- SNX market faces bearish pressure; traders cautioned to proceed cautiously.

- The oversold scenario presents a potential buying opportunity for SNX investors.

- The decreasing slope of the TRIX line suggests a possible trend reversal for the SNX market.

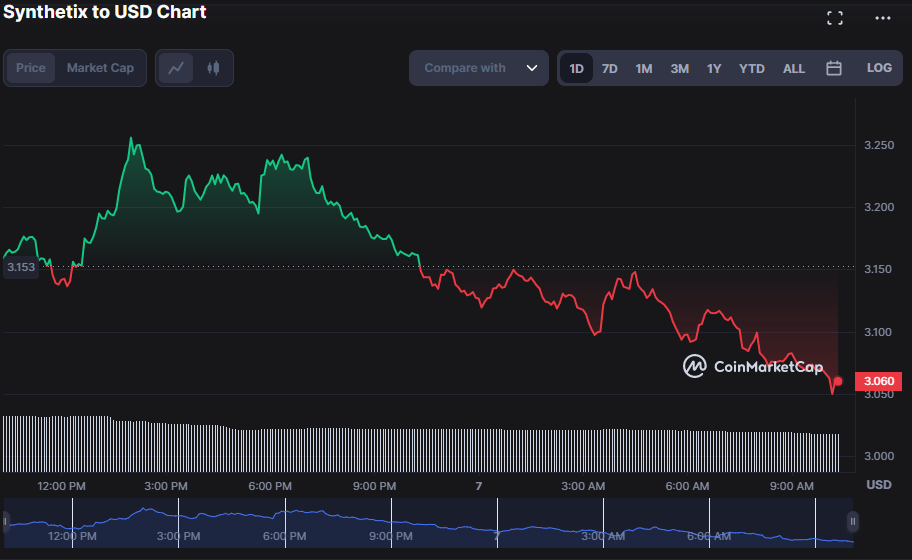

After a solid start to the day, Synthetix’s (SNX) market has plummeted as bulls failed to break above the intra-day high of $3.26. Owing to the bulls’ hesitation, the bears grasped the wheel and pushed the SNX price down until support was established at around $3.05.

The SNX price is now lingering around the support level, and it remains to be seen if the bulls will reclaim control and push the price higher or whether the bears will continue to dominate and drive the price down.

As of press time, bearish sentiment lingered in the market, as reflected by a 3.22% drop in price to $3.06. This downturn spurred traders to draw back, leading to a 3.23% and 32.37% drop in market capitalization and 24-hour trading volume, respectively, to $774,730,680 and $94,867,761.

Since the Keltner Channel bands move south with the upper band hitting 3.2584491 and the lower band contacting 22.9743263, the negative momentum in the SNX market is rising as the price approaches the lower band, suggesting a possible oversold scenario.

Traders may wait for a bullish signal or a rebound from the lower band before entering long positions. It may be prudent for investors to reduce their long positions or switch to short if price action drops below the lower range, suggesting a continuation of the decline.

With a score of -0.1171114, the Bull Bear Power (BBP) has crossed into the negative, indicating that bearish pressure is growing. Traders would want to tighten stop-loss orders on current long holdings or keep an eye out for short opportunities in light of this trend.

As this development indicates that the bearishness in the market may persist, traders should proceed cautiously to prevent losses.

As the stochastic RSI trends below its signal line with a reading of 0.00, the bearish momentum in the SNX market will likely continue, indicating that traders may want to consider short positions or wait for a potential buying opportunity at a lower price level.

This motion suggests that the prevailing bear reign is nearing its end since the stochastic RSI is approaching oversold levels, which could trigger a bullish reversal soon.

The TRIX reading of 24.49 suggests that there is still some bearish momentum in the market, but the decreasing slope of the TRIX line indicates that this momentum is slowing down, and a trend reversal may be imminent.

Bearish pressure grips the SNX market as bulls fail to break resistance; caution is advised for traders amid a potential oversold scenario.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.