- Santiment recently tweeted that ETH’s exchange supply is at a 5-year low.

- The tweet added that ETH’s low exchange supply suggests a lower possibility of a future selloff.

- In related news, the altcoin’s price is slightly down over the last 24 hours.

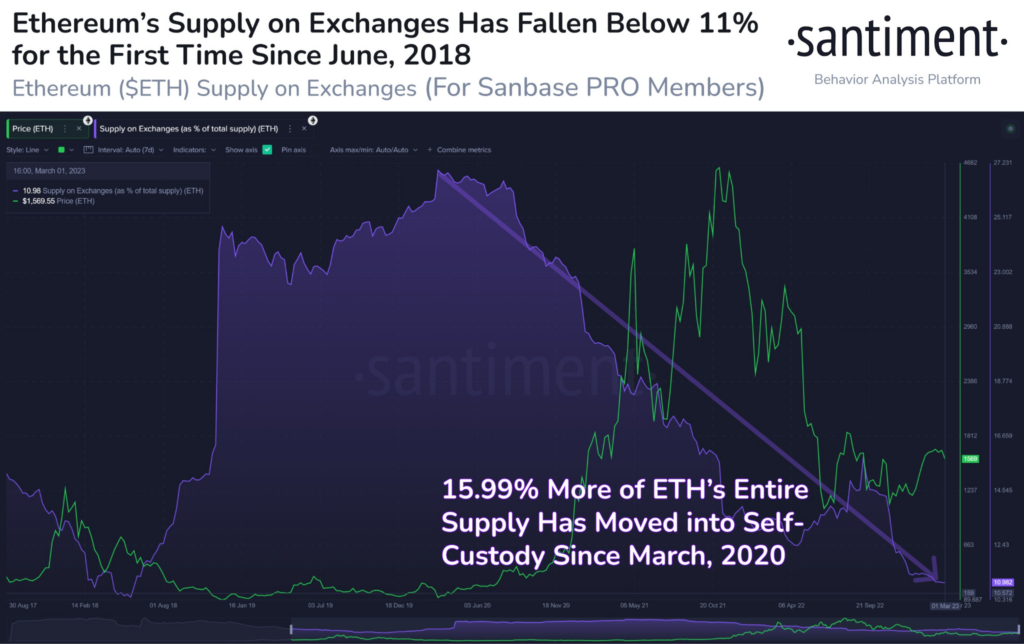

The blockchain analytics firm, Santiment, tweeted yesterday that the exchange supply for Ethereum (ETH) is at its lowest level in nearly five years. In the tweet, the analytics firm added that ETH has been one of the most prominent assets to be moved into self-custody, particularly following the FTX collapse.

In addition, the tweet shared the graphic above which shows that ETH’s supply on exchanges has fallen below 11% for the first time since June 2018, and that 15.99% more of ETH’s entire supply has moved into self-custody since March 2020. According to the tweet, this shift of ETH’s supply into self-custody suggests that there is a lower possibility of a future selloff.

At press time, the price of ETH is down 0.01% over the last 24 hours according to CoinMarketCap. This 24-hour drop in ETH’s price has added to its negative weekly performance which now stands at -1.89%. As a result, the leading altcoin’s price stands at $1,568.67. ETH has also strengthened against Bitcoin (BTC), by 0.06%.

Furthermore, ETH’s total market cap has also risen and is estimated to be around $192,105,666,224.

Trading volume for ETH has also dropped 30.92% over the last 24 hours. This takes the total daily trading volume down to $6,638,140,432 at press time. Lastly, the crypto is trading nearer to its 24-hour high of $1,575.87. Its daily low stands at $1,552.45.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.