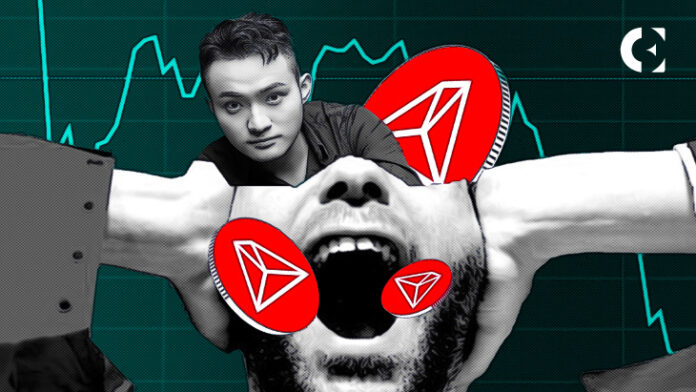

- Justin Sun’s Tron Blockchain requests the court to dismiss the lawsuit filed by the SEC.

- The platform claims that the SEC doesn’t have the authority to intrude into Tron’s foreign digital asset offerings to foreign purchasers.

- Tron asserts that the SEC is not a worldwide regulator and that its regulatory attempts exceeded its limits.

Justin Sun’s Tron Blockchain has recently approached the New York Federal Court to dismiss a lawsuit filed by the Securities and Exchange Commission (SEC). The platform requested the court to dismiss the case under the major questions doctrine, pointing out that the SEC does not hold autocratic authority over the crypto space.

Tron’s key focus was the regulator’s intrusion into the platform’s “foreign digital asset offerings to foreign purchasers on global platforms.” The blockchain firm argued that the regulator’s attempt to apply US security laws to “predominantly foreign conduct” was beyond the authority of the SEC. While the SEC isn’t a “worldwide regulator,” its intrusion into foreign affairs exceeds its limits, Tron added.

The SEC filed a lawsuit against Justin Sun and three of his companies for their alleged “unregistered offer and sale of crypto asset securities.” According to the allegations, Sun’s Tron Foundation Limited, BitTorrent Foundation Ltd., and Rainberry Inc. fraudulently manipulated “the secondary market for TRX through extensive wash trading.”

In the recently filed motion, Tron argued that the tokens were not categorized as investment contracts under the Howey test. Further, the motion accused the SEC’s charges lacked “specificity,” stating,

“This action levels a series of hyperbolic “securities” claims against two foreign entities and a foreign national. Allegations relating to the sole US-based defendant, an entity acquired for its decades-old peer-to-peer data sharing technology, lack specificity and are unrelated to time.”

Moreover, the firm claimed that the agency generalized the allegations, failing to mention each defendant’s role in each claim. The motion added, “The SEC also does not allege a single victim.”

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.