- SHIB is currently worth about $0.000009263 after a 1.74% drop in price.

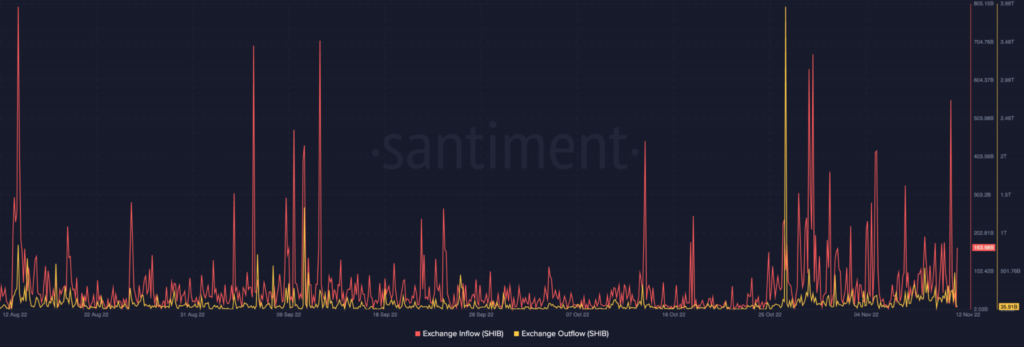

- Shiba Inu experienced massive exchange inflows when compared to its outflows.

- THE meme coin’s RSI solidifies its bearish momentum.

The current turmoil in the market is pummeling most cryptocurrency prices at the moment, and this does not exclude Shiba Inu (SHIB). According to CoinMarketCap, SHIB is currently worth about $0.000009263 after a 1.74% drop in price over the last 24 hours. The meme coin is also still in the red by more than 20% over the last week.

SHIB also weakened against Bitcoin (BTC) and Ethereum (ETH) over the last 24 hours by about 1.96% and 2.27% respectively. With its market cap of $5,087,830,613, SHIB is currently the 14th biggest cryptocurrency.

Adding to the SHIB fire is the fact that SHIB experienced massive exchange inflows when compared to its outflows. At the time of writing, SHIB inflows stood at $163.98 billion while its outflows stood at a mere $35.91 billion.

This data could suggest that many investors were selling their tokens, which in turn could have been a contributing factor in the crypto tumble. This could also have been a bearish sign.

In addition to this, many still believe that the tough times are still not over for the meme coin. This belief is mostly due to the fact that SHIB’s Moving Average Convergence Divergence (MACD) indicates that the crypto is not even close to overpowering its sellers. If things continue like this, it is very unlikely for SHIB to find its way out of the red any time soon.

With SHIB’s Relative Strength Index (RSI) at 32.93, it is obvious that its bearish momentum is now solidified.

Disclaimer: The views and opinions as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.