- APE’s rewards being generated from staking pools are declining.

- The APE NFT collections are also showing signs of struggle.

- APE is currently trading at $3.25 after a 1.09% increase in price.

When the staking rewards for ApeCoin (APE) was announced, it generated a lot of excitement and interest. People were making it a priority to buy the APE token and even the project’s NFT space got a boost, but this quickly faded away.

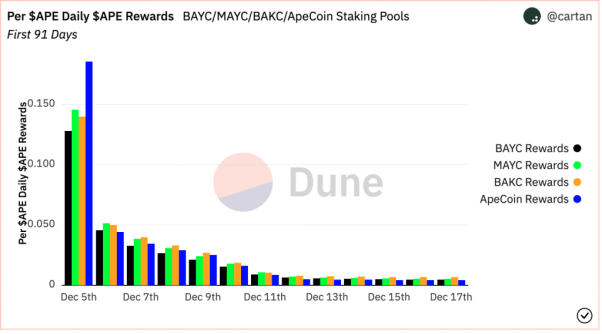

One of the main reasons for the lack of interest in APE is the declining rewards being generated from staking pools. Data from Dune Analytics reveals that the rewards given to stakeholders have dropped significantly.

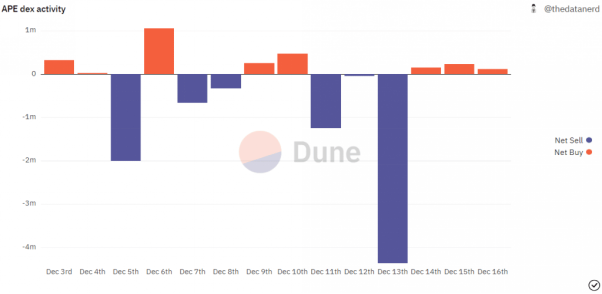

In addition to this, it is still possible that APE’s performance is impacted by the recent Binance FUD. Ever since December 11, APE has been dumped heavily. Even when the frantic selling stopped, the buying pressure was not enough to help the token fully recover.

Unfortunately, it was not just the APE token that was impacted by these recent events. NFT collections like the Bored Ape Yacht Club (BAYC) which is associated with Apecoin were also affected.

The average floor price for BAYC declined by about 4.85% over the last seven days alone. The average price at which an NFT was being sold also saw a decrease of 2.37% over the same time period. The Mutant Ape Yacht Club (MACY) collection suffered a similar fate over the last week as well.

CoinMarketCap indicates that APE is currently trading at $3.25 after a 1.09% increase in price over the last 24 hours. The crypto is, however, still down by more than 18% over the last week. APE’s 24 hour trading volume is also in the red zone and now stands at $93,328,994 after a more than 49% decline since yesterday.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.