- Shiba Inu’s largest wallet holders remain bullish and committed to accumulating more SHIB.

- Recent price analysis shows that Shiba Inu is trading at a four-month low.

- Technical indicators like the RSI and MACD show oversold conditions and a potential turnaround.

Shiba Inu, the meme cryptocurrency that rose to fame in 2021, has weathered the recent market volatility with the help of its large wallet holders. Despite a 13% decrease in the value of the coin on May 1, those holding between 1 million to 1 billion SHIB have remained committed to their accumulation strategy.

Notably, wallets with balances of 1 million to 10 million SHIB briefly sold off 500 billion SHIB worth $5 million in late March before returning to their accumulation strategy, according to the analytic firm, Santiment. This group, along with those holding 10 million to 100 million SHIB and 100 million to 1 billion SHIB, controls about 67% of the total SHIB supply.

The urge to further accumulate seen from these large wallet holders is both an opportunity and a threat for the Shiba Inu price. On the one hand, their unwavering optimism provides the coin with stability and faster recovery from market dips. On the other hand, any selling by these whales could have a negative impact on the price of SHIB.

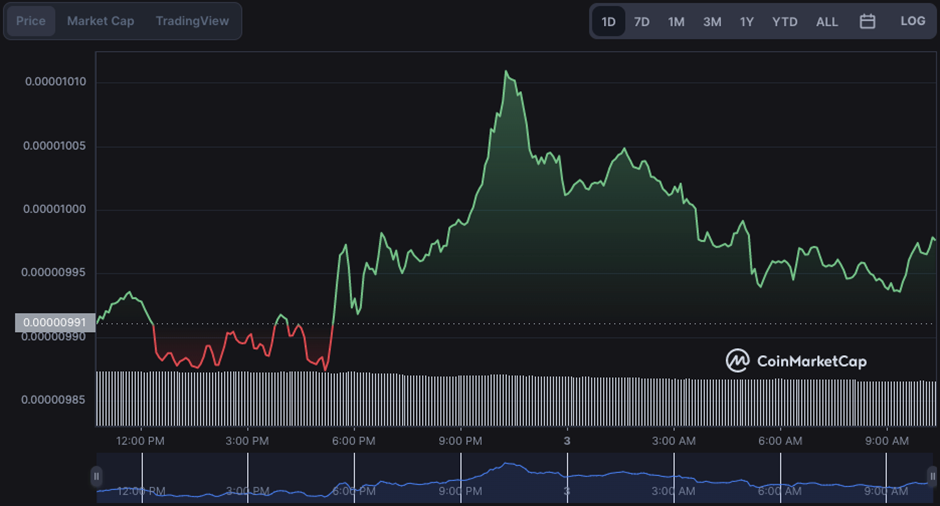

Despite the resilience shown by large wallet holders, Shiba Inu’s recent price analysis has been bearish. Trading at a four-month low, the last time this altcoin fell to this level was back in January this year. The coin has struggled to gain traction in the face of overall market uncertainty and recent sideways traction in the value of Bitcoin and Ethereum.

However, there are signs that Shiba Inu is trying to recover. In the past 24 hours, the coin experienced a modest 0.47% surge, signaling a possible turnaround in the near future. As always, the actions of large wallet holders will be critical in determining the future price of SHIB, and investors will be watching closely to see if they continue to accumulate or if they begin to sell off their holdings.

On a technical front, there is a lessening negative sentiment as measured by the Moving Average Convergence Divergence (MACD) indicator. Although a bearish crossover is still present in the momentum indicator, red bars are fading in the histogram. The MACD line (blue) is getting closer to the signal line (red), signaling a bullish crossing if it were to occur. Investors should nevertheless proceed with care in the Shiba Inu market despite these technical indications showing the present negative trend may not endure forever.

In addition to the momentum and MACD indicators, the Relative Strength Index (RSI) is another important tool for analyzing Shiba Inu’s current market conditions. The RSI is currently showing oversold conditions for SHIB, with the indicator trending below the neutral area. This suggests that the recent selling pressure on SHIB has pushed its price to a point where it may be undervalued, making it an attractive opportunity for investors looking to buy at a discount.

In conclusion, while Shiba Inu’s largest wallet holders remain bullish and committed to accumulating more SHIB, the current market conditions are bearish. The recent price decline and oversold signals from technical indicators like the RSI suggest that investors should exercise caution when considering buying into the SHIB market.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.