- The Injective price is forming a bearish pressure below $3.88 level.

- INJ/USD is trading at $3.69 with a decrease of 2.40% in the last 24 hours.

- The token is trading in a range of $3.54 – $3.88 from the previous day.

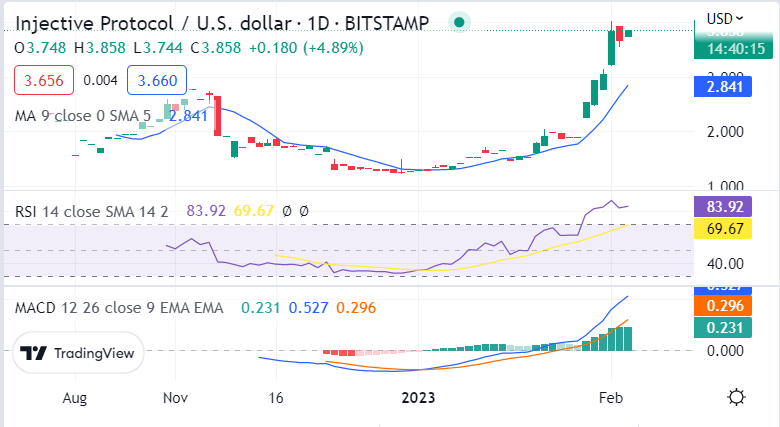

The Injective price analysis shows a downtrend in the market as bears are dominating the market, driving the token price down. The INJ/USD is trading at the level of $3.69 with a decrease of 2.40% in the last 24 hours, and it is trading in a downward direction.

The immediate support for INJ/USD is at $3.54 and if it breaks then further downside may come into action. On the higher side, resistance is formed at $3.88 and if bulls manage to push prices above this mark, then we can expect some upside momentum. Until then, the market pressure will remain bearish and prices may keep sliding down.

Looking at the daily chart, Injective price is forming a bearish pattern as selling pressure increases after the breakdown below the $3.88 level. However, the bullish pressure was seen in today’s trading session a few hours ago. And, the price jumped above $3.80 but failed to sustain itself and hit the support level of $3.54, and the bearish pressure is seen again.

The selling pressure is still increased as the Market cap of Injective Protocol tokens is at $267 million which is more than -2.77% from yesterday’s value. The 24-hour trading volume has increased to $46.26 Million and the total supply of the token is at 1 billion, with a circulating supply of 73 million INJ tokens.

INJ/USD daily price chart, Source: TradingViewAt the present, INJ is trading below the moving average of 50-day moving average and 200-day moving average which is a sign of bearish pressure in the market. The RSI (Relative Strength Index) has fallen below the level of 70, indicating that it is undervalued and there could be further downside movement if the bears continue to dominate the market. The 20-SMA and 50-SMA are trending downwards, suggesting a bearish sentiment in the market. The MACD is trending downward with the MACD line trading below the signal line.

To conclude, the Injective price analysis is showing a bearish pattern as selling pressure increases after the breakdown below the $3.88 resistance level. The bearish pressure is expected to continue unless the bulls regain their strength. The support level of $3.54 should be monitored closely as it will be a crucial indicator for the price movement in the near future.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.