- Ripple’s CTO questions staking’s regulatory status amid securities laws.

- Discussion explores implications of Ethereum’s transition to POS and Blackrock’s asset tokenization.

- David stated that he does not know how to make sense of the current regulations.

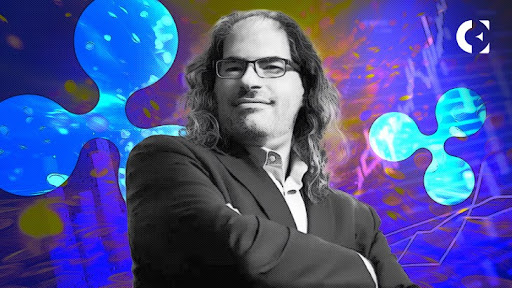

In a recent exchange on social media platform X, Ripple’s Chief Technology Officer (CTO), David Schwartz, engaged in a thought-provoking discussion regarding the regulations surrounding staking and tokenization within the cryptocurrency space.

Schwartz’s comments came as a response to a tweet by user Molly, wherein she raised pertinent questions about the classification of staking, particularly in the context of securities regulations. “I don’t understand how to make sense of this,” Schwartz began, expressing his confusion over the regulatory conundrum.

The CTO highlighted the apparent paradox wherein staking—which is a process integral to many blockchain ecosystems—is being scrutinized through the lens of securities laws.

The conversation went into the complexities surrounding the treatment of staking, with Molly suggesting hypothetical scenarios where staking, despite the underlying asset not being classified as a security, could potentially fall under regulatory scrutiny.

Notably, the discussion touched upon Prometheum’s advocacy for Ethereum (ETH) to be called a security and Blackrock’s involvement in tokenizing assets on the Ethereum network. This further raised questions about the timing of these initiatives in relation to Ethereum’s transition to Proof of Stake (POS) consensus mechanism.

Schwartz’s tweets highlighted the broader industry concerns regarding regulatory clarity and its implications for innovation within the blockchain space. The dialogue also hinted at a potential strategy involving the gradual transition from Proof of Work (PoW) to POS consensus mechanisms, to incentivize institutional participation and capitalize on the tokenization market.

David has been actively engaging in the community through a series of tweets. In a candid discussion, he addressed concerns about the distribution of XRP, Ripple’s native digital asset. Schwartz provided insights into the challenges that Ripple faces in ensuring a fair and equitable distribution of the cryptocurrency, while also addressing concerns about centralized control and concentration of XRP.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.