- TON struggles to break resistance at $2.13, showing the need for more positive momentum.

- TON, RPL, and LEO prices dropped due to a market sell-off, with the total market cap at $1.7 trillion.

- RPL and LEO see increased trading volumes despite price drops, indicating continued investor interest and potential buying opportunities.

Toncoin (TON), Rocket Pool (RPL), and UNUS SED LEO (LEO) have all seen price drops in the last day due to a market sell-off. Furthermore, this trend is reflected in the cryptocurrency market value, which has dropped to $1.7 trillion, a -1.03% decrease in the previous 24 hours.

TON/USD

Toncoin (TON) has been under negative pressure over the previous day after failing to break through resistance at the early high of $2.126. As a result, bearish momentum drove the TON price to a low of $2.1067, where it found support.

However, bulls were able to reverse the slump and bring the price back up to $2.12. Despite this rebound, TON is still encountering solid resistance around $2.13 as of press time, signaling that further positive momentum may be required for a major price gain.

TON/USD 24-hour price chart (source: CoinStats)

The TON market capitalization and 24-hour trading volume climbed by 0.63% and 2.05%, respectively, to $7,371,116,635 and $14,133,358, reflecting greater interest and activity in the TON market. This pattern implies that there is still room for more price volatility and that investors are actively trading TON.

RPL/USD

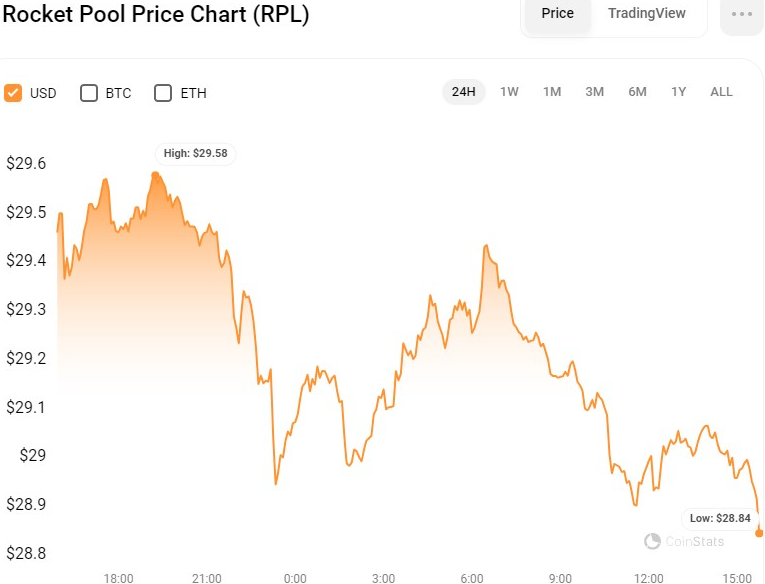

Similarly, Rocket Pool (RPL) has been in a downturn for the previous day after kicking off at $29.7331. Under negative pressure, RPL fell to a low of $29.12, reflecting a drop in investor confidence. The negative trend remained in control at press time, with RPL trading at $28.97, down 1.94% from the day’s high.

RPL/USD 24-hour price chart (source: CoinStats)

Despite a 1.90% drop in market capitalization to $581,066,172, the 24-hour trading volume of RPL increased by 2.31% to $4,485,546. Despite the recent slump, the rise in trade volume demonstrates that there is still interest and activity in the Rocket Pool market. Investors, moreover, may be taking advantage of low prices to purchase RPL tokens.

LEO/USD

Bullish momentum gained the upper hand on the UNUS SED LEO (LEO) market as the day began with a strong trend. However, bullish momentum weakened, giving way to a bearish slump after failing to break above the intra-day high of $4.088. As a result, LEO has fallen to a low of $3.919 at press time, a 2.04% drop from its intraday high.

LEO/USD 24-hour price chart (source: CoinStats)

During the downturn, LEO’s market capitalization and 2-hour trading volume fell by 1.81% and 2.28%, to $3,670,104,410 and $1,435,811, respectively. LEO/USD’s next support level might be around $3.800 if the negative trend continues. However, some investors may see this as an opportunity to buy the dip and increase their holdings in anticipation of a potential price recovery.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.