- An analyst opined that market participants should DCA into altcoins long before the Bitcoin halving.

- Bitcoin and Ethereum’s dominance remains flat, indicating a possible season for altcoins to thrive.

- Using the CMF, the LINK/USD chart showed that accumulation has begun.

In the crypto market, timing plays a crucial role in determining investment outcomes and asset performance. For many cycles, the time factor has been instrumental in determining altcoins’ growth while identifying the season to accumulate these assets.

With recent shifts in the cryptocurrency landscape and the ongoing volatility of major players like Bitcoin (BTC) and Ethereum (ETH), investors are naturally curious about whether the current juncture presents an opportunity to amass a portfolio of altcoins.

Interestingly, crypto analyst Michaël van de Poppe weighed in on the matter while referring to the price performance of several altcoins. According to Poppe, a number of altcoins have lost between 90 to 99% of their value since they fell from their All-Time High (ATH).

However, Poppe, who is also the founder of MN Trading, opined that the drawdown is not the only factor to determine if buying altcoins right now is a great decision. Instead, he focused on the fundamentals, historical performance, and market sentiment.

Bitcoin Dominance to Pave the Way

Poppe explained that online searches for altcoins have decreased significantly. But a look at the Bitcoin halving history suggests that altcoins hit their bottoms ten months before the event. In previous cycles, Bitcoin also lost its dominance and made way for the altcoin season during this period.

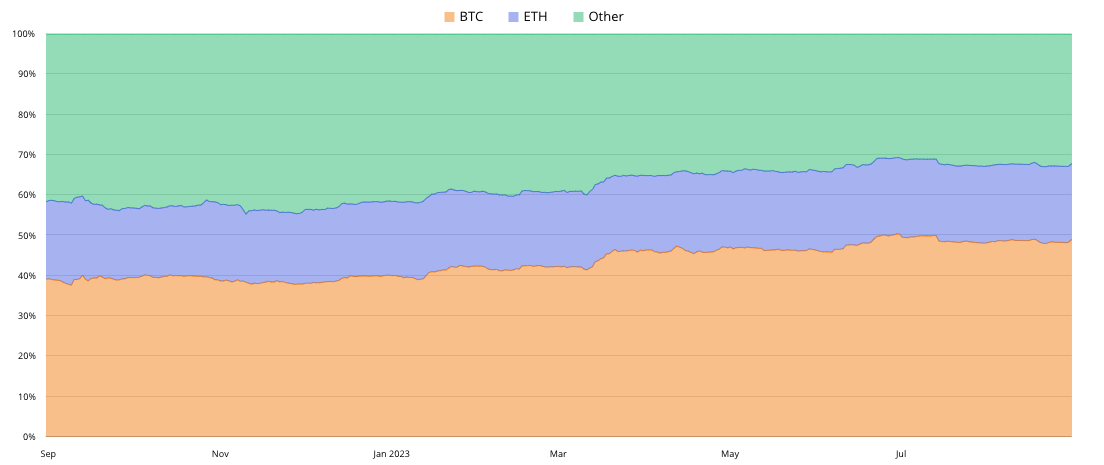

Oftentimes, when the altcoin season is about to begin, Bitcoin dominance shrinks, paving the way for ETH and other altcoins to thrive. However, according to BTCTools, Bitcoin has maintained its dominance over Ethereum with a 48.27% to 18.87% difference.

Furthermore, it is usually a good idea to hold BTC or ETH when the dominance increases. Also, when the dominance decreases, it offers an opportunity to accumulate altcoins. At the time of writing, the dominance flatlined. Thus, offering a relatively good opportunity to buy altcoins at their possible bottoms.

Apart from the dominance chart, Poppe mentioned that the progress made with altcoin projects should be a signal for accumulation. He used examples such as the increase in DeFi and NFT activity as grounds to take altcoin accumulation seriously.

LINK With the High Chances

Like previous times, the analyst did not fail to mention Chainlink (LINK) as a major altcoin to accumulate. According to Poppe, Chainlink’s development of its Cross Chain Interoperability Protocol (CCIP) puts it at the forefront of other altcoins.

For context, Chainlink’s Cross-Chain Interoperability Protocol (CCIP) is a cross-chain communication protocol that provides smart contract developers with the ability to transmit data and tokens across blockchain networks in a trust-minimized manner.

Meanwhile, LINK’s price at press time was $6.06—a 2.96% increase in the last 24 hours. From the LINK/USD 4-hour chart, the token faced rejection at $6.24 after a sudden surge from $5.88. However, the decrease in LINK price seems not to have affected accumulation.

As of this writing, the Chaikin Money Flow (CMF) was 0.04. As a foundation of accumulation and distribution, the CMF indicated that LINK was in bullish territory due to increased buying pressure.

If the CMF continues to increase, then there is a possibility that LINK’s price increase and the target may be between $6.30 and $6.50.

In conclusion, Michaël van de Poppe noted that the current market condition offers a chance for participants to accumulate altcoin using the Dollar Cost Averaging (DCA) strategy. Whether following the advice or not will pay off, time will tell.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.