- Bitcoin remains passive, failing to achieve a 1% increase in seven days.

- Data suggests investors are uninterested in buying Bitcoin at the current price levels.

- BTC opened the year at $46,311.74 but has lost over 60% of its value.

The most popular crypto, Bitcoin (BTC), has maintained a passive gesture in the market over the past weeks, failing to attain even a 1% increase. Data from the intelligence platform, Intotheblock confirmed the usual behavior.

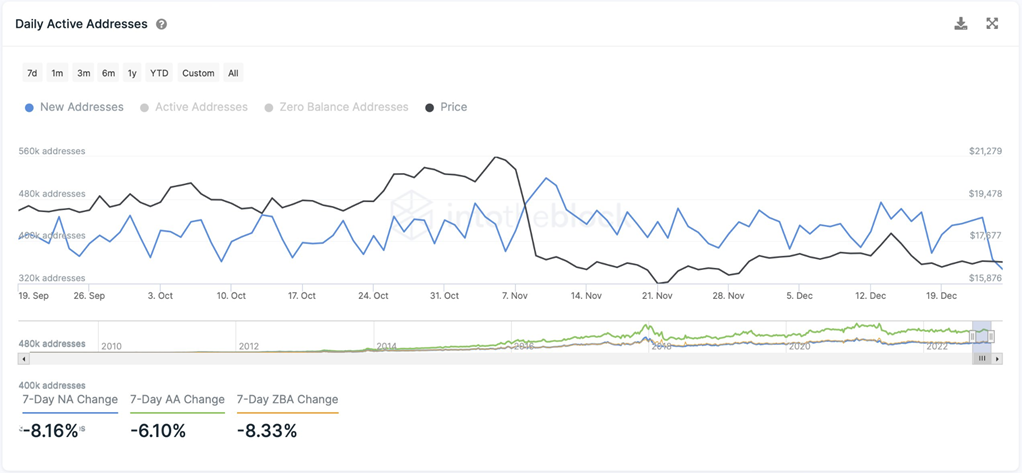

Intotheblock data suggested that the number of new addresses created on the BTC network has been climbing down, decreasing by 8.16% in the past seven days. This activity decrease suggests that investors are uninterested in buying Bitcoin at the current price levels.

In another report, Intotheblock argued that BTC and Ethereum (ETH) have underperformed on the year-to-date time frame against traditional assets like the S&P 500 and the Nasdaq 100.

BTC opened the year at $46,311.74 but has lost over 60% of its value, trading at $16,868.50. On the other hand, ETH lost 67% of its value from January, trading at $1,219.16. Among the crypto with the largest market cap, Bitcoin, Ethereum, Binance Coin (BNB), and Ripple (XRP) have maintained their rankings in January.

However, Cardano’s utility token ADA, which ranked 7 earlier this year with over a $35 billion market cap, lost its ranking. The meme Dogecoin (DOGE) climbed up from the 11 position to become the eighth largest crypto by market cap, displacing ADA and Polkadot (DOT).

In a recent blog post recapping the highlights of this year, IntoTheBlock’s Head of Research, Lucas Outumuro, revealed that the total fees paid on the Bitcoin network were $138 million. Ethereum network, on the other hand, saw a $4.21 billion in fees paid.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.