- Samson Mow and Satoshi Hamada stress the need for Japan to adopt a Bitcoin strategy.

- Hamada calls for a Strategic Bitcoin Reserve to protect Japan’s economy from inflation.

- Leaders warn Japan risks falling behind as other nations embrace Bitcoin adoption.

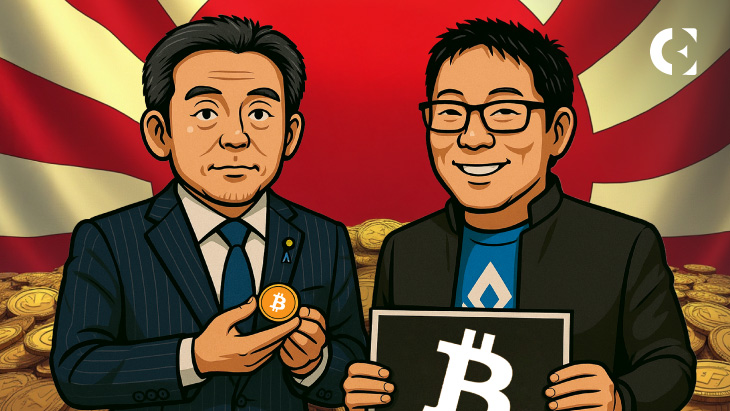

Japan may be on the brink of a financial revolution. Taking a strategic move, entrepreneur Samson Mow, the CEO of JAN3, and Japanese lawmaker Satoshi Hamada urged the nation to adopt a national Bitcoin strategy.

With the digital asset gaining global traction as a hedge against inflation, the two leaders emphasized that the nation must act quickly in adopting the strategy or risk falling behind in the financial run.

This discussion arose after Hamada made attempts to establish a Strategic Bitcoin Reserve in early December, emphasizing that the reserve would protect Japan’s economy against inflation and fluctuations in the global market. Further, he asserted that the decentralized nature of Bitcoin offers multiple disciplines in economic freedom, compared to traditional financial systems.

Japan’s Position in Bitcoin

Mow and Hamada expressed their opinions on Japan’s current standing in the Bitcoin community. The duo agreed that integrating the Bitcoin strategy will make Japan one of the pioneers in the adoption of virtual currencies, prompting discussion over how Bitcoin could help Japan capitalise on the cryptocurrency’s potential for long-term growth.

Both leaders stressed the importance of taking proactive measures. They asserted that while Bitcoin gains global traction, Japan must move swiftly to remain competitive as a potential global financial hub. Further, they explored how Bitcoin is capable of delivering economic stability, differing from traditional fiat currencies.

Related: Could Japan Follow Trump’s Bitcoin Strategy? Here’s What We Know

With Bitcoins as the central focus, Mow stated that Japan’s future economy must involve the asset, noting that several countries have already adopted it in their fiscal systems. The discussion highlighted that further efforts are needed to unlock the benefits of those technologies, which require Bitcoin.

Notably, El Salvador made headlines in 2021 for making Bitcoin its legal currency. The Central American country had only 6.3M members when it gave Bitcoin its legal status. The overall meeting served as an opportunity to raise awareness about Bitcoin. Further, Mow and Hamada’s call may prompt Japan to take the necessary measures to incorporate the digital currency into its central economic planning.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.