- Santiment tweeted yesterday that investors will likely focus on BTC as altcoins drop in price.

- According to Santiment, BTC’s social dominance increasing is a sign of the market rebounding.

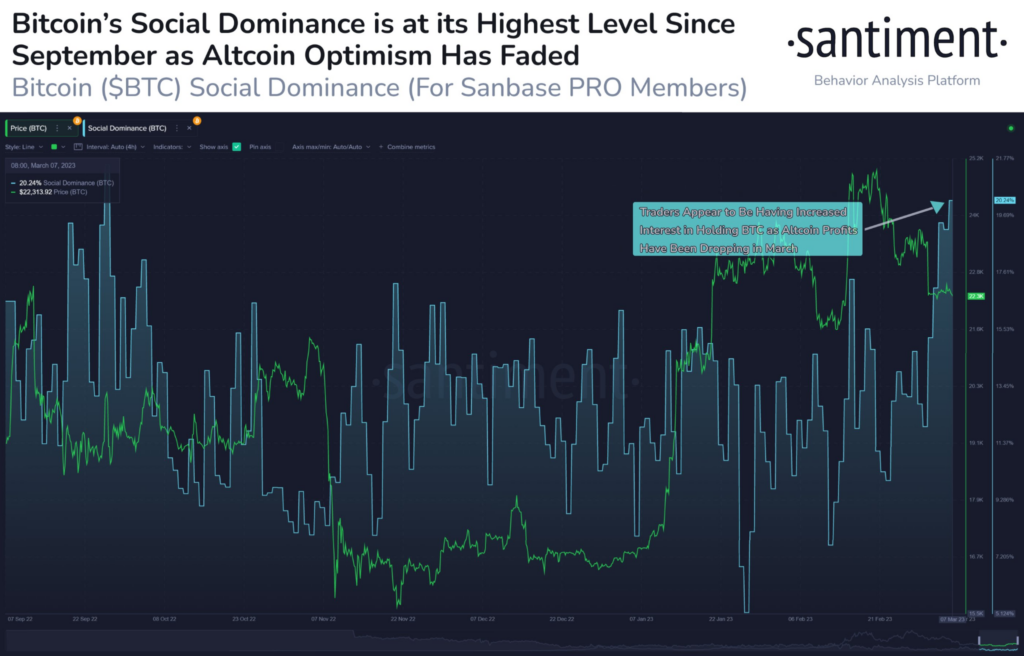

- BTC’s social dominance is at its highest level since September 2022.

The blockchain analytics firm, Santiment (@santimentfeed), tweeted yesterday that the price of Bitcoin (BTC) is down 6% in March. Despite this, the tweet added, the crypto market leader is still outperforming most of the altcoins in the market.

Traders and investors will turn their attention to BTC as the market loses some of its January and February gains, according to the tweet. Santiment shared that a rise in BTC’s social dominance has historically been a key factor in identifying a market rebound.

Santiment’s tweet included that BTC’s social dominance is at its highest level since September 2022. As a result, a market rebound may be on the cards for the crypto market in the coming weeks.

This week, however, BTC will have to overcome all of the economic data that will be released through the course of this week. Key data such as the U.S. unemployment rate and the Fed’s testimony will be made later today. It is expected that this economic data will have a negative impact on the crypto market.

Some analysts have also added that BTC’s price may drop to as low as $19.5K zone as a result of the upcoming economic data.

At press time, CoinMarketCap shows that BTC’s price has dropped 1.99% over the last 24 hours to currently trade at $22,008.52. This 24-hour price drop has added to BTC’s negative weekly performance. As a result, BTC’s price is down 7.15% over the last 7 days.

The daily trading volume for BTC has seen a 55.11% increase over the last 24 hours and currently stands at $24,220,725,036.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.