- Sharks and whales have dumped 3.3 million ETH over the last 5 weeks.

- The ratio of ETH/BTC has dropped 12.7% during this time period.

- ETH’s price is now trading at $1,284.72 after dropping 0.84%.

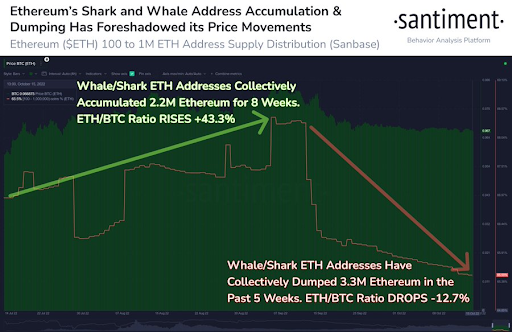

Data from the blockchain analysis firm, Santiment, has shown that Ethereum (ETH) sharks and whales (people holding between 100 and 1 million ETH) have been dumping the altcoin over the last 5 weeks.

These ETH holders have dropped approximately 3.3 million ETH over the course of the last 5 weeks, which equates to around $4.2 billion in dumped coins at the altcoin’s current price. These key stakeholders have also been the main driving force behind ETH’s latest price movement that has ebbed and flowed when compared to Bitcoin’s (BTC) price.

As can be seen from the chart above, the last 13 weeks have seen a change in investor accumulation behavior, as ETH whales and sharks kicked off the time period by accumulating 2.2 million ETH for the first 8 weeks. This saw the ratio of ETH/BTC rise by 43.3%.

Thereafter, these stakeholders dumped ETH for the following 5 weeks, bringing the ETH/BTC ratio down 12.7%. The change in investor behavior over the last couple of weeks has seen ETH’s price drop 2.37% over the last 7 days, with its price down 0.84% over the last day. Currently, the price of ETH stands at $1,284.72.

ETH’s price is attempting to challenge the 9 Exponential Moving Average (EMA) line when looking at today’s candle. There is still some bearish pressure on the altcoin as the 9 EMA line is positioned below the 20 EMA line, In addition, both of these lines are sloped negatively – suggesting that the price of ETH may drop further.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.