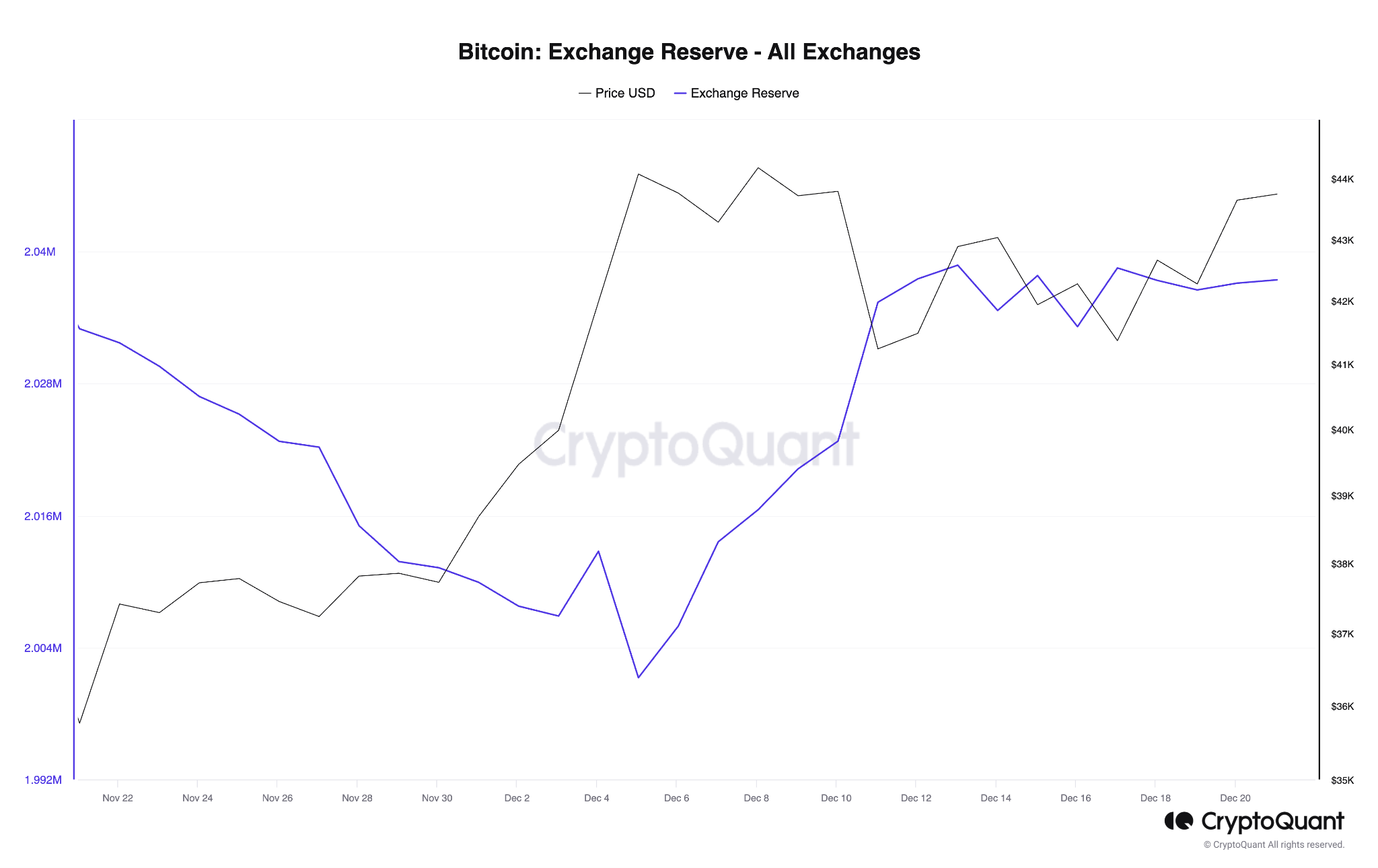

- There has been a slight rally in BTC’s exchange reserve in the past two weeks.

- BTC’s past performance shows that whenever this happens, a price fall is imminent.

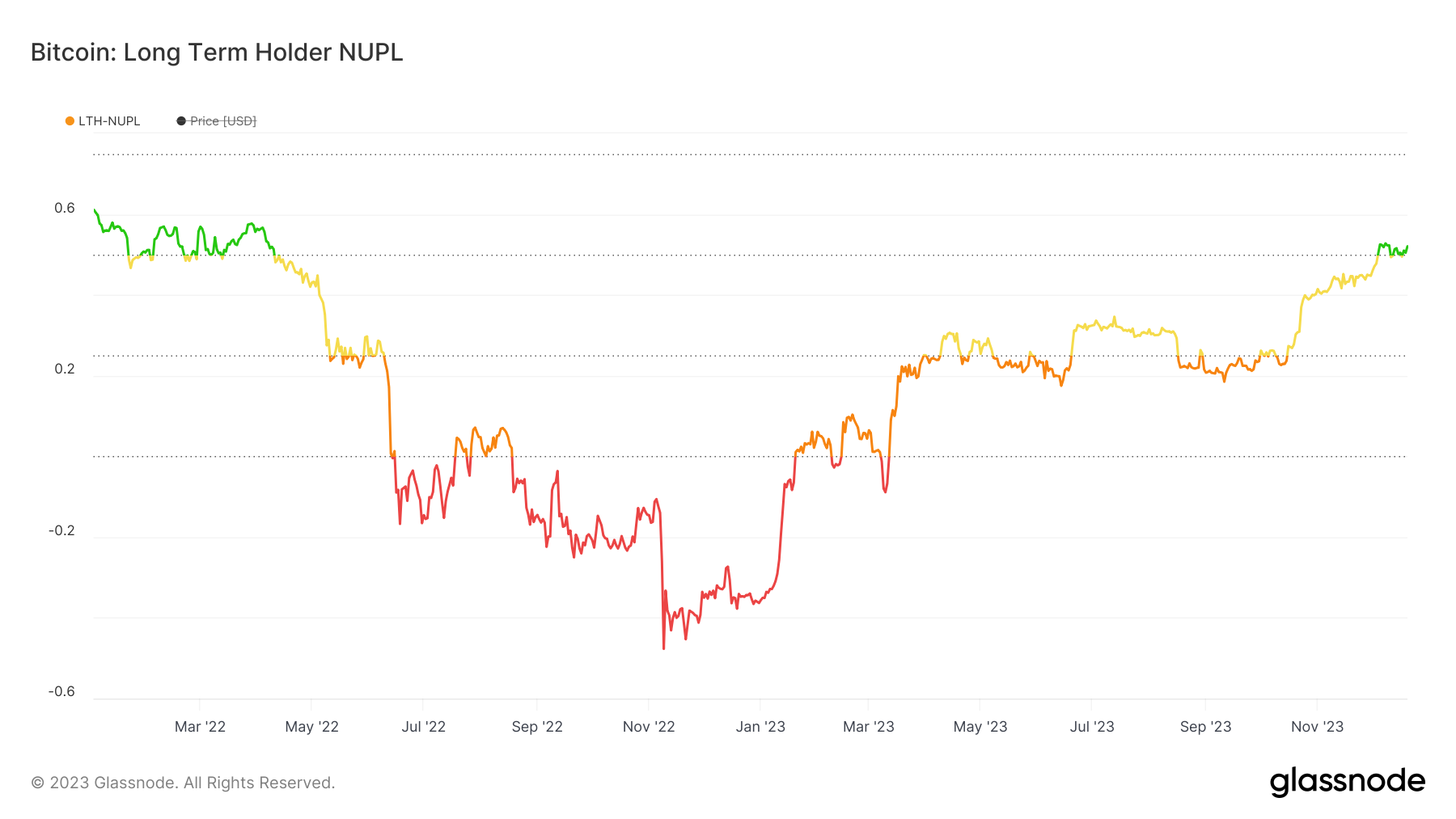

- A key on-chain metric shows that the BTC market sentiment has changed from capitulation to belief.

According to crypto analyst Ali Martinez, Bitcoin (BTC) might experience a significant decline in value following the recent surge in bullish sentiment.

Martinez assessed the historical performance of BTC’s Long Term Holder Net Unrealized Profit/Loss (LTH-NUPL) and how the metric movement impacts the coin’s price.

The NUPL metric assesses the profitability of coin holders. It measures the difference between the current market value of all coins in existence and the value at which they were last moved on the blockchain.

For LTH-NUPL, it shows the average profit/loss for all long-term BTC holders. It also gauges the overall confidence and conviction of long-term investors.

Investor sentiments in the market can vary, moving from capitulation (evident when the LTH-NUPL experiences a decline) to belief (noted when the metric begins an uptrend) and reaching euphoria (observable when the LTH-NUPL returns very high values).

According to Martinez, every previous shift in market sentiment from capitulation to belief has been followed by a retracement in BTC’s price. As of this writing, BTC’s LTH-NUPL was 0.5, showing that market sentiment has shifted to belief, according to data from Glassnode.

Bitcoin Long-Term Holder NUPL: (Source: Glassnode)

Retracement incoming?

At press time, BTC exchanged hands at $43,640. Bitcoin’s price has faced resistance at the $43,600 price mark in the last month. There is a possibility that BTC’s price might witness a minor retraction due to the resurgence in profit-taking activity. This thesis is supported by an uptick in a recent increase in the amount of BTC being moved to exchanges. According to data from CryptoQuant this the amount of BTC held on exchanges has increased by 2% since December 5.

Bitcoin Exchange Reserve (Source: CryptoQuant)

When there is a rise in a coin’s exchange reserve, it indicates that there is higher selling pressure, which puts downward pressure on price. At press time, 2.03 million BTC were held across exchanges.

Further, the coin’s Moving Average Convergence Divergence (MACD) indicator observed on a daily chart revealed a downward intersection of the coin’s MACD line with its trend line of December 12.

BTC/USD 24-Hour Chart (Source: TradingView)

When the MACD line crosses below the trend line, it is seen as a bearish signal, as many view it as time to distribute their holdings.

Since the crossover occurred, there has been a notable decline in BTC’s key momentum indicators. This showed that coin holders have since reduced BTC accumulation.

At press time, the coin’s Relative Strength Index (RSI) was 62.28, while its Money Flow Index (MFI) was 55.21.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.