- CRV market experiences short-term bearishness amid long-term positive trends.

- Traders should wait for confirmation of downward momentum before shorting.

- Stochastic RSI indicates possible buying opportunities if CRV falls into the oversold zone.

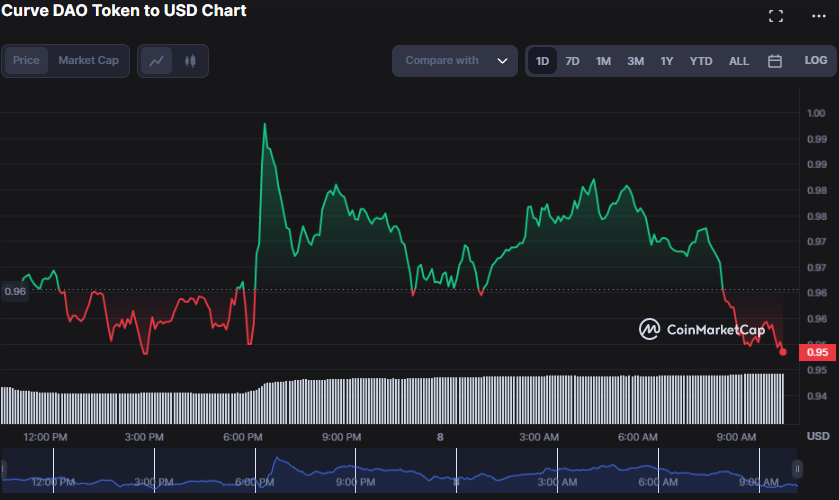

The Curve DAO Token (CRV) market has been volatile in the previous 24 hours, with bulls and bears battling to keep the price between $0.9469 and $0.9928, respectively. The bearish hand had won at press time, and the CRV price was $0.9504, a 1.08% drop.

During the market’s uncertainty, capitalization fell by 1.01% to $697,658,620, demonstrating investors’ cautious stance.

Despite the doubt, trade continues, with a 36.92% increase in 24-hour volume to $75,722,858. This surge suggests that some investors may be taking advantage of the fall in market capitalization to buy at a lower price.

Bollinger bands on the CRVUSD 4-hour price chart are contracting, with the upper band at 0.98338472 and the lower band at 0.90954809. This move indicates that the current negative trend is substantial, and the price may go lower within the provided range. Traders should wait for a confirmation of additional downward momentum by a breach below the lower band before committing to short trades.

While the market is now adverse, the Aroon up reading of 71.43 and the Aroon down reading of 7.14% point to a robust positive trend over the long run.

As the underlying trend is still rising despite short-term swings, this development gives traders more reason to maintain and increase their long holdings.

The stochastic RSI reading of 34.33 indicates that the CRV bearishness may remain, as this level denotes that selling pressure is still present in the market. If the level falls into the oversold zone below 30, it might signify a possible buying opportunity since CRV may be ready for a comeback.

With a Klinger Oscillator reading of 5.012k and going below its signal line, traders should be cautious and wait to confirm a trend reversal before making any buying decisions.

This belief stems from the fact that this trend shows that the market is now oversold and may have a short-term recovery before continuing its downward trend. Therefore traders should also monitor important support levels to establish possible entry targets.

The Chaikin Money Flow (CMF) rating of -0.14 and downward movement indicate selling pressure in the market. Still, traders should not rule out the potential of a short-term comeback owing to oversold circumstances and should exercise caution when making trading decisions.

CRV’s bearish trend continues, but high trading volume may indicate buying opportunities for investors looking for a potential comeback.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.