- About 327 million SAND will be unlocked on August 14, propelling talks of a price dip.

- If SAND’s volatility remains low, the price may consolidate around $0.39 and $0.41.

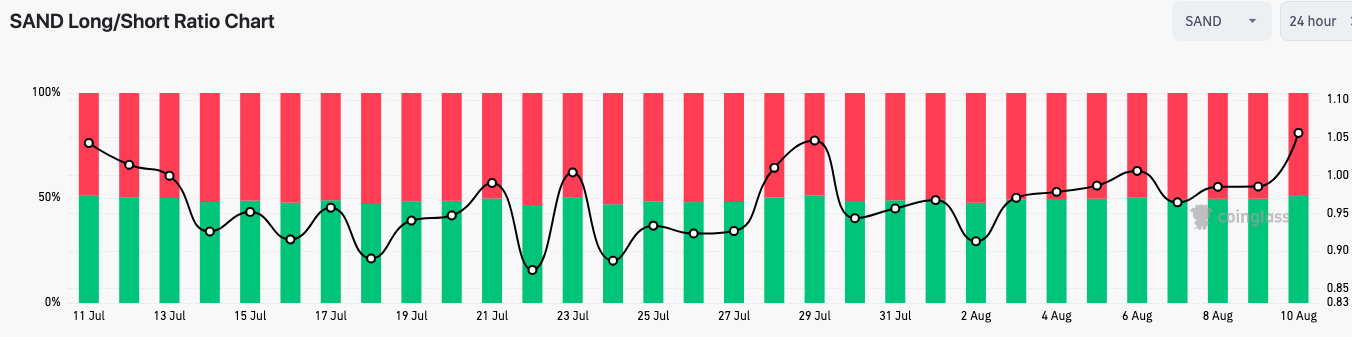

- Open long contracts overrode short positions, indicating a bullish sentiment among traders.

Oftentimes, the cryptocurrency market experiences moments of anticipation and speculation when large token unlocks are on the horizon. The Sandbox (SAND), the decentralized blockchain-based gaming platform, is currently facing the risk of a downtrend as a substantial number of tokens are set to be unlocked.

According to Token Unlocks, 372 million SAND tokens are set to be unlocked on August 14. For context, token unlocks refer to the release of a portion of tokens held by a project which have been subject to restrictions. So, releasing them means they can be traded.

In the case of The Sandbox, the upcoming unlock of 372 million tokens represent 18.1% of the total supply. Also, 71 million SAND will go to the project team while the foundation gets 37 million. Furthermore, the rest will be shared among consultants, and the project’s reserves.

In times past, SAND token unlocks have impacted the price negatively. So, there was speculation that the upcoming event could distort SAND’s price which has maintained some sort of stability.

Interestingly, the SAND/USD 4-hour chart showed that the volatility around the token was relatively low. So, there is a chance that the price fluctuation remains very minimal. That’s if the Bollinger Bands (BB) continue to maintain the same level of volatility as the unlock approaches.

If SAND sustains a close level of volatility, then the price may be between $0.39 and $0.41. At press time, the Awesome Oscillator (AO) was at 0.000484. Although the AO was in positive territory, the initial bullish crossover was showing signs of a decline.

The set-up of the indicators displayed lower lows of red candlesticks suggesting a potential sell opportunity before the token unlock. Like in previous unlocks, it is likely that massive selling pressure appears. If that’s the case, then SAND may dip as low as $0.35.

Meanwhile, traders in the derivates market seem to be unconcerned about a potential downtrend. According to Coinglass, SAND’s long/short ratio was 1.05 at the time of this writing.

The long/short ratio provides insight into the collective sentiment of traders in terms of a bearish or bullish outlook around an asset. Values below 1 mean that the average open position is bearish. But in SAND’s case, there are more long positions than shorts.

In conclusion, the upcoming SAND token unlock may not cause intense pain for holders or traders who long the token. As it stands, SAND may end up consolidating between $0.39 and $0.41 as previously mentioned.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.