- Dan Gambardello, a popular crypto trader and analyst, recently shared his upside and downside targets for BTC.

- According to the trader, BTC is at risk of dropping to as low as $24K in the short term.

- At press time, BTC’s price stood at $27,361.08 following a 1.92% increase in the past 24 hours.

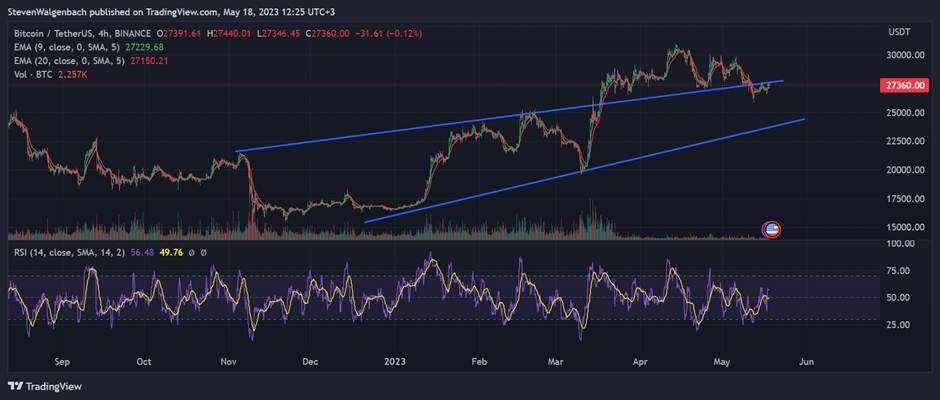

The crypto trader and analyst Dan Gambardello shared in his latest analysis that a downside target of $24K may still be reached by Bitcoin (BTC) in the next few weeks. Although he added that he cannot fully guarantee this will happen, he stated that from a macro perspective, it makes sense to predict a drop to this level in the near future.

In the video, Gambardello also mentioned Tether’s recent announcement that it will purchase BTC with up to 15% of the company’s profits. The trader labeled this development as an overall positive sign for the crypto space. Despite this, BTC’s price recently dropped back down into a long-term channel, which was established back in November last year.

The trader warned that BTC’s price will need to break out of this channel soon to avoid a drop to $24K. Should BTC’s price successfully break out of the channel in time, according to Gambardello, then it will look to climb to $33.5K in the next few months. On its path toward $33.5K, however, BTC will first need to flip the 20-day and 50-day EMA lines into support.

At press time, BTC was trading at $27,361.08 following a 1.92% increase in the past 24 hours. The market leader was also able to strengthen against its biggest competitor, Ethereum (ETH), by 0.83% during this time period.

In tandem with the price increase, BTC also saw an increase in its daily trading volume over the last day. As a result, the total daily trading volume for BTC stood at approximately $14.9 billion.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.