- A Bitcoin whale transferred 5000.01 BTC worth $100 million to Kraken.

- There is a decrease in the reserve balance and the participants let off their HODLs.

- The drop in dominance is never an indicator of the BTC price’s fall.

Reports revealed that on September 5, 2022, at 04:50 a.m. (UST), a Bitcoin whale transferred 5000.01 BTC worth $100 million to Kraken, a Bitcoin trading platform. The wallet was initially created and the bitcoins were added to the account in 2013.

The Chinese crypto journalist, Colin Wu, tweeted:

5000.01 BTC at 04:50:38 (UTC+8) on September 5th to the Kraken, which is worth about The Bitcoin whale address (18xGHNrU26w6HSCEL8DD5o1whfiDaYgp6i) transferred out $100m now. The wallet was created and bitcoins were transferred to this address in 2013.

The overall analysis showed a reasonable number of participants buying the coins for the past few weeks. But the same notified a decrease in the exchange reserve balance. Anyhow, the participants are letting their HODLs off.

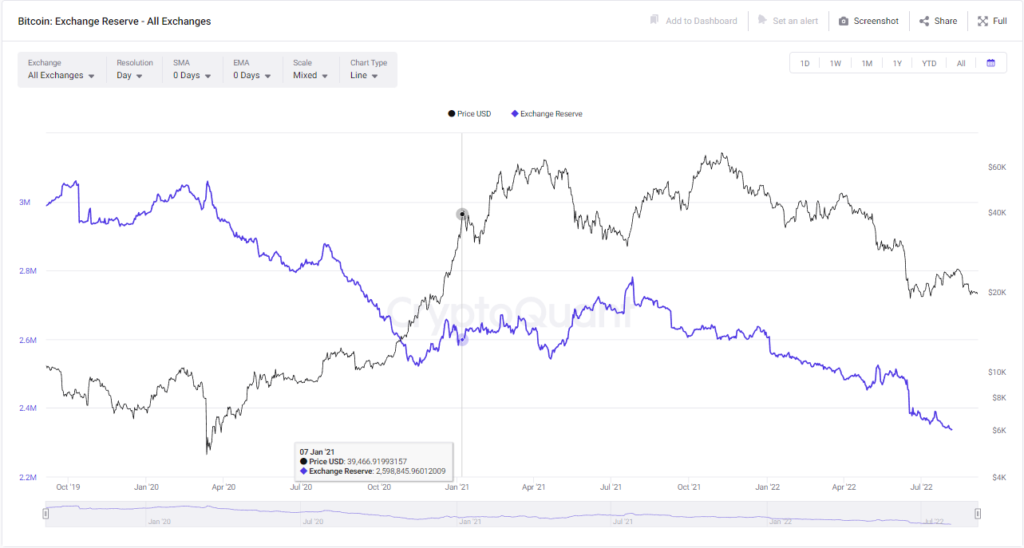

CryptoQuant released a graph on the Bitcoin Exchange Reserve which stated that the exchange reserve value had elevated to $2.316 million BTC from a value of $2.296 million BTC that was marked on August 30, 2022, implying the rising pressure in sales.

Interestingly, the deflection in Bitcoin’s flow determines whether the asset is undervalued or overvalued depending on the ratio between the current price and ‘stock-to-flow’. An asset is stated as overvalued if the deflection is greater than or equal to 1 and undervalued if it is less than 1.

According to the findings from Glassnode, a blockchain analytics digital platform, it is indicated that Bitcoin’s stock-to-flow deflection has reached as low as an ATL of 0.188, suggesting it is undervalued.

It is to be noted that Bitcoin’s dominance has dropped from 48.45% to its maximum low range over the past few weeks. However, the drop in dominance doesn’t suggest the fall in Bitcoin’s price. Instead, it is a reminder of other coins moving at a greater pace.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.