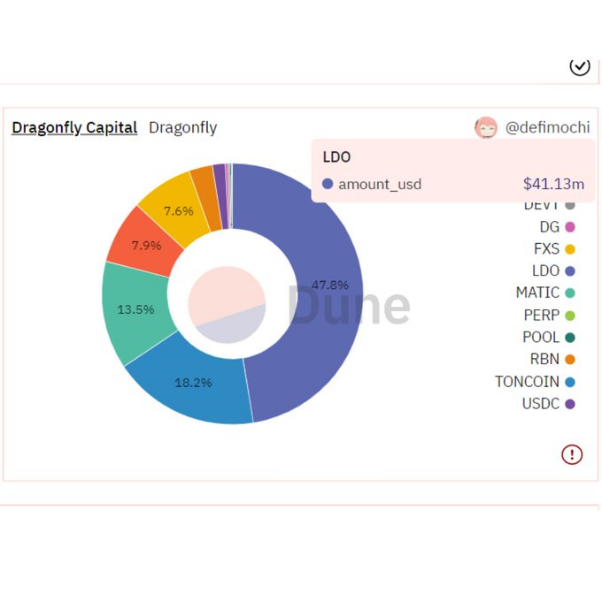

- Dragonfly Capital has a huge Lido DAO holding of more than $40 million.

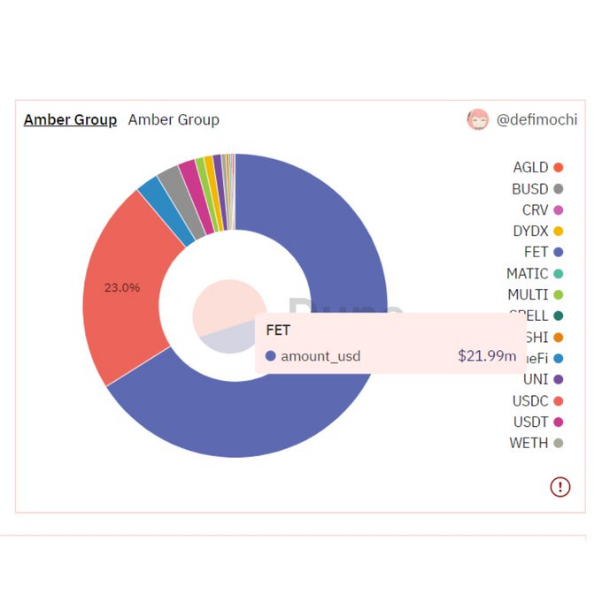

- Amber Group recently added FET, which now makes up about 60% of their portfolio.

- LDO is currently trading hands at $3.22 after a 3.53% increase in price.

A crypto enthusiast took to Twitter yesterday to share some of the most held tokens among the top venture capitalist funds like Wintermute, Dragonfly, and Amber Group in an attempt to help the trader on the street keep up to date with the tokens with the most potential at the moment.

According to the post, Dragonfly’s portfolio balance has risen by almost 39.2% over the last thirty days. This is mainly due to its huge Lido DAO (LDO) holding of more than $40 million. LDO makes up about 48% of their portfolio while Toncoin (TON) is the second-largest holding.

The poster noted that Amber Group recently added Fetch.ai (FET), which now makes up about 60% of their portfolio. This FET was transferred from a Binance hot wallet on the 14yh of February.

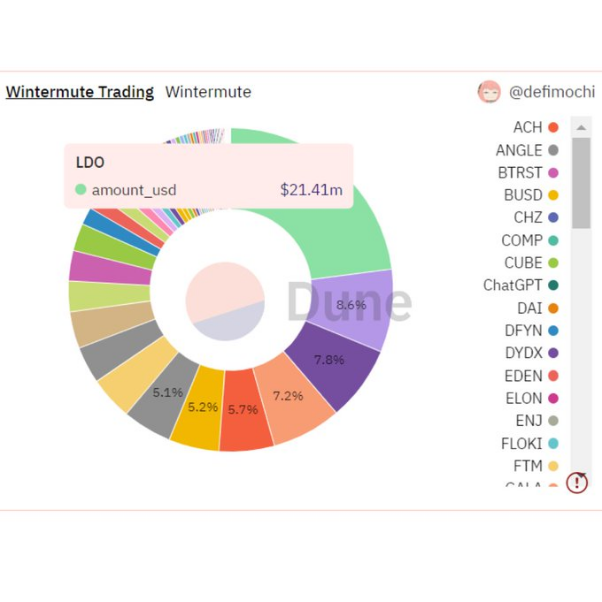

Wintermute also seems to be a fan of LDO with the altcoin making up about 17% of their portfolio. The VC also has huge amounts of Gala (GALA), dydx (DYDX) and Polygon (MATIC).

The poster concluded the Tweet by summarising that some of the largest VC holdings include LDO, MATIC, DYDX, Hashflow (HFT) and GALA.

CoinMarketCap indicates that LDO is currently trading hands at $3.22 after a 3.53% increase in price over the last 24 hours. In addition to this, the crypto is also up by more than 30% over the last month.

GALA is in the red after a 1.26% drop in price over the last day, and the altcoin now trades hands at $0.04782.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.