- Kaiko tweeted that the market may be in the midst of its longest period without a major selloff since 2020.

- At press time, the total cryptocurrency market cap was down 0.50% and stood at around $1.18 trillion.

- TRX, DOGE, and ADA were the only top 10 cryptocurrencies that achieved 24-hour gains.

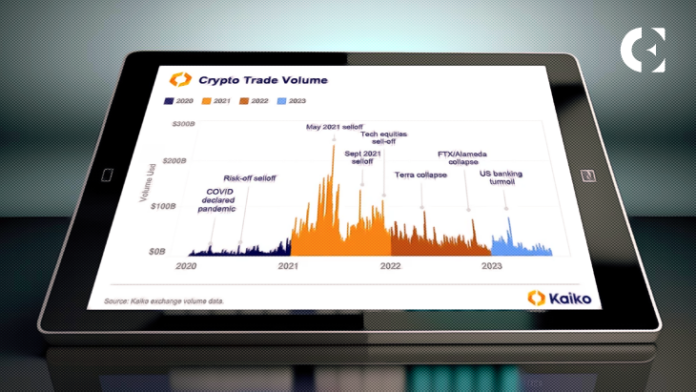

The cryptocurrency market intelligence platform Kaiko tweeted yesterday that the market might be in the midst of one of its longest periods without a major selloff since 2020. According to the post, the 3rd quarter of this year started off fairly quietly. Subsequently, Kaiko questioned the possibility of a potential market-wide selloff in the next few weeks.

Since 2020, the market has experienced its fair share of selloffs. The first major selloff that took place in the cryptocurrency market during this period followed shortly after COVID was declared as a pandemic in mid-2020. Thereafter, a significant selloff of more than $200 billion occurred in May of 2021.

In the same year, the market suffered another 2 selloffs. Both of these selloffs totaled more than $100 billion each. The Terra and FTX collapse ignited another pair of smaller sell-offs between 2022-2023. Lastly, the latest selloff occurred earlier this year following the U.S. banking turmoil, according to Kaiko.

Meanwhile, CoinMarketCap indicated that the total cryptocurrency market cap stood at around $1.18 trillion at press time. This was after the market experienced a 0.50% drop over the past 24 hours. During this period, almost all of the top 10 cryptocurrencies saw their prices drop. Only Dogecoin (DOGE), Cardano (ADA), and Tron (TRX) were able to achieve daily gains.

DOGE was changing hands at $0.07545 after its price rose 0.50%. This positive daily performance also pushed the meme coin’s weekly performance further into the green zone to +1.47%. Similarly, ADA was up 0.1% and its price stood at $0.2981 at press time. The Ethereum-killer’s weekly performance was also positive, as ADA was up 0.26% for the week.

Lastly, TRX printed a 24-hour gain of 0.26% – boosting its price to $0.07679. Similar to DOGE and ADA, TRX’s positive daily performance boosted its weekly performance to +0.33%.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.