- Rocket Pool ranked third among the top gainers, according to CoinMarketCap.

- UNI and LINK exhibit similar trading patterns over the past week.

- LDO makes higher highs early in the week but loses momentum later.

Decentralized finance (Defi) has been the topic that has taken center stage in the finance sector. Defi is most wanted due to its ability to bypass the middle man such as banks and other financial institutions. Having these middlemen taken out of the equation means that transactions could be made at a lower cost without paying interest to these entities.

However, bypassing the middleman doesn’t mean that a Defi token is foolproof and safe for investing in. Traders must do thorough background research on the resilience, legitimacy, user base, developments, on Defi coins before investing.

Coin Edition has listed the top 5 Defi tokens to watch out for. These Defi tokens have outperformed the other Defi cryptocurrencies on various parameters.

1. Rocket Pool (RPL)

Rocket Pool (RPL) which recently was listed on the Binance exchange, has drawn attention in the crypto space. It is one of the top five DeFi tokens that have to be kept an eye on as the token is showing signs of growth. RPL ranked third in the list of top gainers for today, with an increase of 8.66% to $34.40.

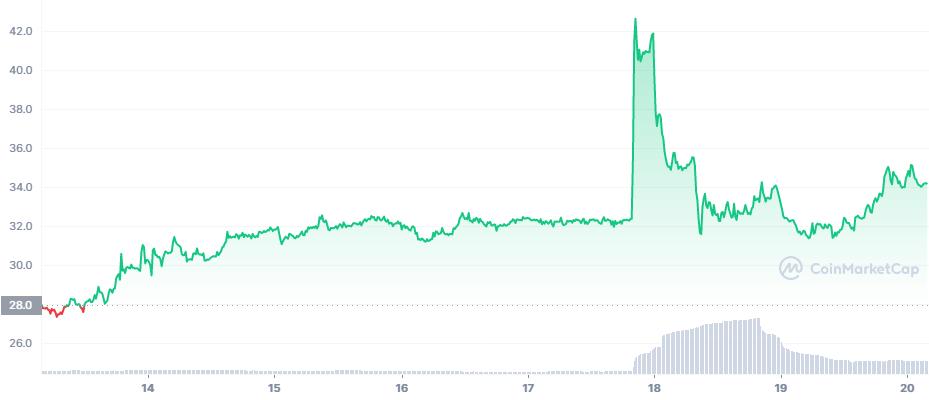

The token’s opening price for the week was $28. Soon after the market opened, RPL tanked into the red zone. But RPL recovered and started trading in the green zone. On the fifth day of the week, RPL rose from $32.36 to $42.62, with it being listed on Binance. However, RPL lost momentum and is currently priced at $34.16 and is up 7.86% in the last 24 hours.

2. Avalanche (AVAX)

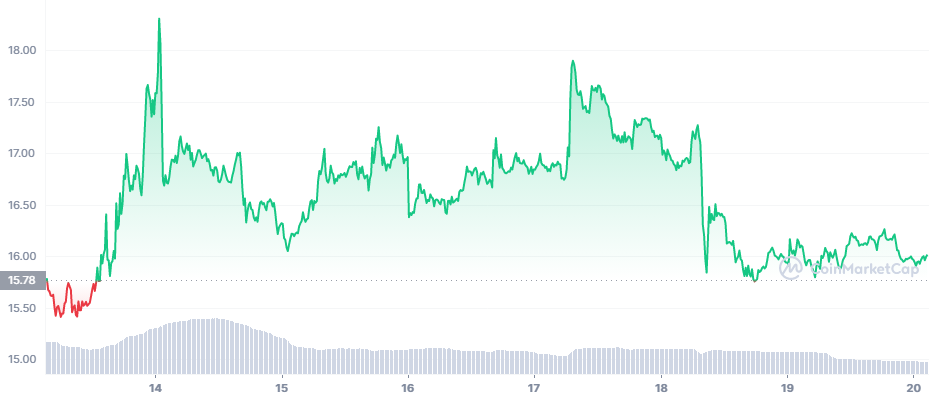

Avalanche (AVAX) didn’t have a great start this week as it tanked into the red zone just hours after the market opened. It reached its lowest price of $15.42. However, its resilience made it eligible to be ranked among the top five coins. Amidst much pressure from the bulls, AVAX was able to fluctuate between the $16-$17 range. However, the bulls are currently losing their grip on AVAX, and the bears are taking over.

3. Uniswap (UNI)

Uniswap (UNI) started the week with hype. It showed exponential growth as it touched $6.90 from its opening market price of $6.05 just hours after the market opened for the week. The bears were able to control the bulls within a tight range of $6.40 -$6.60 for the first four days.

However, come the fifth day of the week, the bears were too strong for the bulls, as UNI crashed from $6.78 to 6.09, just above the opening price. The bulls still haven’t let the bears off the hook, as UNI is trading marginally above the red zone, a characteristic that top crypto would demonstrate.

4. Chainlink (LINK)

When considering UNI and Chain LINK’s behavior for the past week, the chart emits similar characteristics. LINK opened the market at $6.30, and just like UNI, it, too, had a brief exponential rise over the first day of the week. From the second day up until the fifth day, LINK consolidated, but on the fifth day, it fell from $6.9 to 6.39 within hours.

Nonetheless, the bulls came to LINK’s rescue and kept it from tanking below $6.30.

5. Lido DAO (LDO)

Lido DAO (LDO) kicked off the week with its price at $1.92. It made higher highs up until the second and reached a maximum of $2.42. However, once LDO was over the hump, it started its descent, and prices crashed gradually over the next few days. With every drop, the bulls tried to consolidate, but the bears were too strong; hence the prices kept descending over the next few days. Currently, LDO is trading at $1.98 and is up 4.45% in the last 24 hours.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.