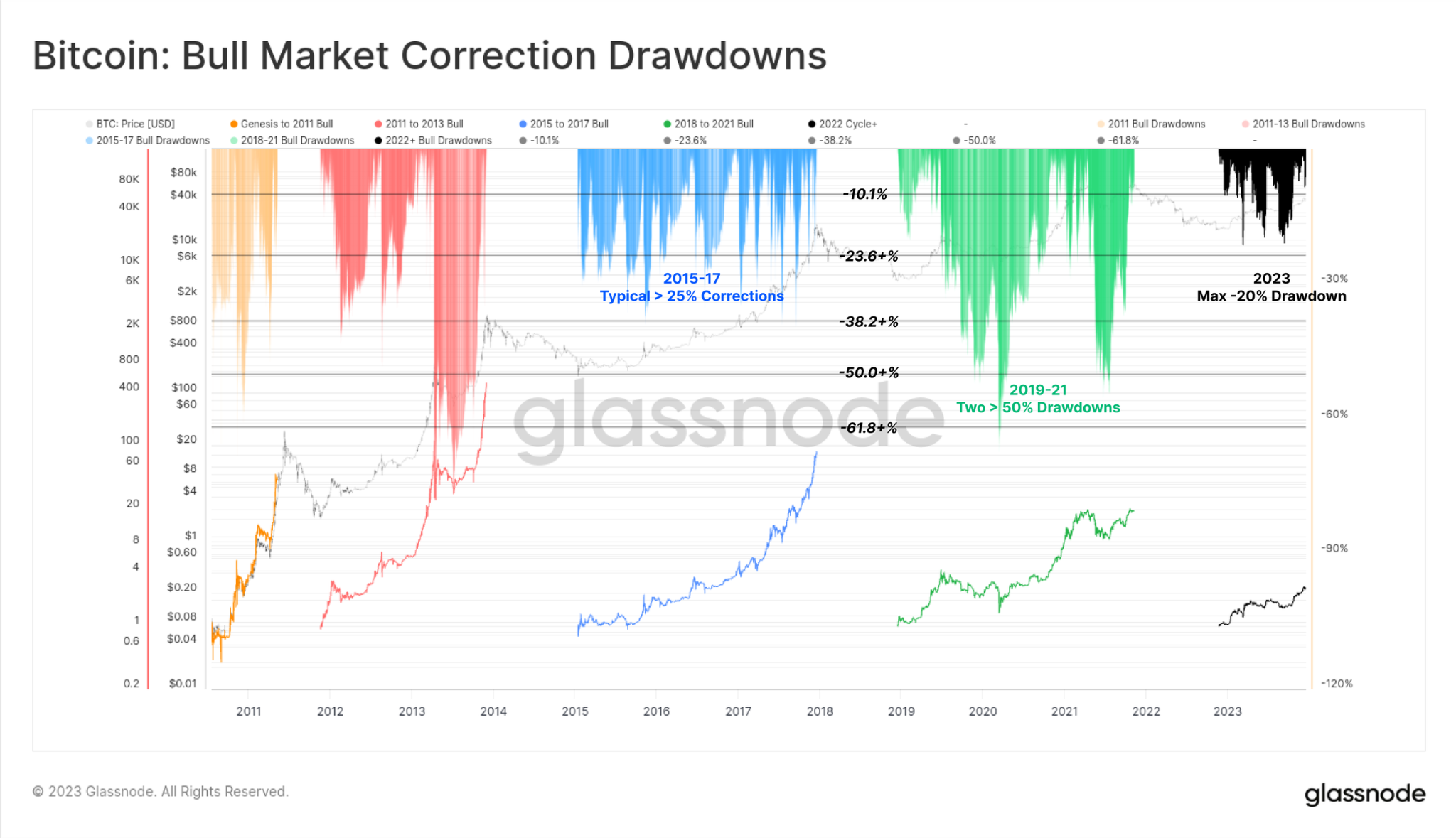

Year of the Bull for BTC According to Glassnode, a notable characteristic of this trading year has been the unusual shallowness of price pullbacks and corrections for BTC.

BTC Bull Market Correction Drawdowns (Source: Glassnode)

Compared to past bull markets with frequent 25% or even 50% retracements, this year’s deepest correction has been a 20% dip in the BTC’s price.

The research firm noted:

The buy-side support and the overall supply and demand balance has been favorable all year.

Shallow corrections are good because they indicate the presence of a bull cycle where there are moderate price increases instead of sharp rallies and declines.

Also, the year has seen a slow recovery of capital that left the BTC market during the 2022 bear market. Glassnode found that in 2022, BTC experienced significant capital outflows, with its Realized Capital plummeting by 18%.

However, while some capital has flown in this year, it is much slower than in previous cycles.

Glassnode stated:

Capital inflows have been recovering at a much slower rate, however, with the Bitcoin Realized Cap ATH (all-time high) hit over 715 days ago. This compares to a full recovery of the Realized Cap taking around ~550 days2 in prior cycles,

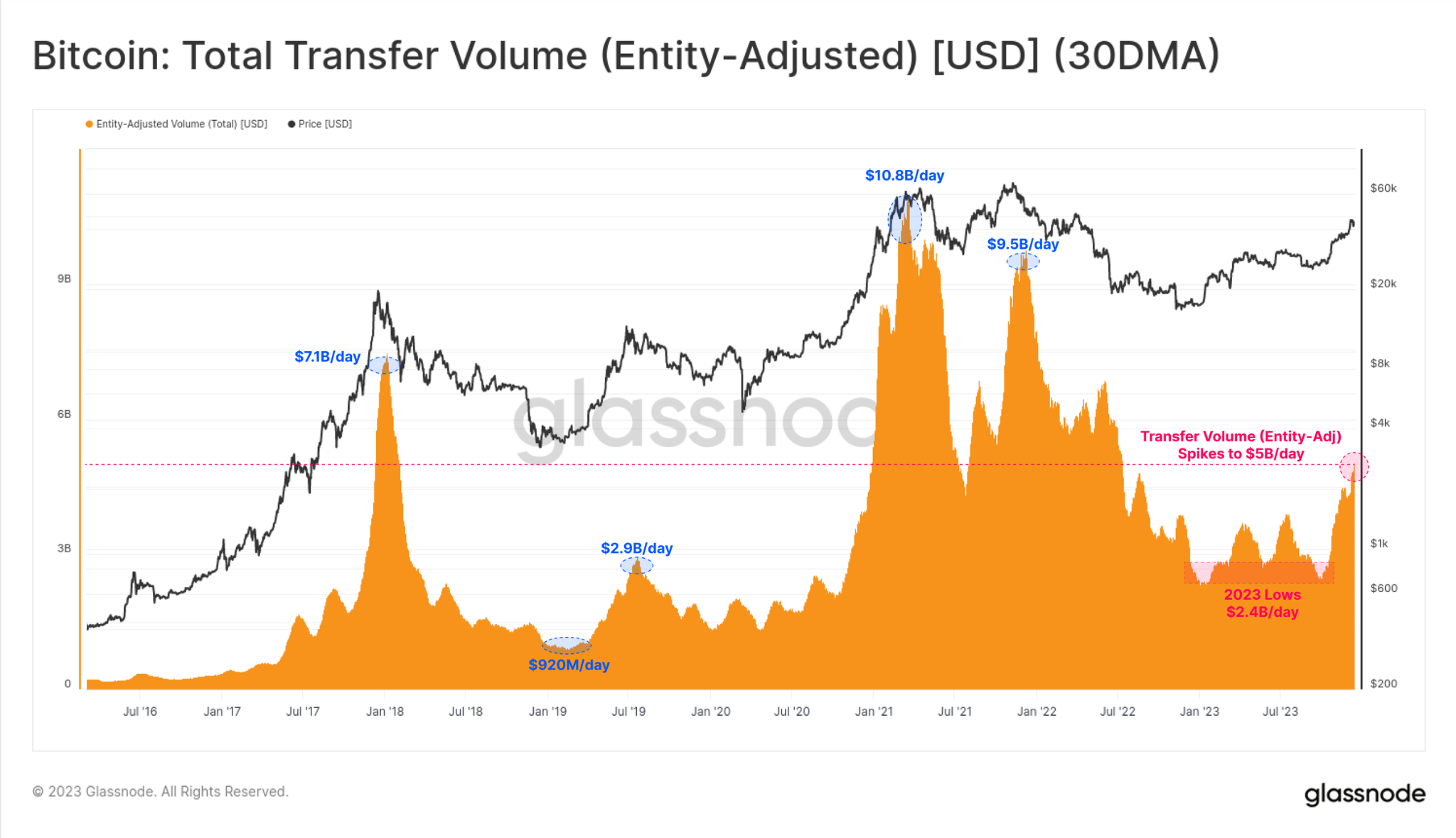

Apart from the surge in BTC’s value, the Bitcoin network has also experienced an uptick in user activity, trading volume, and inscriptions.

As the October rally pushed BTC past its psychological $30,000 price level, the network witnessed an upswing in daily transaction volumes.

The price rally led to a twofold increase in BTC transfer volumes, as it increased from $2.4 billion daily to over $5 billion. This represents its highest level since June 2022.

Bitcoin Total Transfer Volume (Source: Glassnode)

Moreover, due to the activity around Inscriptions and Ordinals on the BTC network, its transaction count recorded a new all-time high.

Monetary transactions on the chain have surged to new multi-year highs, almost reaching all-time highs at 372,500 transactions per day. Also, transactions involving inscriptions have contributed an additional 175,000 to 356,000 daily transactions to these.

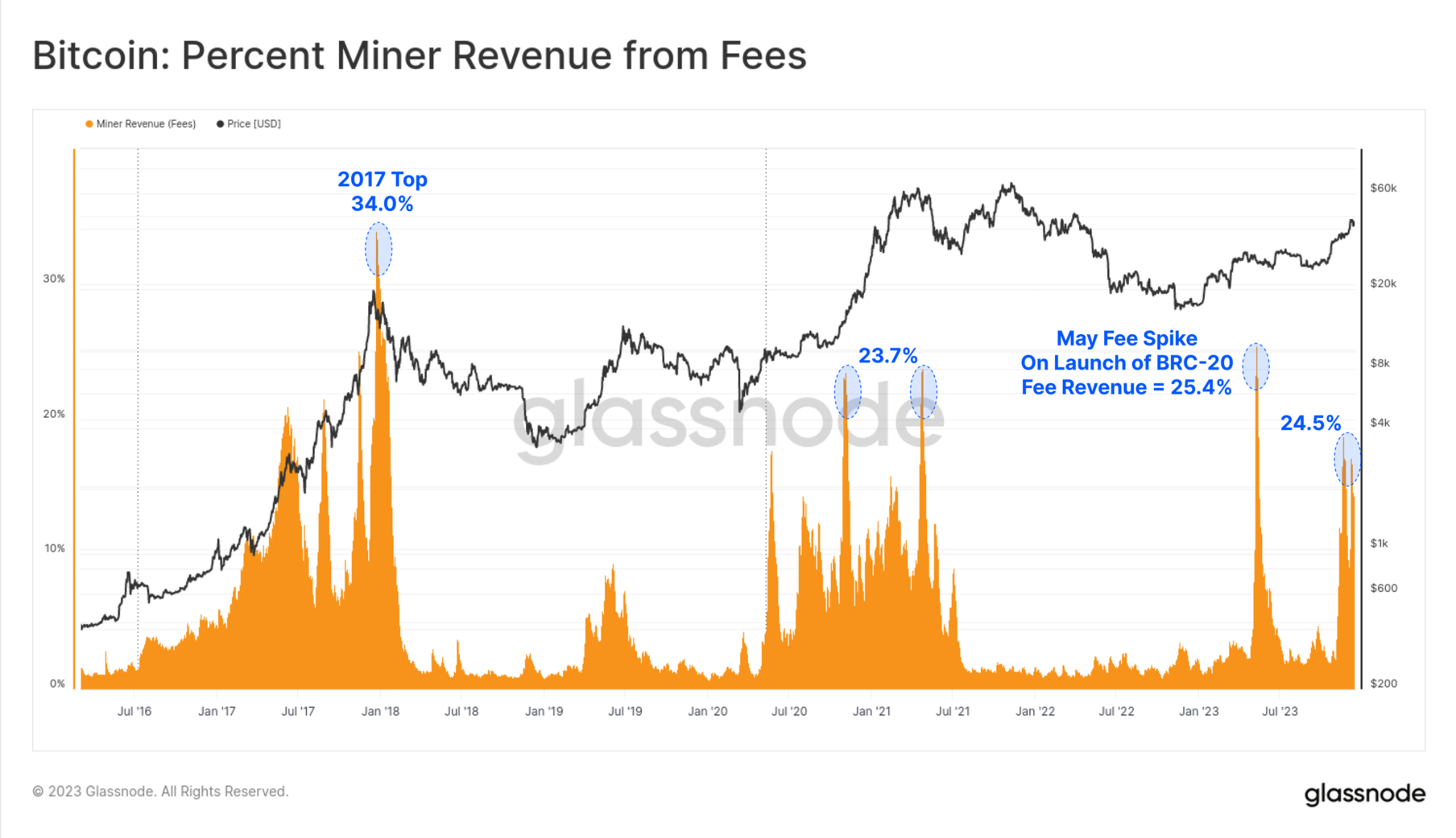

As expected, the uptick in demand for the BTC network led to a spike in miner revenue. According to Glassnode:

As a result of this new buyer of Bitcoin block space, miner revenue from fees has increased significantly, with several blocks in 2023 paying fees which even exceeded the 6.25 BTC subsidy..

Bitcoin Miner Revenue From Fees (Source: Glassnode)

At an 18-month high, BTC exchanged hands at $42,500 at press time. At its current price, “a super-majority of investor coins have returned to being ‘in-profit.’”

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.