- Bullish THORChain (RUNE) price prediction ranges from $1.65 to $3.

- Analysis suggests that the RUNE price might reach above $2.5.

- The RUNE bearish market price prediction for 2023 is $0.365.

THORChain seeks to facilitate the non-custodial trade of assets between several blockchains and serve as the backend for numerous user interfaces. The value of a pegged cryptocurrency is related to another medium of exchange, such as gold or another currency.

If you are interested in the future of RUNE and want to know its predicted value for 2023, 2024, 2025, and 2030, keep reading!

Table of contents

- THORChain (RUNE) Market Overview

- What Is THORChain (RUNE)?

- THORChain (RUNE) Current Market Status

- THORChain (RUNE) Price Analysis 2023

- THORChain (RUNE) Price Prediction 2023-2030 Overview

- THORChain (RUNE) Price Prediction 2023

- THORChain (RUNE) Price Prediction 2024

- THORChain (RUNE) Price Prediction 2025

- THORChain (RUNE) Price Prediction 2026

- THORChain (RUNE) Price Prediction 2027

- THORChain (RUNE) Price Prediction 2028

- THORChain (RUNE) Price Prediction 2029

- THORChain (RUNE) Price Prediction 2030

- THORChain (RUNE) Price Prediction 2040

- THORChain (RUNE) Price Prediction 2050

- Conclusion

- FAQ

- More Crypto Price Predictions:

THORChain (RUNE) Market Overview

| 🪙 Name | THORChain |

| 💱 Symbol | RUNE |

| 🏅 Rank | #54 |

| 💲 Price | $5.32725857073 |

| 📊 Price Change (1h) | -0.04 % |

| 📊 Price Change (24h) | -3.36 % |

| 📊 Price Change (7d) | -1.4 % |

| 💵 Market Cap | $1786241875.66 |

| 💸 Circulating Supply | 335302267 RUNE |

| 💰 Total Supply | 414148178 RUNE |

THORChain (RUNE) is currently trading at $5.32725857073 and sits at number #54 on CoinMarketCap in terms of market capitalization. There are 335302267 RUNE coins currently in circulation, bringing the total market cap to $1786241875.66.

Over the past 24 hours, THORChain has decreased by 3.36%. Looking at the last week, the coin is down by 1.4%.

What Is THORChain (RUNE)?

THORChain is a decentralized liquidity protocol, that enables its users to effortlessly trade Bitcoin assets across many networks without giving up control of their funds. Furthermore, users of THORChain can instantly exchange one asset for another in a permissionless system, without resorting to checking order books to find buyers and sellers. Instead, asset ratios in a pool are used to stabilize market prices.

THORChain’s native utility token, RUNE, is named after the Norse god of Thor. Due to the fact that every THORChain node must stake at least 1 million to 300,000 RUNE in order to take part in the network’s revolving consensus mechanism, this serves as the ecosystem’s primary currency in addition to being used for platform governance and security.

THORChain was funded with an initial DEX offering (IDO) on the Binance DEX in July 2019. Its single-chain chaosnet went online in April 2021, its multi-chain upgrade went live in April 2021, and its Mainnet is now operational as of June 2022.

THORChain uses a unique system to help mitigate the issue of “impermanent losses” — or the often temporary losses that a liquidity provider can experience when contributing to liquidity pools. It achieves this by using a slip-based fee to help ensure liquidity stays where it is needed.

THORChain integrates a number of innovative technologies, such as on-way state pegs, a state machine, the Bifrost Signer Module, and a TSS protocol, to smoothly support permissionless cross-chain token swaps. All of this is hidden from view, making the platform accessible to even novice traders.

The THORChain network is protected using Proof of Stake and Tendermint, a form of BFT. The network is constructed using the Tendermint-based Cosmos SDK. Tendermint protects the cross-chain bridges by verifying the integrity of Nodes and other network operations.

THORChain (RUNE) Current Market Status

The maximum supply of THORChain (RUNE) is 500,000,000 RUNE, while its circulating supply is 339,429,574 RUNE, according to CoinMarketCap. At the time of writing, RUNE is trading at $1.04 representing 24 hours increase of 4.06%. The trading volume of RUNE in the past 24 hours is $28,532,356which represents a 27.57% decrease.

Some top cryptocurrency exchanges for trading are Binance, Deepcoin, Bybit, Bitrue, and Bitget.

Now that you know RUNE and its current market status, we shall discuss the price analysis of THORChain (RUNE) for 2023.

THORChain (RUNE) Price Analysis 2023

Currently, RUNE ranks 82 on CoinMarketCap’s list of the biggest cryptocurrencies by market capitalization. Will THORChain’s most recent improvements, additions, and modifications help its price rise? First, let’s focus on the charts in this article’s RUNE price forecast.

THORChain (RUNE) Price Analysis – Bollinger Bands

The Bollinger bands are a type of price envelope developed by John Bollinger. It gives a range with an upper and lower limit for the price to fluctuate. The Bollinger bands work on the principle of standard deviation and period (time).

The upper band as shown in the chart is calculated by adding two times the standard deviation to the Simple Moving Average while the lower band is calculated by subtracting two times the standard deviation from the Simple Moving Average.

Currently, the bands after maintaining a constant distance, the Bollinger bands seem to be opening up. Moreover, RUNE is hugging the upper band on its way up. As such, there might be a small pullback for RUNE. However, as buyers seem to be flooding the market, RUNE may keep on rising after a short pullback.

The above charts show the trend for RUNE. The patches marked in green show the uptrends while the red patches show RUNE on a downtrend. When the overall behavior of RUNE for 2023 is put together, we could see that it has been bearish. The green patches could be considered retracements or pullbacks.

When the longer timeframe for RUNE is considered, it could be noted that RUNE is presently in the consolidation phase. When looking back at its behavior, RUNE had a surge at the beginning of 2021 which was the very next year after BTC halved. As such, if RUNE reciprocates this behavior, then, the whole of 2024 could be a year of consolidation where RUNE prepares for a big spike by the beginning of 2025.

THORChain (RUNE) Price Analysis – Relative Strength Index

The Relative Strength Index is an indicator that is used to measure whether the price of a cryptocurrency is over or undervalued. For this purpose, it has two extreme regions known as the overbought and oversold regions.

When the RSI reads a value (>70) then the crypto is overbought, which means that due to more buying the demand has increased as such the price has also increased. On the other hand, when it is oversold, many are selling, as such, its price is undervalued.

Currently, the RSI reads a value of 65.74 and the line seems to be heading toward the overbought region. If the buyers keep on the pressure, there is a high chance that the RSI could reach the overbought.

When looking at the bigger picture for RUNE, it could be seen that the crypto is currently consolidating and moving sideways. The RSI reads a value of 41.88 and the RSI line seems to be heading upwards. However, since the RSI line is neither overbought nor oversold, we could assume that the trend is strong. As RUNE is currently consolidating, there could be more consolidation for RUNE in the future.

THORChain (RUNE) Price Analysis – Moving Average

The Exponential Moving averages are quite similar to the simple moving averages (SMA). However, the SMA equally distributes down all values whereas the Exponential Moving Average gives more weightage to the current prices. Since SMA undermines the weightage of the present price, the EMA is used in price movements.

The 200-day EMA is considered to be the long-term moving average while the 50-day EMA is considered the short-term moving average in trading. Based on how these two lines behave, the strength of the cryptocurrency or the trend can be determined on average.

Both EMA’s seem to be moving downwards, as such, RUNE is bearish. However, RUNE has been testing the 50-day EMA on numerous occasions since late 2022. Although on a few occasions, it was able to break the 50-day EMA, it wasn’t however able to stay above it for a long period of time.

Currently, RUNE has risen above the 50-day EMA. This could be another feint movement towards the 200-day EMA especially if this is a reciprocation of the spike that happened at the beginning of 2023. Moreover, the volume Weighted Moving Average is also rising, this shows that there is some force or volume behind the rising price of RUNE.

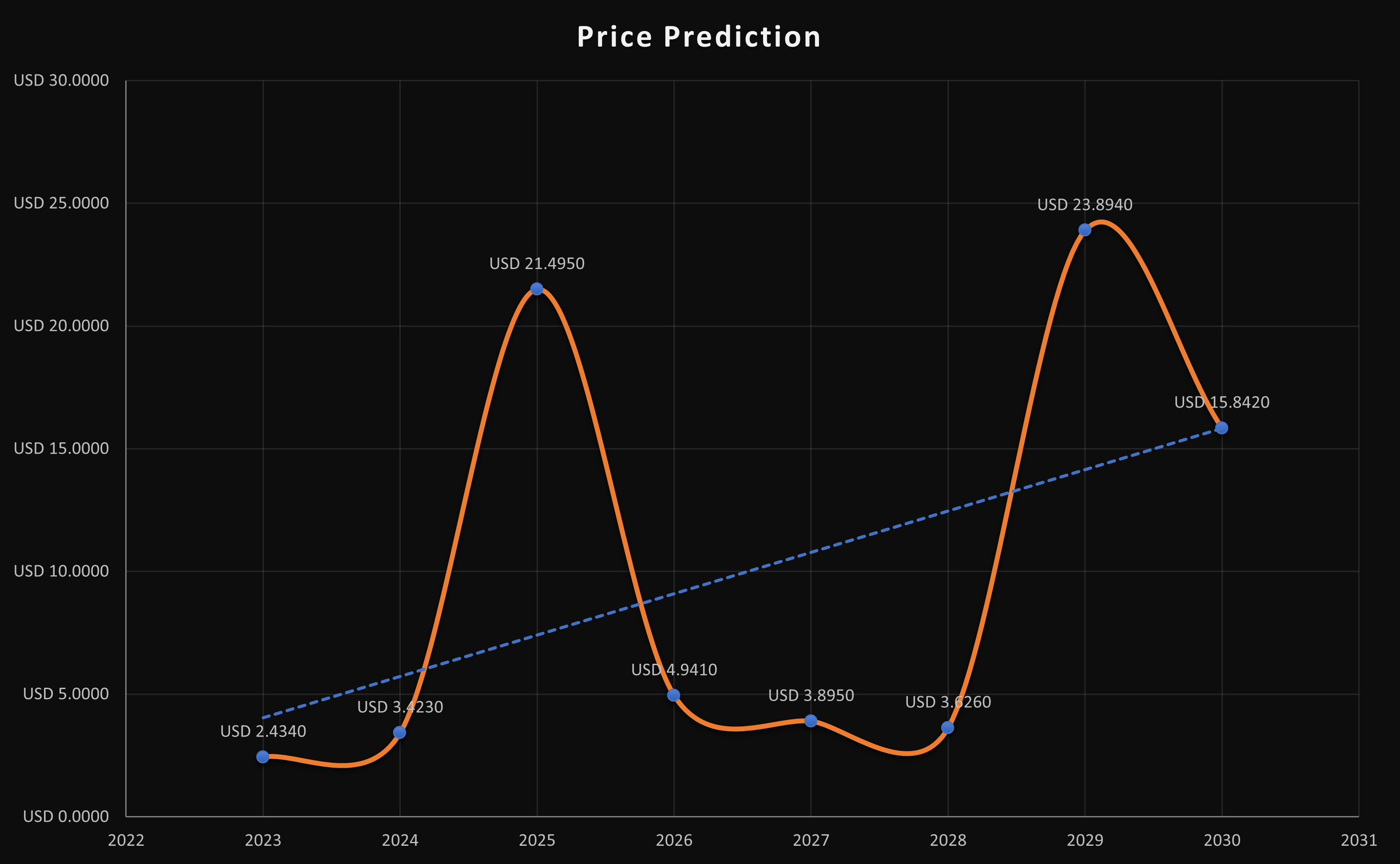

THORChain (RUNE) Price Prediction 2023-2030 Overview

| Year | Minimum Price | Average Price | Maximum Price |

| 2023 | $1.95 | $2.43 | $3.5 |

| 2024 | $3.00 | $3.42 | $5.75 |

| 2025 | $15.00 | $21.49 | $30.5 |

| 2026 | $3.25 | $4.94 | $6.75 |

| 2027 | $2.85 | $3.89 | $5.5 |

| 2028 | $2.55 | $3.65 | $4.95 |

| 2029 | $12.75 | $23.89 | $35.5 |

| 2030 | $10.25 | $15.85 | $25.5 |

| 2040 | $25 | $30 | $45 |

| 2050 | $35 | $42.6 | $55.5 |

THORChain (RUNE) Price Prediction 2023

As shown in the chart above, it could be seen that RUNE has been trading inside a falling wedge since late May 2022. It has been making lower highs and low lows since May 2022. Currently, RUNE is heading toward the upper trend line and it has the potential to break it.

Interestingly, the lowest price in the Value Area intersects the upper trendline. As such, when RUNE breaks out from the wedge, it will automatically be in the Value Area where there’ll be high trading. Hence, the prices of RUNE could drastically go up and RUNE could be expected to reach $1.65.

Thereafter, it may reach the point of control (PoC) at $1.81 inside the value area. After it reaches the PoC RUNE might take some time to rise as the trading volume marginally reduces.

However, in the event that the breakout is conventional, then, as per the best practice of trading, RUNE should technically rise above PoC, passing the highest price in the value to $2.45.

If the breakout is not conventional, then RUNE may fall test the lower trendline and if it is breached, then $0.822 and $0.368 are the only supports for it.

THORChain (RUNE) Price Prediction – Resistance and Support Levels

When considering the above chart, we could see that RUNE had a fall in May 2022. After crashing, RUNE was supported at 0.618 fib retracement level in June 2022. Once it received support at the above-mentioned level, it started rising above the 1:2 Gann fan line but it fell after reaching a maximum price of almost $3. After reaching its maximum price, RUNE started falling below the 2:1 Gann line and slid along the 1:1 Gann till November 2022.

After receiving help from the 8:1 Gann line in November 2022, RUNE rose and reached 0.5 fib retracement level from below 0.786 fib level. However, it started to descend again and was supported by the 8:1 Gann line. Since receiving support from the 8:1 Gann line, it slid along the 2:1 Gann line and now it is moving sideways just under the 0.786 fib level. As it is rising, RUNE may test the 0.786 fib level.

THORChain (RUNE) Price Prediction 2024

There will be Bitcoin halving in 2024, and hence we should expect a positive trend in the market due to user sentiments and the quest by investors to accumulate more of the coin. However, the year of BTC halving didn’t yield the maximum for RUNE based on the previous halving. Hence, we could expect RUNE to trade at a price, not below $3.5 by the end of 2024.

THORChain (RUNE) Price Prediction 2025

RUNE may experience the after-effects of the Bitcoin halving and is expected to trade much higher than its 2024 price. Many trade analysts speculate that BTC halving could create a huge impact on the crypto market. Moreover, similar to many altcoins, RUNE will continue to rise in 2025 forming new resistance levels. It is expected that RUNE would trade beyond the $21.5 level.

THORChain (RUNE) Price Prediction 2026

It is expected that after a long period of bull run, the bears would come into power and start negatively impacting the cryptocurrencies. During this bearish sentiment, RUNE could tumble into its support regions. During this period of price correction, RUNE could lose momentum and be way below its 2025 price. As such it could be trading at $5 by 2026.

THORChain (RUNE) Price Prediction 2027

Naturally, traders expect a bullish market sentiment after the crypto industry was affected negatively by the bears’ claw. Moreover, the build-up to the next Bitcoin halving in 2028 could evoke excitement in traders. However, there’ll be a dip in price before the excitement will be reciprocated in RUNE. As such we could expect RUNE to trade at around $3.9 by the end of 2027.

THORChain (RUNE) Price Prediction 2028

As the crypto community’s hope will be re-ignited looking forward to Bitcoin halving like many altcoins, RUNE may reciprocate its past behavior during the BTC halving. Hence, RUNE would be trading at $3.65 after experiencing a considerable surge by the end of 2028.

THORChain (RUNE) Price Prediction 2029

2029 is expected to be another bull run due to the aftermath of the BTC halving. However, traders speculate that the crypto market would gradually become stable by this year. In tandem with the stable market sentiment, RUNE could be trading at $23.9 by the end of 2029.

THORChain (RUNE) Price Prediction 2030

After witnessing a bullish run in the market, RUNE and many altcoins would show signs of consolidation and might trade sideways and move downwards for some time while experiencing minor spikes. Therefore, by the end of 2030, RUNE could be trading at $15.85.

THORChain (RUNE) Price Prediction 2040

The long-term forecast for RUNE indicates that this altcoin could reach a new all-time high(ATH). This would be one of the key moments as HODLERS may expect to sell some of their tokens at the ATH point.

If they start selling then RUNE could fall in value. It is expected that the average price of RUNE could reach $30 by 2040.

THORChain (RUNE) Price Prediction 2050

The community believes that there will be widespread adoption of cryptocurrencies, which could maintain gradual bullish gains. By the end of 2050, if the bullish momentum is maintained, RUNE could hit $42.6.

Conclusion

If investors continue showing their interest in RUNE and add these tokens to their portfolio, it could continue to rise. RUNE’s bullish price prediction shows that it could reach the $2.5 level.

FAQ

THORChain is the company that created the Socios platform as well as the RUNE coin. RUNE is an ERC-20 token that runs on the THORChain blockchain, which is built on Ethereum. The token functions as cash, allowing users to purchase NFTs from THORChain’ Socios, a fan token marketplace.

Like other digital assets in the crypto world, RUNE can be traded on many exchanges. Binance, Deepcoin, Bybit, MEXC and CoinTiger are currently the most popular cryptocurrency exchanges for trading RUNE.

Since RUNE provides investors with several opportunities to profit from their crypto holdings, RUNE seems to be a really good investment in 2022. However, RUNE has a high possibility of surpassing its current ATH in 2029.

RUNE is one of the few cryptocurrencies that has gained value in the past seven days. If RUNE spikes it could rise to $3.5.

RUNE has been one of the most suitable investments in the crypto space. It is highly volatile, as such, it has quite a margin when its price fluctuates. Hence, traders may be allured to invest in RUNE. It’s a good investment in the short term and in the long term as well.

The lowest RUNE price is $0.007939, which was attained on September 27, 2019, according to CoinMarketCap.

RUNE was launched in 2019.

THORChain is a decentralized project with no business, chief executive officer, or founders.

The maximum supply of RUNE is 500,000,000 RUNE.

RUNE can be stored in a cold wallet, hot wallet, or exchange wallet.

RUNE is expected to reach $2.5 by 2023.

RUNE is expected to reach $3.5 by 2024.

RUNE is expected to reach $21.5 by 2025.

RUNE is expected to reach $5 by 2026.

RUNE is expected to reach $3.9 by 2027.

RUNE is expected to reach $3.6 by 2028.

RUNE is expected to reach $23.9 by 2029.

RUNE is expected to reach $15.85 by 2030.

RUNE is expected to reach $30 by 2040.

RUNE is expected to reach $42.6 by 2050.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

More Crypto Price Predictions:

- Apecoin (APE) Price Prediction 2023-2030

- Quant (QNT) Price Prediction 2023-2030

- Hedera (HBAR) Price Prediction 2023-2030

- Axie Infinity (AXS) Price Prediction 2023-2030

- BitTorrent (BTT) Price Prediction 2023-2030

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.