- In a widespread crypto sell-off, RUNE and ETC plunged 20%, dropping to $4.05 and $23, respectively.

- BSV’s value tumbles to $74.69, marking a 23% weekly drop and sliding to 47th in market cap rankings.

- LDO’s bear rally deepens, falling 18% in a week to $3.04, despite a 115.5% surge in the past three months.

The cryptocurrency market experienced a notable downturn this week, with major digital assets like Bitcoin and Ethereum seeing significant drops in value. This trend extended to various altcoins, including THORChain (RUNE), Bitcoin SV (BSV), Ethereum Classic (ETC), and Lido DAO (LDO), all of which recorded a 20% decline in their respective valuations over the past seven days.

Grayscale’s activities have influenced the recent crypto market fluctuations. The investment firm transferred 9,840 BTC, valued at approximately $418 million, to Coinbase Prime. This move was part of a series of transactions to manage ETF redemptions, totaling over $1.7 billion in BTC since January 12. Alex Thorn, head of research at Galaxy, highlighted these significant outflows, noting the impact on the broader market.

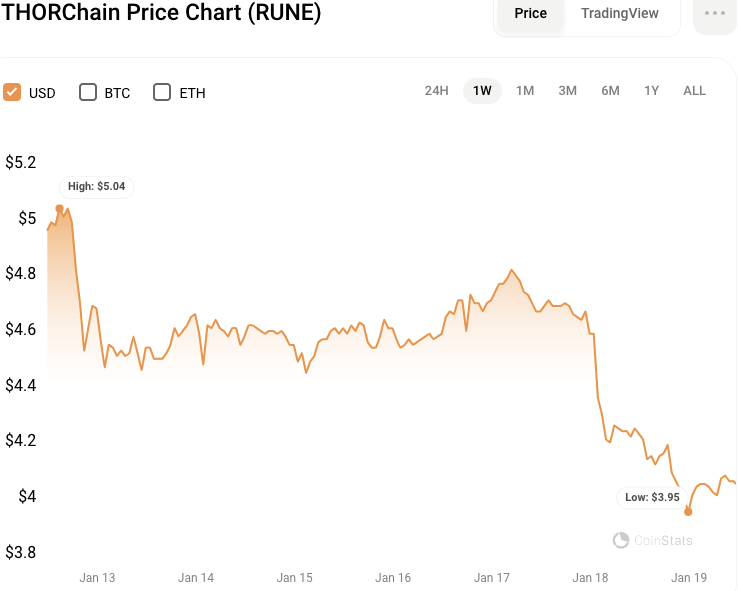

THORChain (RUNE)

THORChain’s RUNE token, after a period of trading sideways, encountered a steep 20% drop. The token, trading between $4.843 and $5.849, faced rejection at a high of $6.455, leading to a downward trend.

RUNE/USD 7-day price chart (source: CoinStats)

This decline reflects a broader bearish sentiment in the crypto market as RUNE struggles to maintain its earlier gains. At press time, RUNE was exchanging hands at $4.05, a 4.23% decline from the 24-hour high.

Bitcoin SV (BSV)

Bitcoin SV (BSV) has concurrently tumbled by 6% in the last 24 hours, marking a 23% decrease over the past week. This decline brought the live price of Bitcoin SV down to $74.69, with a trading volume surpassing $91 million. The cryptocurrency, once a market leader, has now fallen to the 47th position in market cap rankings, with its total market value hovering around $1.67 billion.

BSV/USD 7-day price chart (source: CoinStats)

Ethereum Classic (ETC)

Ethereum Classic (ETC) wasn’t spared from the market’s bearish turn. After trading between $20.32 and $21.94, ETC experienced a brief surge, only to face rejection at $32.45. This rejection led to a 15% correction in its valuation, echoing the overarching bearish trend across the crypto space.

ETC/USD 7-day price chart (source: CoinStats)

On the last day, bearish pressure intensified in the ETC market after failure to breach the intra-day high of $27.64, according to Coinstats. ETC was trading at $24.14 at press time, a 5.74% dip from the day’s high and 19% down from its weekly high.

Lido DAO (LDO)

Lido DAO (LDO) has also navigated turbulent waters. The asset, which had been on an upward trajectory, reaching a high of $4, began to show signs of decline. Despite a 115.50% surge in the last three months, LDO faced resistance around $4, hinting at potential further dips if it breaches crucial support levels.

LDO/USD 7-day price chart (source: CoinStats)

Consequently, LDO has been in a bear rally in the last week, falling from a high of $3.83. In the last 24 hours, the bear rally has intensified, sending the LDO price to a 7-day low of $2.93, where support was established. At press time, LDO was priced at $3.04, a 3.19% decline in the last day and an 18% dip in the last week.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.