- Investors’ trust in CZ increases their eagerness to use TWT.

- According to a recent analysis, the token is bullish, and this trend is expected to continue.

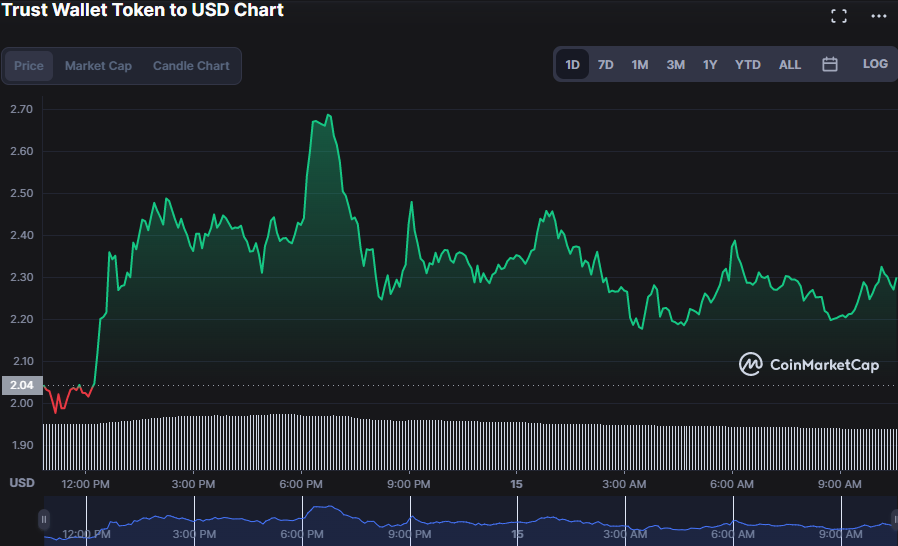

- TWT prices had risen by 4.65% to $2.32 as of press time.

Trust Wallet Token (TWT) has gained 4.65 % in the last 24 hours to trade at $2.32 after Binance CEO CZ postulated that investors use decentralized exchanges.

This increase inferred that many investors had faith in CZ, as the market capitalization increased by 11.66% to $984,359,910. However, the 1-day trading volume slipped by 12.58% to $526,266,208.

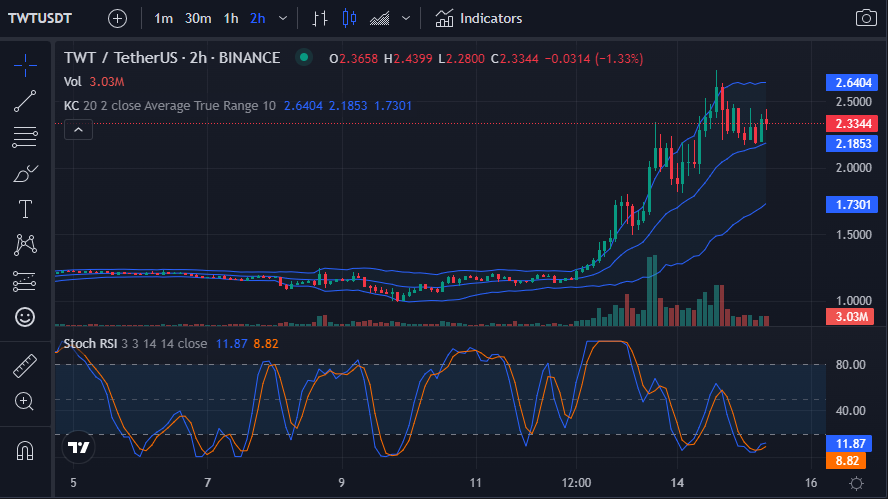

The three lines spreading apart and rising on the Williams Alligator indicator represent trending periods in which long or short positions should be maintained and managed. The 2-hour TWT price chart illustrates this, with the upper band touching 2.3090 and the lower band touching 2.1209.

The Bull Bear Power (BBP) reading is greater than zero, noting that the bulls’ run on TWT prices will continue. This is supported by its BBP reading score of 0.1954 and upward trend.

The Relative Strength Index (RSI) of 57.31 signifies a stable market with equal selling and buying pressure, inferring that the bullish momentum in the TWT price action will continue.

Herniated Keltner Channels reflect a heightened market and thus a high probability of a break out with an upper band reading of 2.6367 and a lower band reading of 1.7266. This movement indicates that the bulls will remain in charge of the TWT market.

The bears may repudiate the bulls’ run as the Stoch RSI reads 9.58 in the oversold region. This action implies the end of the prevailing bull control, but it does not necessarily imply that prices will revert lower.

TWT/USD 2-hour price chart (Source: CoinMarketCap)Technical indicators indicate that the bulls will continue to dominate the ApeCoin (APE) market.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.