- Santiment tweeted their latest Insights relating to SUSHI this morning.

- The report showed that long-term SUSHI holders are closing their positions in SUSHI.

- Goldentree recently capitulated more than 5.9 million SUSHI according to the report.

Santiment shared their latest Insights via a tweet this morning. The report relates to SushiSwap (SUSHI) after the decentralized exchange was recently served a subpoena by the Securities and Exchange Commission (SEC).

According to the report, things are not looking too great for the decentralized platform as SUSHI’s TVL dropped by 93% ever since the collapse of FTX around mid-November of last year. The report stated that SUSHI’s TVL currently stands at around $581.47 million.

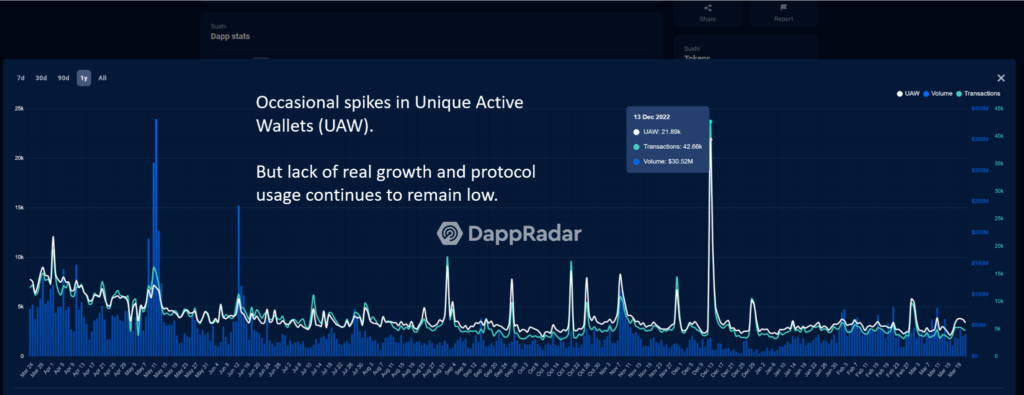

Dappradar data shows that SUSHI’s protocol usage seems to be struggling in the last year. The report analyzed the number of unique active wallets (UAW) interacting or performing a transaction with the dapp’s smart contracts. This analysis showed that the average number of UAW has remained relatively low with little growth over the past few months.

The report also highlighted the number of SUSHI tokens that have been dormant for at least 365 days. According to Santiment, long-term holders have been exiting their positions at SUSHI.

The total amount of SUSHI tokens that have been dormant for at least 365 days experienced a sharp decline in the last 24 hours, the report added. This has historically been followed by sharp declines in SUSHI’s price.

This bearish thesis is supported by the number of dormant tokens that have been sent to exchanges, as SUSHI’s supply on exchanges coincides with the observation made in the number of tokens that have been dormant for at least 365 days.

In addition, data from Lookonchain showed that the fund Goldentree capitulated 5,954,024 SUSHI recently on Binance via Cumberland.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.