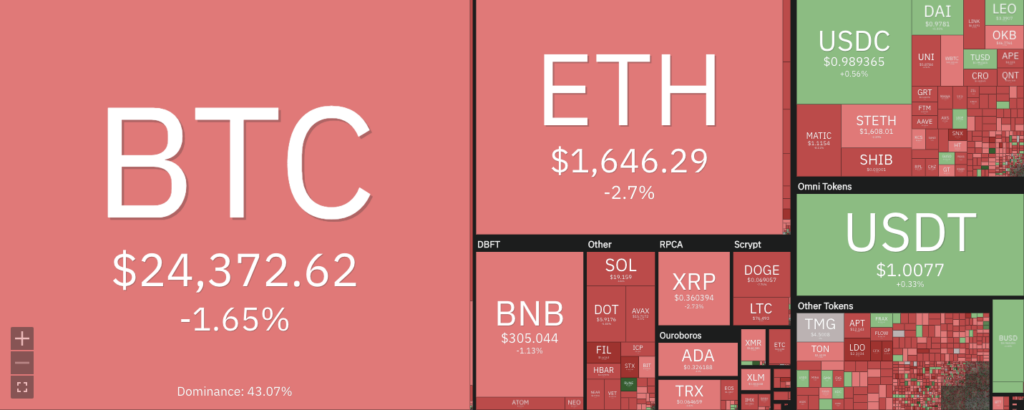

- Polygon (MATIC), Dogecoin (DOGE), and Cardano (ADA) are all trading in the red zone.

- Bitcoin reached a 9-month high of $26,000 in the early hours of March 14 but has currently reported a 0.83% decline.

- However, many investors and experts remain optimistic about the future of these tokens.

The cryptocurrency market has been experiencing chaos, with the top 10 coins trading in the red zone on Thursday. During the same week, the price of Bitcoin plunged to its highest value in 9 months, and a cryptocurrency that promoted itself as a stable means of exchange lost its peg.

Concretely, as of today, Polygon (MATIC) has seen a decline of 7.08%, Dogecoin (DOGE) has decreased by 6.41%, and Cardano (ADA) has seen a decline of 5.16%.

Investors and cryptocurrency enthusiasts have been closely watching the market over the past few weeks, as many have been anticipating a possible price correction after the recent surge in value. The market saw unprecedented growth earlier this year, with Bitcoin gaining high in March.

This happened allegedly after moments of the cryptocurrency ecosystem acting as a haven amid major bank runs. The downfall of the likes of Silicon Valley Bank (SVB), Signature, and others on the Fed’s policy failures have, however, been blamed by experts.

Cathie Wood, CEO of asset management firm ARK Invest, blasted the Federal Reserve’s failure to prevent bank runs. However, all the warning indicators were in a discussion posted on Twitter on March 16.

Amid all uncertainties in the crypto and finance sector, Coinmarketcap reports a 0.83% decline in Bitcoin`s price to trade at $24,678 within the past 24 hours. On the other hand, the second-largest crypto, Ethereum (ETH), is trading at $1,658.53, a 2.73% decline within the same timeframe.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.