- Coinbase has filed a brief in the U.S. Court of Appeals for the Third Circuit on Monday.

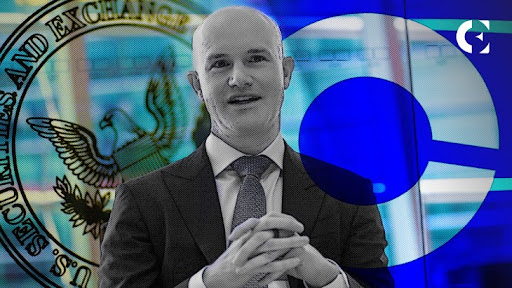

- As pointed out by Paul Grewal, the brief highlights the inconsistencies in the SEC’s arguments.

- The exchange requests the court to force the SEC to adopt a new set of comprehensive crypto rules

Grewal highlighted the inconsistencies in the SEC’s arguments that contradict themselves. The lawyer directed his readers to go through the brief notes in the post that show “how broken the Commission’s approach has been.”

According to Grewal’s post, the brief centered around three key questions involving digital assets’ status as a security, the SEC’s authority over cryptocurrencies, and the clarity of the existing law. He pointed out that over time, the SEC has made contradicting arguments regarding these pertinent questions.

Notably, in 2018, the SEC stated that digital assets are not security. However, in 2021, they argued that a digital asset embodies and represents the “investment contract.” In 2024, they made another conflicting statement, positing, “A digital asset is just computer code.” Just five days later, they reiterated their previous statement that the digital asset is an investment contract.

Though the agency accepted that there is no “market regulator for cryptocurrencies” in 2021, they reframed their words in 2022, stating, “Congress gave us a broad framework…to regulate exchanges.” Also, regarding the clarity of the law, the SEC allegedly holds conflicting stances. While they admitted in 2020 that there is no “certainty” about whether digital assets are securities, in 2023, they argued, “We have a clear regulatory framework built up over 90 years.”

In addition, Coinbase’s brief requested the court to force the SEC to adopt a convenient and comprehensive regulatory framework, reiterating their previous filings. The exchange accused the regulators of behaving arbitrarily and capriciously while refusing to frame new crypto rules.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.