- Bulls defended AXS at an important $4 region as sellers got exhausted.

- AXS may retrace but a recovery above the recent highs depends on the lack of distribution shown by the OBV.

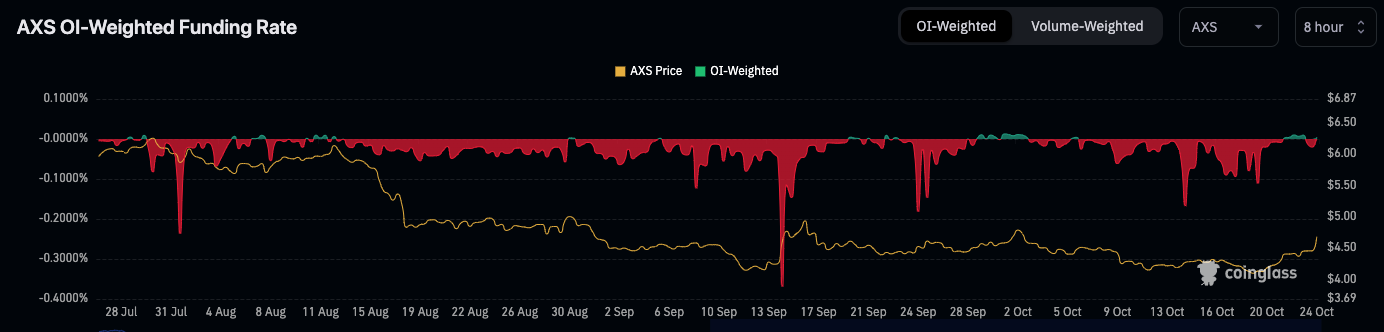

- Traders are opening more short positions, indicating a bearish sentiment around AXS in the futures market.

Despite being one of the top performers of the 2020-2021 bull market, many Axie Infinity (AXS) bag holders have since been left deep in the red. Although several altcoins that had a similar performance to AXS have recovered slightly, AXS has faced a double-digit decline over the past year.

Respite comes to AXS

According to CoinMarketCap, the token’s 365-day performance was an underwhelming 44.11% decrease. But according to crypto analyst Ali Martinez, AXS holders who are “out of the money” could soon heave a sigh of relief.

As shown above, one reason Martinez shared this opinion was because sellers are now fatigued and AXS now has a strong support at $4. This viewpoint was also shared by the token’s 7-day performance.

At the time of writing, AXS’ value was $4.68— an 8.40% increase within the last week. From the AXS/USD 4-hour chart, bulls defended the token at $4.13 on October 20. This shield served as the stepping stone for AXS’s next leg up to $4.45.

Around $4.45, sellers sought to re-enter the market. But this entry was quickly invalidated as bulls once again used the point as support for the rise to $4.68. Also, the Relative Strength Index (RSI) was 69.92 at press time.

The value of this indicator suggests that truly, sellers have been exhausted and there has been good buying momentum. However, the RSI also indicated that AXS was overbought since the value was very close to 70.

A Drawdown May Not Be the End

The impact of this overbought condition can be seen in the recent price action of AXS, which retraced to $4.63. As it stands, the price of AXS may still fall to around $4.55 to $.4.60. But the decline may not take long to recover as indicated by the On Balance Volume (OBV) above.

As shown in the chart, OBV jumped to 44.68 million. This increase is a sign of accumulation. Should AXS fall to $4.55, and the OBV remains in accumulation mode, then there might be an upward breakout that could send the token in the $5.00 direction.

Meanwhile, AXS’ uptick over the last few days has not yet convinced traders that the token was on its way to recovery. According to Coinglass data, the AXS funding rate was negative as of this writing.

Funding rates are fees paid between long and short-positioned traders to keep their positions open. When the funding rate is positive, it means traders’ sentiment is bullish. Thus, AXS’ funding rate means most traders have short AXS positions open.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.